Investing.com’s stocks of the week

Market Brief

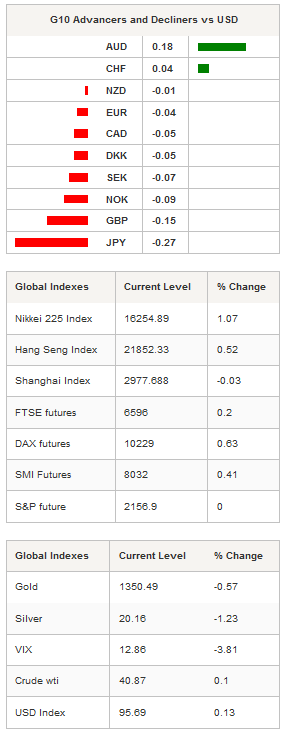

After suffering a substantial sell-off against most of the G10 currencies - the dollar index has tumbled 2.60% since mid-July - the US dollar had a surge of pride on Wednesday and continued to recover the following day as Chicago Fed President Evans declared, “I do think that perhaps one rate increase could be appropriate this year,” before adding, “even if I would prefer none until we saw inflation much more strongly.”

Overall, the market took this declaration as a strong sign of confidence in the US economy, especially from one of the most dovish FOMC members (albeit one who is non-voting this year).

EUR/USD continued its downside adjustment yesterday as it broke the 1.1170 (Fibonacci 50% on June’s debasement) level before stabilizing at around 1.1135 during the Asian session. The pair is trading with a negative short-term bias and should find a strong support at around 1.10 (psychological level and bottom of the yearly rising trend line).

The Australian dollar took a breather in overnight trading, boosted by a recovery in treasury yields. Australian 10-year yields moved closer to the 2% threshold in Sydney, surging 15bps since Tuesday. Similarly, 5-year yields bounced up almost 10bps to 1.55%.

AUD/USD rose 0.18% to 0.7602 in spite of lackluster data from the retail sector. Indeed, June retail sales rose 0.1%m/m (versus 0.3% consensus and 0.2% previous). In the second quarter, retail sales ex inflation surged 0.4%q/q and missed estimates and previous reading of 0.5%, suggesting the domestic consumption is having a hard time to take off as consumers struggle to get better clarity on the country’s outlook.

AUD/USD continued to trade with an upside bias and headed towards the next resistance at 0.7676 (high from July 15th).

The pound sterling spent most of the Asian session trading within a very narrow range (between 1.3282 and 1.3346) ahead of the BoE meeting. The market is broadly expecting a rate cut from the British central bank for the first time since 2009 as the UK’s exit from the EU may trigger a recession.

We maintain our view that the BoE should keep the interest rate unchanged and should rather increase the asset purchase target to relieve financial markets. Our main argument is that the BoE has little room to maneuver before switching into negative territory and that central bankers around the globe are increasingly wary about negative interest rate policy. In my opinion it will be a close call.

GBP/USD should continue to move sideways before the decision.

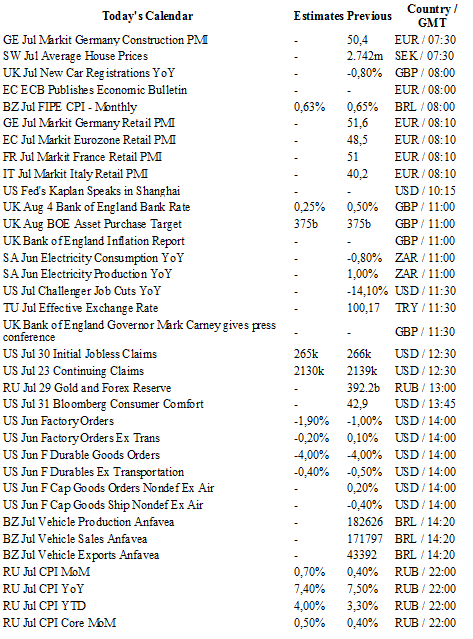

Today traders will be watching Markit retail PMI from Germany, the eur zone, France and Italy; BoE interest rate decision and asset purchase target; initial jobless claims, factory orders and durable goods orders from the US.

Currency Tech

EUR/USD

R 2: 1.1428

R 1: 1.1234

CURRENT: 1.1132

S 1: 1.0913

S 2: 1.0822

GBP/USD

R 2: 1.3981

R 1: 1.3534

CURRENT: 1.3295

S 1: 1.2851

S 2: 1.2798

USD/JPY

R 2: 107.90

R 1: 102.83

CURRENT: 101.53

S 1: 100.00

S 2: 99.02

USD/CHF

R 2: 1.0328

R 1: 0.9956

CURRENT: 0.9733

S 1: 0.9522

S 2: 0.9444