The December shopping season was busier than economists had expected. Data out of the U.S. showed that Consumer Consumption rose 0.5 percent and Retail Sales climbed 0.6 percent last month (which does not take into account the impact of a 1.6 percent decline in gas prices). The news helped boost the value of the U.S. Dollar despite the fact that the Federal Reserve Chairman, Ben Bernanke, avoided commenting on discontinuing quantitative easing in the near future.

Other data showed that the Empire State Manufacturing Survey fell -7.78 in the first month of 2013 and Producer Prices dipped for the third consecutive month. According to official reports, Producer Prices slipped 0.2 percent rather than the expected 0.1 percent. Since Consumer Spending is considered the backbone of the American economy, stronger metrics overshadowed the lackluster releases. The greenback maintained its support as market investors sought refuge on concerns over the deadlock on debt ceiling negotiations in Washington.

President Barack Obama asked Republicans to allow for an increase in borrowing without asking for anything in return. Meanwhile, Canada’s dollar dropped the most in six months versus the yen on the probability that the Bank of Japan may place a limit on measures to be implemented in order to devalue the currency, especially after the country’s Economic Minister, Akira Amari, suggested that Japan is facing many economic risks. The loonie also weakened against the U.S. currency after reports confirmed that Canadian Existing Home Sales dipped while the New York Manufacturing sector shrunk in January.

The euro declined against the U.S. dollar following a speech by the Prime Minister of Luxembourg, Jean-Claude Juncker, during which he suggested that the value of the 17-nation currency is “dangerously high” and could therefore hurt the region’s growth. But the euro rebounded from session lows against the greenback subsequent to the announcement of U.S. economic data which showed that Retail Sales rose more than forecast.

Worries over the euro region growth outlook were reignited as reports indicated that Germany’s economy contracted during the last three months of 2012. The British pound erased losses against the greenback after the U.S. issued upbeat economic data; however, concerns over the U.S. debt ceiling continued to weigh on risk appetite.

The yen advanced for the first time in five days against the U.S. Dollar as investors believe the currency’s drop happened too quickly. The Japanese currency remained strong after words by the Economy Minister raised speculations the country won’t attempt to spur further declines of the currency. Minister Akira Amari stated that a weak currency could potentially hurt people’s livelihoods.

Lastly, in the South Pacific, the Australian dollar weakened against all of its counterparts in anticipation of reports due out this week which are expected to show a rise in unemployment. The Aussie and New Zealand dollars slipped from the highest prices in over four years against the yen following a statement by the Japanese Economy Minister which in turn spurred speculation that the government won’t debase the currency any further.

EUR/USD- German Economy Contracts

The euro declined against the U.S. dollar as the Prime Minister of Luxembourg delivered a speech to the region’s Finance Ministers and in it he suggested that the value of the shared currency is too high and could hurt the growth outlook. Meanwhile, eurozone leaders are preparing to increase their efforts to stem the soaring levels of unemployment. And while they’re asking for additional time to get a bailout package ready for Cyprus, and elections in Italy are just around the corner, Germany’s Finance Minister, Wolfgang Schaeuble, suggested that the worst of the debt crisis is over.

However, investors are still worried about the region’s growth outlook as yesterday’s data showed that Germany, the region’s biggest economy, shrunk by 0.5 percent in the final quarter of 2012. Other data showed that the eurozone’s Trade Surplus expanded from 7.4 billion euros to 11 billion euros in October, given the hike in exports. The euro rebounded from session lows subsequent to the announcement of better than predicted U.S. Retail Sales. EUR/USD" title="EUR/USD" width="624" height="331">

EUR/USD" title="EUR/USD" width="624" height="331">

GBP/USD- Sterling Rebounds

The British pound erased previous day losses following the release of better than expected U.S. economic data. The sterling benefitted from an increase in risk appetite but declined later on as market investors continued to worry over the U.S. debt woes. The British currency slipped as official releases indicated that Consumer Price Inflation stayed at 2.7 percent in December, just as analysts had predicted. Furthermore, Consumer Price Inflation MoM climbed 0.5 percent. GBP/USD" title="GBP/USD" width="624" height="329">

GBP/USD" title="GBP/USD" width="624" height="329">

USD/CAD- Greenback Up On Retail Data

The U.S. dollar rallied against its Canadian counterpart as data showed increases in U.S. Retail Sales for the month of December. However, sentiment was weighed down due to worries that U.S. lawmakers will come to an impasse during the debt ceiling talks. The loonie remained under pressure after less than stellar domestic data revealed that Canadian Existing Home Sales fell 0.5 percent in December to 35,386 units.

The Canadian Real Estate Association also confirmed that the number of transactions dipped 17.4 percent from the previous year. Crude Oil, the nation’s biggest export, dipped 0.8 percent and traded at $93.37 on the New York Mercantile Exchange. USD/CAD" title="USD/CAD" width="624" height="331">

USD/CAD" title="USD/CAD" width="624" height="331">

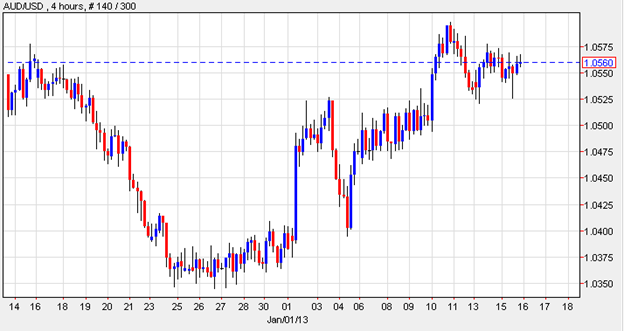

AUD/USD- Aussie Dips Before Reports

The Australian dollar fell against the greenback as investors believe this week’s reports will show that employers added fewer jobs since August. Analysts suggested that the economy of the small South Pacific nation is showing weaknesses, and it’s likely that Unemployment climbed to 5.4 percent in December. AUD/USD" title="AUD/USD" width="624" height="331">

AUD/USD" title="AUD/USD" width="624" height="331">

Today’s Outlook

Today’s economic calendar shows that Japan will report on Household Confidence and the Tertiary Industry Activity Index. Switzerland will issue data on Retail Sales. The Euro region will announce CPI and Core CPI. The U.S. will publish figures on CPI and Core CPI as well as on TIC Net Long-Term Transactions and Industrial Production. Furthermore, the Federal Reserve is scheduled to issue the Beige Book. Lastly, Australia will release the Unemployment Rate as well as Changes in Employment.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

USD: Consumer Consumption Rose Unexpectedly By 0.5% In December

Published 01/16/2013, 05:03 AM

Updated 09/16/2019, 09:25 AM

USD: Consumer Consumption Rose Unexpectedly By 0.5% In December

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.