Market Brief

Japan’s GPIF – the world’s largest pension fund - allocated less than 50% of its assets in domestic bonds for the first time at end of September, according to a Reuters report today. USD/JPY and JPY crosses traded mixed in Tokyo, Nikkei stocks gained 1.46%. Yesterday’s close above 108.00 (MACD pivot) turned the bias on the upside. Option bids are noted at 108.00/25 for today’s expiry. The ascending Ichimoku cloud cover (105.27/107.15) will likely give support before the FOMC verdict later today. The USD/JPY direction will be contingent on global USD move later today. EUR/JPY tests 50/100-dma (137.57/66) on the upside. We see a formation of bearish engulfing line (on Oct 27th) indicating a future bearish trend. Resistance should come into play at daily Ichimoku cover (138.48/139.12).

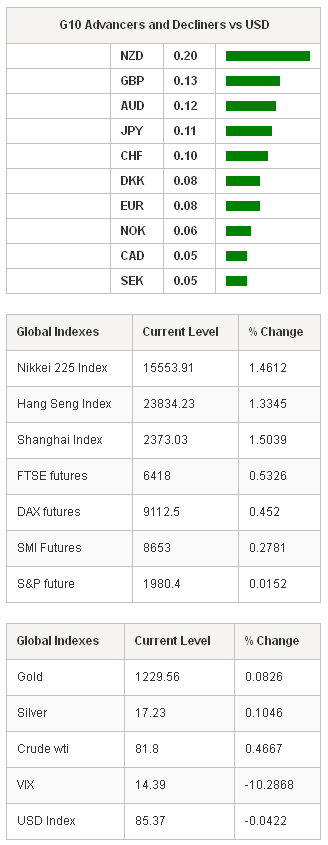

Released in New York yesterday, the US durable goods orders contracted 1.3% on month to September, reviving dovish Fed speculations. The significant improvement in consumer confidence in October (from 86.0 to 94.5 vs 87 exp.) tempered weakness in USD. The FOMC gives policy verdict today and is expected to announce the end of the QE3 program. This implies cutting the last 15 billion dollar worth Treasury and MBS purchases, this amount is above the regular 10 billion dollar decrease since the tapering started. Anything less than 15 billion dollar should give additional boost to Fed-doves. The accompanying statement should remain cautious as the Fed will certainly prefer to keep its maneuver margin as wide as possible. The greenback is weaker against its G10 peers, the US 10-year yields remain below 2.30% resistance on week.

EUR/USD bull momentum develops via higher-lows pattern over the 4 past sessions. The short-term bias is positive. Broad USD weakness is believed to play major role in the short-term bull pattern. Resistance is seen at 1.2853/55/86 (Fib 23.6% on May-Oct sell-off / 50-dma / Oct 15th high). Option bets are mixed with slight positive bias at 1.27/1.2880 pre-FOMC, barriers are touted at 1.29+. EUR/GBP tests 0.79 offers. A daily close below 0.7912 will keep the bias on the downside.

GBP/USD tests the Fibonacci 23.6% resistance of 1.6186 on Jul-Oct sell-off. Option barriers are solid at 1.6200/20 area, light bids at 1.6250 (50-dma) should remain under the shadow of more barriers at 1.63+. The upside looks challenging at the upper half of 30-day Bollinger band (1.6156-1.6396).

Another central bank focus is in New Zealand. NZD/USD trades ranged before the RBNZ policy decision later today. The RBNZ is expected to maintain its official cash rate unchanged at 3.50% as signs of cool-off in house prices recently will allow the bank to pause the policy tightening and to keep the NZD off the upside pressures for some more time. NZD/USD tests 0.7975 (Fib 23.6% on July-October sell-off), if breached should push the pair towards its 50-dma (0.8075). The key resistance is eyed at daily Ichimoku cloud cover (currently at 0.8199-0.8433, descending toward 0.7900/0.8105 range in November).

In the emerging markets, the post-election rally in USD/BRL sees some correction down to 2.4610. Support zone is eyed at 2.40/2.45 (Fib 61.8% / 21-dma) walking into FOMC decision. USD/TRY retreats to 2.2044 for the first time since mid-September. We expect limited domestic activity due to National Holidays. The FOMC remains in the driver seat to determine whether TRY and BRL have more room to recover or it is time to face a hawkish Fed.

The economic calendar: French and Swedish October Consumer Confidence, Swedish October Manufacturing Confidence, Spanish September Retail Sales m/m & y/y, Norwegian August Unemployment Rate, UK September Net Consumer Credit and Net Lending Sec. on Dwellings, UK September M4 Money Supply, US October 24th MBA Mortgage Applications, Canadian September Industrial Product & Raw Materials Price Index.

Currency Tech

EURUSD

R 2: 1.2853

R 1: 1.2765

CURRENT: 1.2737

S 1: 1.2668

S 2: 1.2614

GBPUSD

R 2: 1.6300

R 1: 1.6186

CURRENT: 1.6135

S 1: 1.6070

S 2: 1.5995

USDJPY

R 2: 109.23

R 1: 108.40

CURRENT: 108.05

S 1: 107.15

S 2: 106.24

USDCHF

R 2: 0.9559

R 1: 0.9521

CURRENT: 0.9467

S 1: 0.9445

S 2: 0.9368