The Canadian dollar continues to show little movement this week. Currently, the USD/CAD pair is trading at 1.2424, down 0.12% on the day.

On the release front, the North American country will release its latest GDP figures on Wednesday, concerning the month of November. Meanwhile in the U.S., the Consumer Confidence index is expected to post a rise to 123.2 points today. And U.S. President Donald Trump will deliver his State of the Union address to Congress. On Wednesday, a batch of other key indicators is due, led by the ADP Nonfarm Employment Change. The Federal Reserve will release a monetary policy statement, with the markets expecting the benchmark rate to remain unchanged at the 1.25%-1.50% range.

Wednesday's statement will be the final one under Janet Yellen’s tenure. While it’s a virtual certainty that the Fed will hold rates at current levels this time around, it’s likely that the U.S. central bank will opt for a quarter-point hike at its next meeting in March. Yellen will make way for Jerome Powell, who takes over as chair in early February. Powell is expected to stay the course on monetary policy, which has been marked by small, incremental interest rates last year, in order to keep the country's economy from overheating.

The markets have become accustomed to GDP releases above 3.0% in the U.S., so Advance GDP reading of 2.6% for Q4 was disappointing, falling short of 3.0% forecasts. The economy grew 2.3% in 2017, compared to 1.6% in 2016. Growth in Q4 was affected by stronger consumer spending, which led to a surge in imports. At the same time, the increase in consumer spending also boosted inflation, as the personal consumption expenditures index, which the Fed prefers to use, unveiled a 1.9% surge in Q4 on Mondayrose 1.9%, up from a 1.3% rise in Q3. Meanwhile, the US manufacturing sector is booming, as durable goods orders hit 2.9% in December, crushing the estimate of 0.6%. This was the highest gain in six months, and helped make 2017 a banner year. The indicator increased 5.8% last year, the sharpest yearly expansion since 2011.

USD/CAD Fundamentals

Tuesday (January 30)

- 9:00 US S&P/CS Composite-20 HPI. Estimate 6.3%

- 10:00 US CB Consumer Confidence. Estimate 123.2

- 21:00 President Trump Speaks

Wednesday (January 31)

- 8:15 US ADP Nonfarm Employment Change. Estimate 191K

- 8:30 US Employment Cost Index. Estimate 0.5%

- 8:30 Canadian GDP

- 8:30 Canadian RMPI

- 9:45 US Chicago PMI. Estimate 64.3

- 10:00 US Pending Home Sales. Estimate 0.5%

- 14:00 US FOMC Statement

- 14:00 US Federal Funds Rate. Estimate

*All release times are GMT

*Key events are in bold

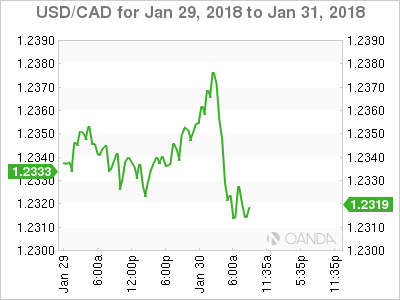

USD/CAD for Tuesday, January 30, 2018

USD/CAD, January 30 at 8:15 EDT

Open: 1.2340 High: 1.2380 Low: 1.2310 Close: 1.2424

USD/CAD Technicals

| S3 | S2 | S1 | R1 | R2 | R3 |

| 1.1903 | 1.2060 | 1.2190 | 1.2351 | 1.2494 | 1.2630 |

USD/CAD edged higher in the Asian session. In European trade, the pair posted slight gains but has retracted.

- 1.2190 is providing support

- 1.2351 was tested earlier in resistance and is under pressure. This line could see more activity in the North American session

- Current range: 1.2190 to 1.2351

Further levels in both directions:

- Below: 1.2190, 1.2060 and 1.1903

- Above: 1.2351, 1.2494, 1.2630, and 1.2757

OANDA’s Open Positions Ratio

USD/CAD ratio is unchanged in the Monday session. Currently, long positions have a majority (58%), indicative of trader bias towards USD/CAD continuing to move to higher ground.