The Stock market Indexes are making new fresh highs, the safe havens like JPY, CHF or gold are sold off and also the bonds are being sold off lately. What is this meaning? That we have a RISK ON environment. The only thing that is not fixing in this picture are the high yield currencies being on their lows. If the investors are looking for higher returns (they buy stocks don't they?) how come they are not taking the same risk in the currency market?

In the good old times, when we had a risk on environment, currencies like NZD, AUD, MXN, TRY or ZAR were flying. The central banks from New Zealand, Australia, Mexico, Turkey or South Africa are paying 2% up to 8.25% interest rates and the high yields starved investors would not think twice to buy them.

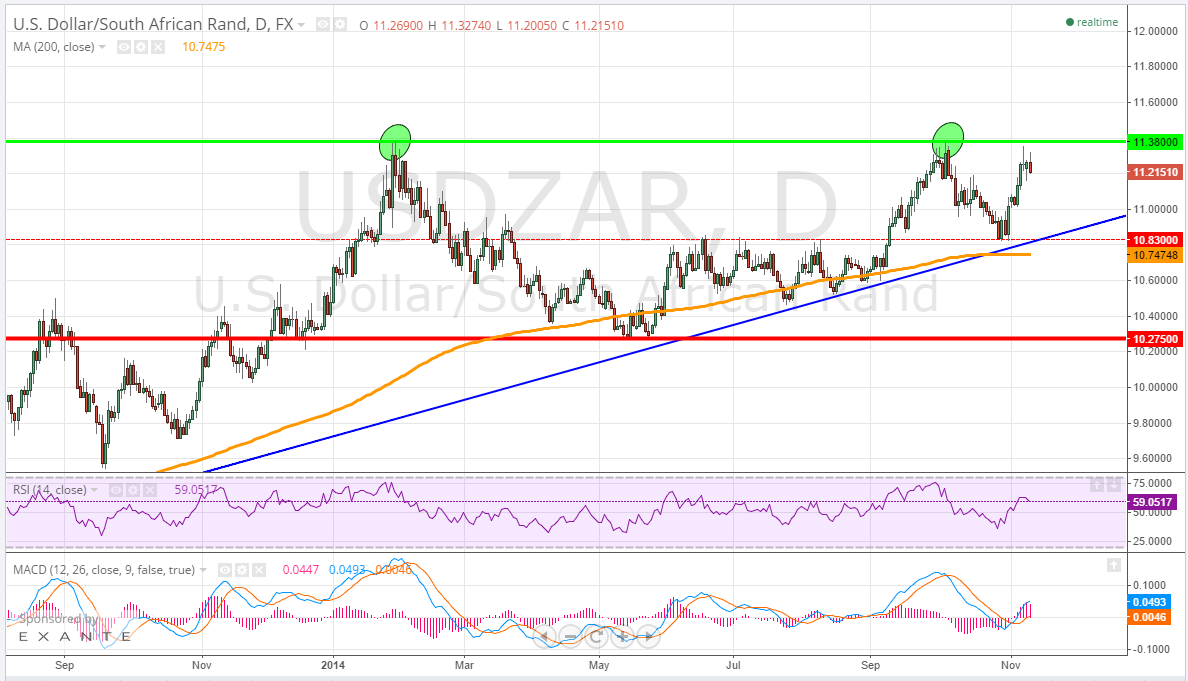

USD/ZAR made a high of the year in January 2014 at 11.3800. On October 3rd had an attempt to break it but it failed. Now the rate action is close to that area as it went up to 11.3567 on November 7 but again it failed to make a new fresh high.

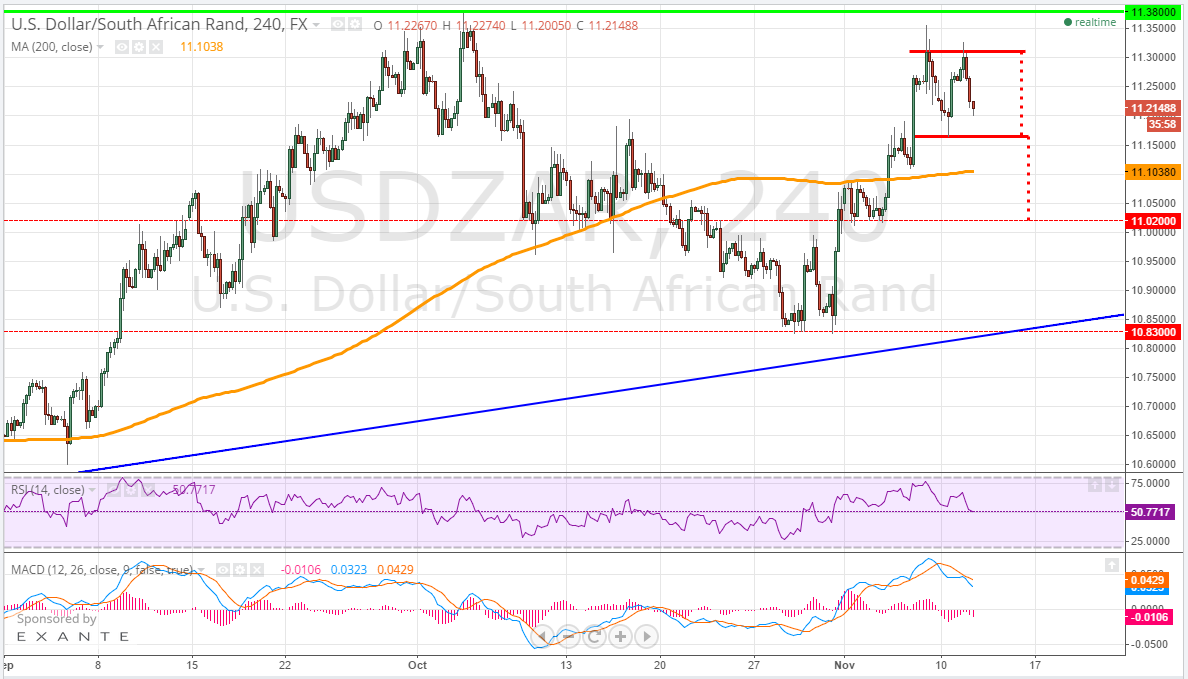

USD/ZAR is still in position to make this new fresh higher high for 2014 but on the 4h chart we might have a double top in play which could delay the bulls attack to the 11.3800 area. A double top pattern is not a double top until the neck/support is broken and the rate action closes under it. The support we are looking at is at 11.1640. We need the rate action to go lower than 11.1640 to make a double top pattern complete. As you can see on my chart below, I ignored the tails to the upside but even if you take them in consideration we still have a lower high and we only need a lower low for the bears to gain more momentum.

The target of the double top pattern is 11.0200 - good support in the past also. Under 11.0200 we have to look at 10.8300 for the next support. In this moment I am only concerned for the USD/ZAR not to go above 11.3280 so if you plan to short this currency pair take that area in consideration to place your stops.