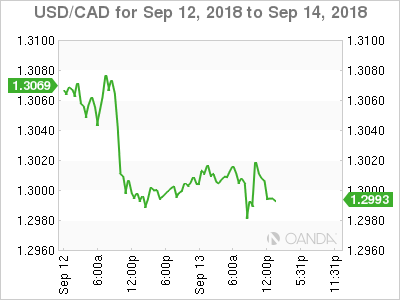

The Canadian dollar is almost unchanged in the Thursday session. Currently, USD/CAD is trading at 1.3006, up 0.05% on the day. On the release front, Canada releases NHPI, which is expected to post a gain of 0.1% for a second straight month. In the U.S, the focus will be on key consumer inflation reports. CPI is expected to edge up to 0.3%, while Core CPI is forecast to remain pegged at 0.2%. As well, unemployment claims are expected to rise to 213 thousand. On Friday, the U.S release retail sales and UoM Consumer Sentiment.

The Canadian dollar has rallied this week, gaining 1.2%, as it hovers at the symbolic 1.30 level. Trade talks between the U.S and Canada are continuing, with the parties hoping to wrap up an agreement shortly. The Bank of Canada is also keeping a close eye on the NAFTA negotiations Last week’s rate announcement that policymakers would be “monitoring closely the course of the NAFTA negotiations and other trade policy developments, and their impact on the inflation outlook”. With the Canadian economy performing well and the Fed likely raising rates later this month, there is pressure on the BoC to again raise rates in 2018. However, concerns over NAFTA and global trade tensions have won the day for now, as the BoC took a pass on a rate hike.

USD/CAD Fundamentals

Thursday (September 13)

- 8:30 Canadian NHPI. Estimate 0.1%

- 8:30 US CPI. Estimate 0.3%

- 8:30 US Core CPI. Estimate 0.2%

- 8:30 US Unemployment Claims. Estimate 210K

- 10:00 US FOMC Member Rafael Bostic Speaks

- 10:30 US Natural Gas Storage. Estimate 65B

- 13:01 30-year Bond Auction

- 13:15 US FOMC Member Raphael Bostic Speaks

- 14:00 US Federal Budget Balance. Estimate -169.8B

Friday (September 14)

- 8:30 US Core Retail Sales. Estimate 0.5%

- 8:30 US Retail Sales. Estimate 0.4%

- 8:30 US Import Prices. Estimate -0.2%

- 9:15 US Capacity Utilization Rate. Estimate 78.3%

- 9:15 US Industrial Production. Estimate 0.3%

- 10:00 US Preliminary UoM Consumer Sentiment. Estimate 96.7

- 10:00 US Business Inventories. Estimate 0.5%

- 10:00 Preliminary UoM Inflation Expectations

*All release times are DST

*Key events are in bold

USD/CAD for Thursday, September 13, 2018

USD/CAD, September 13 at 8:05 DST

Open: 1.3000 High: 1.3018 Low: 1.2994 Close: 1.3006

USD/CAD Technicals

| S3 | S2 | S1 | R1 | R2 | R3 |

| 1.2666 | 1.2831 | 1.2970 | 1.3067 | 1.3160 | 1.3292 |

USD/CAD showed little movement in the Asian session. In European trade, the pair posted small gains but has retracted

- 1.2970 is under pressure in support

- 1.3067 is the next resistance line

- Current range: 1.2970 to 1.3067

Further levels in both directions:

- Below: 1.2970, 1.2831 and 1.2666

- Above: 1.3067, 1.3160, 1.3292 and 1.3386