The U.S. dollar experienced a relatively broad-based appreciation in the last days. While the greenback’s recent rally became most visible in other major currency pairs such as NZD/USD or USD/JPY, the British pound was however able to gain ground against the dollar.

What drives the rally in the USD are fundamental conditions that are slowly improving. Market participants are more confident for prospects of the U.S. congress passing budget reform plans this year. On the back of these hopes of tax reform legislation, investors are currently less concerned about U.S. President Trump’s pick for the next Chair of the Federal Reserve. Trump said he is considering John Taylor and Fed Governor Jerome Powell while Powell appears to be the most likely candidate. Powell’s preference for gradual rate hikes may not be the best scenario for the dollar in short-term time frames, but it may be the best choice for the stock market. Janet Yellen’s chances of being re-nominated as Fed Chair are, in contrast, slim.

For the dollar, the most interesting piece of economic data this week will be Fridays U.S. GDP report. The GDP is forecast to increase at a lower pace of 2.6 percent in the third quarter, due to the effects of the hurricanes.

The EUR/USD tumbled towards 1.1750 on the back of a stronger U.S. dollar but this week, trading will be dominated by Thursday’s ECB meeting. The European Central Bank is set to announce a tapering or reduction of its monetary stimulus program, starting from January next year. Expectations are that the ECB will cut monthly bond purchases by EUR30 billion from EUR60 billion. While the announcement of tapering is generally considered positive for the euro, there is still room for surprise. If the ECB makes a smaller reduction or lengths the period of purchases, the taper is considered dovish, which would be negative for the euro. On Thursday we will know more and until then, the euro could trade with a slight tailwind.

EUR/USD is still confined to a range between 1.1850 and 1.1730. Any price breakouts above or below this range require our attention but for the time being, we expect the euro to remain range-bound between 1.1850 and 1.1750.

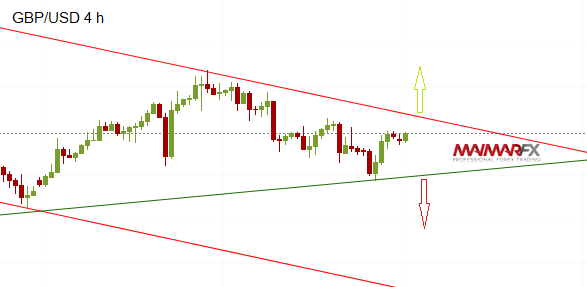

GBP/USD refrained from breaking significantly below 1.31 and recovered its recent losses towards 1.32. However, we still see the cable trading within a crucial price range between 1.3235 and 1.31. As mentioned in previous analysis, price breakouts above or below this range may define the near-term direction in this pair.

From a fundamental perspective, U.K. Prime Theresa May is likely to make a statement to Parliament today on the progress of Brexit talks. Any new Brexit headlines could affect the pound’s price action.

Here are our daily signal alerts:

EUR/USD

Long at 1.1780 SL 25 TP 20, 40

Short at 1.1730 SL 25 TP 30-35

GBP/USD

Long at 1.3235 SL 25 TP 20, 50

Short at 1.3165 SL 25 TP 20, 40

We wish you good trades and many pips!

Disclaimer: Any and all liability of the author is excluded.