The US dollar traded weak on Monday as the 10-year bond prices rallied pushing yields lower. The spreads between the 3-month and 10-year yields continued to widen with the inverted yield curve taking a more pronounced shape at the front end.

Canadian bond markets also showed an inversion following in the footsteps of the US markets. The sentiment continued to remain weak pushing prices of safe-haven assets higher as a result.

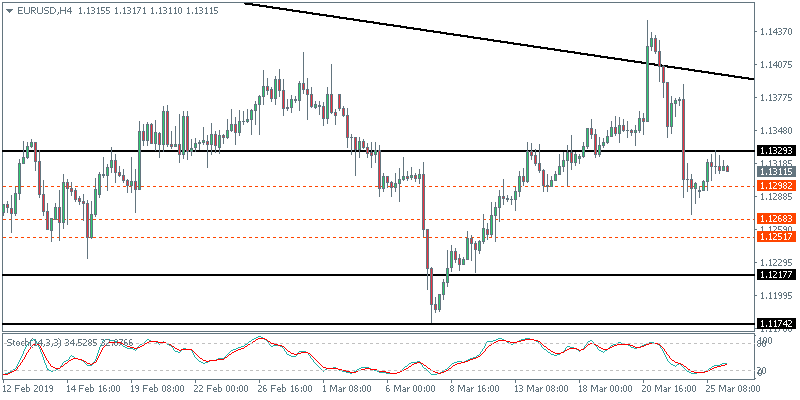

Euro Posts Modest Gains on Ifo Data

The common currency attempted to recover from the losses from last week as it gained 0.17% on the day. The German Ifo business climate data showed an increase for the first time in six months. The Ifo index rose to 99.6 in March, up from 98.7 in February and beat estimates of an unchanged print. Can the EUR/USD Break the Resistance at 1.1330?

The currency pair inched higher on an intraday basis and briefly tested the resistance level at 1.1330 before pulling back. Price action has formed a possible consolidation pattern near the lows from last Friday. If the resistance level cannot be breached, we anticipate price to retest Friday’s lows of 1.1272 level and could potentially validate the bearish flag pattern. This could push the currency pair lower toward 1.1217.

Yen Stabilizes as Risk Aversion Eases

The Japanese yen traded flat on Monday after the markets were trading a bit more stable. The USD post modest gains on the day, following a decline to a six-week low previously. This came as risk aversion was seen easing with the U.S. equities posting a slower decline.

Will USD/JPY Hold the Support at 110.84?

Price action closed with a doji on Monday following last Friday’s strong bearish close. This potentially indicates a rebound in the price action to the upside. However, we need to see a bullish follow-through today. A close above the trend line could be positive for the currency pair as the USD/JPY will attempt to retest the breached support at 111.40 where resistance could now be established.

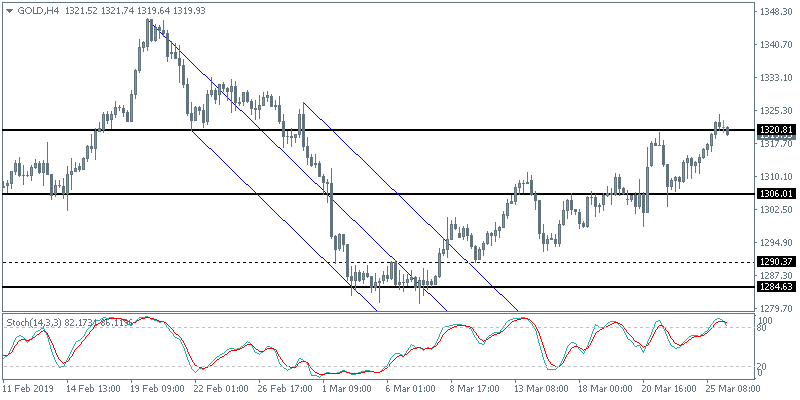

The risk aversion from last week sent gold prices higher on Monday. The precious metal gained 0.63% on the day pushing to highs of $1324.44. The gains came amid the investor concerns of an economic slowdown and the ongoing Brexit narratives. The British parliament will vote on various measures of the Brexit deal on Wednesday.

Will Gold Maintain the Bullish Momentum?

Price action suggests that gold prices could post a correction near the current highs. The rally to 1320.81 level marks a retest of the previously held support level. Thus, establishing resistance here could see some downside in the near term. Watch for the initial support at 1306.00 in the short term.