The USDA refused to move yield estimates in June, despite a six-week period of poor growing conditions in major corn and soybeans growing areas. Lower corn production due to decreased planted acres pushed 2015/16 corn ending stocks down by 172 million bushels. 2015/16 soybean production increased 35 million bushels on greater planted acres, but endings stocks decreased on higher crush and disappearance reports from 2014/15. wheat production also increased as greater spring wheat production expectations more than offset declining winter wheat production reports.

Corn

The USDA estimated U.S. corn production for the 2015/16 crop season at 13.530 billion bushels in the July WASDE Report, a 100 million bushel decrease due to the decrease in planted and harvested acres reported in the June 30th Acreage report. The average corn yield estimate was 166.8 bushels per acre, unchanged from last month. Harvested corn acres for 2015/16 was decreased by 0.6 million acres from last month’s estimate.

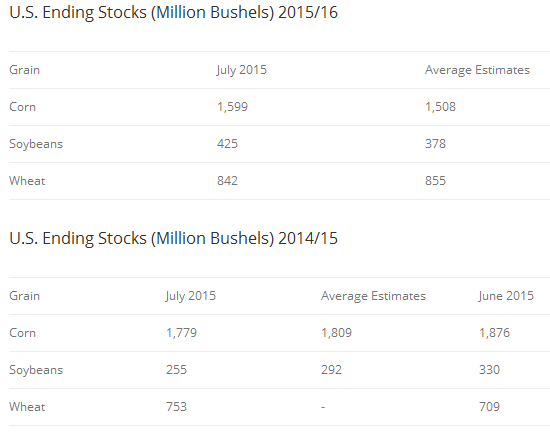

Corn beginning stocks for 2015/16 were decreased by 97 million bushels, due to higher gas consumption outlook expected for 2014/15 increasing corn used for ethanol by 25 million bushels. 2014/15 corn feed and residual use and exports were also increased decreasing 2015/16 beginning stocks. Corn ending stocks for 2015/16 were also decreased 172 million bushels, to 1,599 million bushels, to reflect the change in beginning stocks and account for the decrease in expected production. The projected season-average price range for corn in 2015/2016 was projected at $3.45 to $4.05 per bushel.

World corn production for 2015/16 was projected at 987.11 million tons, a 2.19 million ton decrease form last month due to lower expected production from the U.S. and E.U. Global corn supplies for 2015/16 were decreased 4.3 million tons, primarily due to lower beginning stocks reported by the U.S.

Soybeans

U.S. soybean production for 2015/16 was estimated at 3.885 billion bushels, a 35 million bushel increase from last month due to increased harvested area. The average U.S. soybean yield was projected at 46.0 bushels per acre, unchanged from last month. Ending stocks for 2015/16 were estimated at 425 million bushels, a 50 million bushels decrease from last month due to decreased beginning stocks caused by an increase in crush and disappearance estimates for 2014/15. The U.S. season-average price forecast for soybeans in 2015/2016 was projected at $8.50 to $9.75 per bushel.

Global soybean production was projected at 318.9 million tons for 2015/16, a 1.3 million ton increase from last month due to higher production reported form the U.S. and Bolivia. Global soybean stocks for 2015/16 declined 1.42 million tons from last month to 91.80 million tons due to lower stocks in the U.S.

Wheat

Estimated U.S. wheat production for 2015/16 was increased by 27 million bushels to 2,148 million bushels due increasing spring wheat production estimates more than offsetting declines in winter wheat production expectations. Ending stocks for 2015/16 increasing by 28 million bushels to 842 million, the highest level since 2010/11. The increase in 2015/16 beginning stocks and production more than offset increase in exports and feed and residual use, causing ending stocks to increase. The projected 2015/2016 season-average price was reported at $4.75 to $5.75 per bushel.

Global wheat production for 2015/16 was increased 0.4 million tons to 722 million tons, the second highest level on record. Production increases reported from the Black Sea region and the U.S. more than offset decreases reported from the E.U. and Canada.

Outlook

In the short-term, focus will be on the weather over the next few weeks as the majority of the corn crop enters the pollination stage. Ideal weather during pollination can make-up for a lot of the damage that has occurred to the crops progress thus far, but poor weather over the period will cause a significant negative impact.

Looking further into the future, the next major checkpoint for the 2015/16 crops will be the Pro Farmer Midwest Crop Tour beginning August 17th and ending the 20th. The Pro Farmer Crop Tour provides reports from in-field analyst who travel across the Corn Belt inspecting crop conditions and giving expected yield estimates. The Crop Tour reports have influenced crop prices in the past and provide a different opinion on the crop conditions from the USDA Crop Progress Report.