THE TAKEAWAY: USD Federal Open Market Committee releases quarterly economic forecasts > Growth, Inflation downgraded, while Unemployment Rate upgraded > $85B/month pace of QE3 unchanged.

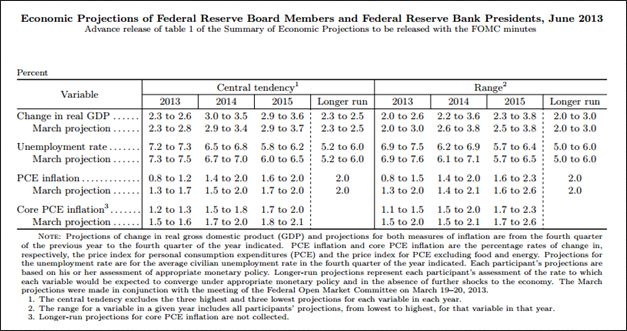

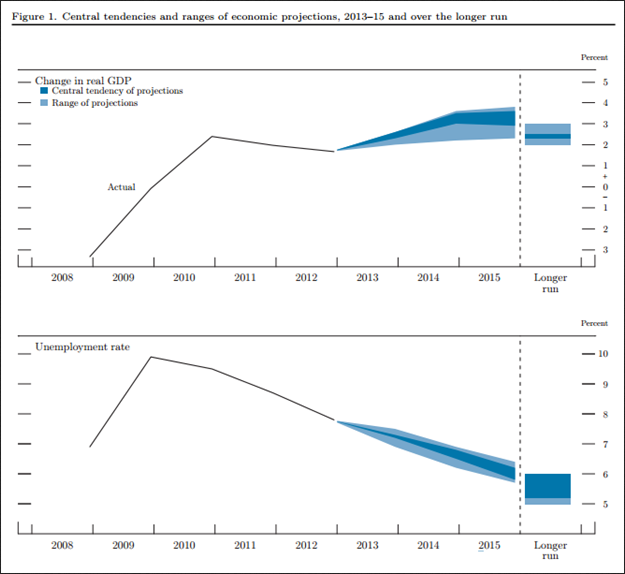

The US economy will grow at a rate of +2.3% to +2.6% in 2013, according to the Federal Reserve’s latest round of economic projections released today, down from the +2.3% to +2.8% range revised in March 2013. Amid the softer growth forecast, policymakers have also downgraded the inflation forecast for the world’s largest economy, with the Core PCE forecast for 2013 falling to +0.8% y/y to +1.2% y/y, from +1.3% y/y to +1.7% y/y.

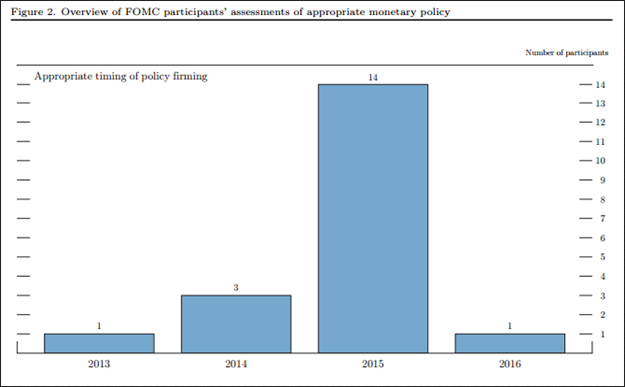

Nevertheless, the key interest rate was kept on hold at 0.25%, and the pace of QE3 was kept on hold at $85B/month in agency MBS and US Treasury purchases.

Presented below, without commentary, are the key figures from the Fed’s revised 2013 forecasts.