The Canadian dollar has posted gains in the Monday session. Currently, the pair is trading at 1.2344, up 0.23% on the day. On the release front, there are no Canadian events. In the US, the key event is Personal Spending, which is expected to edge lower to 0.5%. On Tuesday, the US releases CB Consumer Confidence and President Trump will deliver the State of the Union address.

Investors have become spoiled with recent US GDP reports, which have come in around the 3 percent level. This led to some disappointment on Friday, as Advance GDP came in at 2.6%, short of the estimate of 3.0%. The economy grew 2.3% in 2017, compared to 1.6% in 2016. Growth in Q4 was affected by stronger consumer spending, which led to a surge in imports. At the same time, the increase in consumer spending also boosted inflation, as the personal consumption expenditures index, which the Fed prefers to use, rose 1.9% in the fourth quarter, up from 1.3% in Q3. Meanwhile, the US manufacturing sector continues to look sharp, as durable goods orders in December hit 2.9%, crushing the estimate of 0.6%. This was the highest gain in six months, and helped make 2017 a banner year. Durable good orders increased 5.8% in 2017, the sharpest expansion since 2011.

On Thursday, Canada posted mixed numbers, and the Canadian dollar didn’t show much movement. Canadian Core Retail Sales jumped 1.6% in November, crushing the estimate of 0.8%. This marked the strongest gain since January. Retail Sales couldn’t keep pace, as the small gain of 0.2% missed the estimate of 0.7%. In the US, unemployment claims rose to 233 thousand, but still beat the estimate of 239 thousand. Housing numbers continue to soften, as New Home Sales fell to 625 thousand, well off the estimate of 679 thousand. This follows the trend we saw earlier in the week, when Existing Home Sales slowed to 5.57 million, short of the estimate of 5.72 million.

USD/CAD Fundamentals

Monday (January 29)

- 8:30 US Core PCE Price Index. Estimate 0.2%

- 8:30 US Personal Spending. Estimate 0.5%

- 8:30 US Personal Income. Estimate 0.3%

Tuesday (January 30)

- 10:00 US CB Consumer Confidence. Estimate 123.2

- 21:00 President Trump Speaks

*All release times are GMT

*Key events are in bold

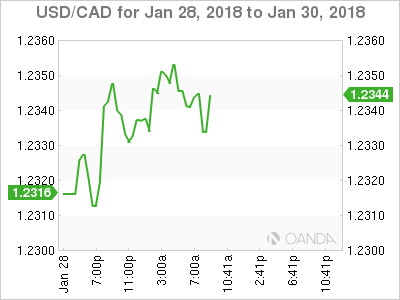

USD/CAD for Monday, January 29, 2018

USD/CAD, January 29 at 8:05 EDT

Open: 1.2316 High: 1.2356 Low: 1.2310 Close: 1.2344

USD/CAD Technical

| S3 | S2 | S1 | R1 | R2 | R3 |

| 1.1903 | 1.2060 | 1.2190 | 1.2351 | 1.2494 | 1.2630 |

USD/CAD edged higher in the Asian session. In European trade, the pair posted slight gains but has retracted.

- 1.2190 is providing support

- 1.2351 was tested earlier in resistance and is under pressure. This line could see more activity in the North American session

- Current range: 1.2190 to 1.2351

Further levels in both directions:

- Below: 1.2190, 1.2060 and 1.1903

- Above: 1.2351, 1.2494, 1.2630, and 1.2757

OANDA’s Open Positions Ratio

USD/CAD ratio is unchanged in the Monday session. Currently, long positions have a majority (58%), indicative of trader bias towards USD/CAD continuing to move to higher ground.