USD/CAD has posted small gains in the Friday session, recovering the losses from Thursday. Currently, the pair is trading at 1.3265, down 0.12% on the day. On the release front, Canada releases CPI, which is expected to post its third decline of 0.4% in the past four months. In the U.S., today’s key event is UoM Consumer Sentiment. The indicator has slowed over the past three months, and the downward trend is expected to continue, with an estimate of 97.0 points.

Risk appetite remains steady, which has been good news for the Canadian dollar. The currency has sparkled in January, posting gains of 2.7 percent. The U.S-China trade war, which is one of the biggest threats to the global economy, has triggered a slowdown of the Chinese economy, and there are concerns that U.S growth will slow if the sides don’t resolve the conflict. Senior Chinese and U.S. officials are meeting for another round of trade talks on January 30, and investors remain hopeful that the U.S will not impose new tariffs on March 1.

The U.S. government shutdown has meant that the flow of economic data has been reduced. This has magnified the importance of the Beige Book, which was released on Wednesday. The report found that businesses across the country had become less optimistic, due to higher interest rates, swings in the financial markets and global trade tensions. At the same time, most of the regional Feds said that growth in their region was “modest to moderate”. The report reiterates the recent dovish stance we are seeing from the Federal Reserve, which has sent strong signals to the markets that rate hikes could be on hold for the near future.

USD/CAD Fundamentals

Friday (January 18)

- 8:30 Canadian CPI. Estimate -0.4%

- 8:30 Canadian Common CPI. Estimate 1.9%

- 8:30 Canadian Median CPI. Estimate 1.9%

- 8:30 Canadian Trimmed CPI. Estimate 1.9%

- 8:30 Canadian Core CPI

- 8:30 Canadian Foreign Securities Purchases. Estimate 2.05B

- 9:05 US FOMC Member Williams (NYSE:WMB) Speaks

- 9:15 US Capacity Utilization Rate. Estimate 78.6%

- 9:15 US Industrial Production. Estimate 0.2%

- 10:00 US Preliminary UoM Consumer Sentiment. Estimate 97.0

- 10:00 US Preliminary UoM Inflation Expectations

*All release times are EST

*Key events are in bold

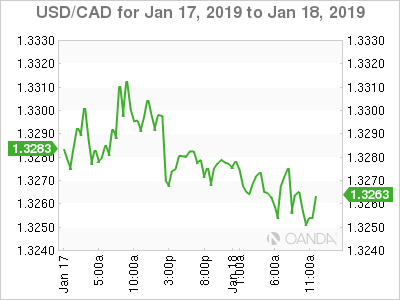

USD/CAD for Friday, January 18, 2019

USD/CAD, January 18 at 7:50 EST

Open: 1.3280 High: 1.3284 Low: 1.3250 Close: 1.3266

USD/CAD Technicals

| S3 | S2 | S1 | R1 | R2 | R3 |

| 1.3049 | 1.3125 | 1.3200 | 1.3290 | 1.3383 | 1.3461 |

USD/CAD showed little movement in the Asian session and has posted small losses in European trade

- 1.3200 is providing support

- 1.3290 is the next resistance line

- Current range: 1.3200 to 1.3290

Further levels in both directions:

- Below: 1.3200, 1.3125 and 1.3049

- Above: 1.3290, 1.3383, 1.3461 and 1.3552