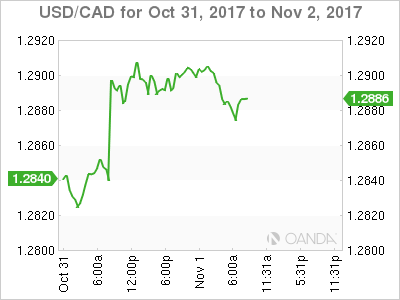

The Canadian dollar is almost unchanged in the Wednesday session. Currently, USD/CAD is trading at 1.2881, down 0.05% on the day. In economic news, today’s highlight is the FOMC rate statement, with no change expected in the benchmark interest rate. Later in the day, BoC Governor Stephen Poloz testifies before the Standing Senate Committee on Banking, Trade and Commerce in Ottawa. The US will also release two key events – ADP Nonfarm Payrolls and ISM Manufacturing PMI. On Thursday, the key event is US unemployment claims.

On Tuesday, Canada’s GDP, which is released monthly, contracted in August. This disappointed the markets, which had expected a small gain. The decline of 0.1% was the first drop since October 2016. The soft reading extended the Canadian dollar’s misery, pushing USD/CAD above 1.29 and coming close to a 10-week low. The currency has endured a miserable October, slipping 3.5 percent.

Janet Yellen will be on center stage on Wednesday, as the Federal Reserve issues its monthly rate statement. The Fed will almost certainly refrain from a rate hike, so analysts will be combing through the rate statement, looking for clues about future rate moves. The markets have priced in a December rate hike at a whopping 96 percent, and the markets are looking for clues with regard to rate policy in 2018. This will depend to a large degree on the new chair of the Fed, who will take over from Janet Yellen in February. The two front-runners, John Taylor and Jerome Powell, have very different stances on monetary policy, which has created some suspense ahead of President Trump’s nomination. Trump is expected to choose the new head before departing for Asia at the end of the week. Powell is expected to continue Yellen’s incremental approach to raising rates, while Taylor is a proponent of much higher rates, as underscored in his “Taylor Rule”, which calls for higher rates when inflation is high or the labor market is at full capacity.

USD/CAD Fundamentals

Wednesday (November 1)

- 8:15 ADP Nonfarm Employment Change. Estimate 202K

- 9:30 Canadian Manufacturing PMI

- 9:45 US Final Manufacturing PMI. Estimate 54.5

- 10:00 US ISM Manufacturing PMI. Estimate 59.5

- 10:00 US Construction Spending. Estimate -0.1%

- 10:00 US ISM Manufacturing Prices. Estimate 68.0

- 10:30 US Crude Oil Inventories. Estimate -1.5M

- All Day – Total Vehicle Sales. Estimate 17.5M

- 14:00 US FOMC Statement

- 14:00 US Federal Funds Rate. Estimate

- 16:15 BoC Governor Stephen Poloz Speaks

Thursday (November 2)

- 8:30 US Unemployment Claims. Estimate 235K

*All release times are GMT

*Key events are in bold

USD/CAD for Wednesday, November 1, 2017

USD/CAD Wednesday, November 1 at 7:50 EDT

Open: 1.2818 High: 1.2915 Low: 1.2812 Close: 1.2881

USD/CAD Technical

| S3 | S2 | S1 | R1 | R2 | R3 |

| 1.2598 | 1.2701 | 1.2778 | 1.2943 | 1.3032 | 1.3126 |

USD/CAD was flat in the Asian session and has posted small losses early in European trade

- 1.2778 is providing support

- 1.2943 is the next resistance line

- Current range: 1.2778 to 1.2943

Further levels in both directions:

- Below: 1.2778, 1.2701, 1.2598

- Above: 1.2943, 1.3032 and 1.3126

OANDA’s Open Positions Ratio

USD/CAD ratio is unchanged in the Wednesday session. Currently, long positions have a slender majority (51%), indicative of a lack of trader bias as to what direction USD/CAD takes next.