The USD rally was perturbed in places yesterday by a downdraft in risk appetite. A significant driver, if not the main driver, of the latter is the sheer, unrelenting momentum of the USD strength, which at its current pace threatens to destabilise global markets.

Emerging market currencies have been heavily hit of late, and the nervousness has spread to US equities over the last few days as well, on fears that the strong US Dollar will significantly dent US corporate profits.

This pace of appreciation will stop soon and when it does, it will likely do so abruptly. The most interesting pair may be USD/JPY if the trend is turning in an environment of weak risk appetite.

The first days of the European Central Bank's quantitative easing are clearly having an effect on European sovereign yields, as the German Bund yield has plunged to new record lows below 0.25% this morning and peripheral yields are also lower, with the Portugal 10-Year yields almost 50 basis points below the U.S. 10-Year yield. That latter fact does a lot to explain why EUR/USD is trading near 1.0700 now.

Pity the European-based investor who is happy to unload bonds onto the ECB at these ridiculous prices and doesn’t want to buy equities – where to park cash? The answer seems to be not in Europe…

Few event risks today, though we do have a Swedish CPI release that will be out before this is posted and a few central bank officials out speaking as well. Also, Sterling has been on a remarkable run higher and it will be an interesting test of sentiment there to see how the currency trades on a surprise either way in today’s manufacturing production release.

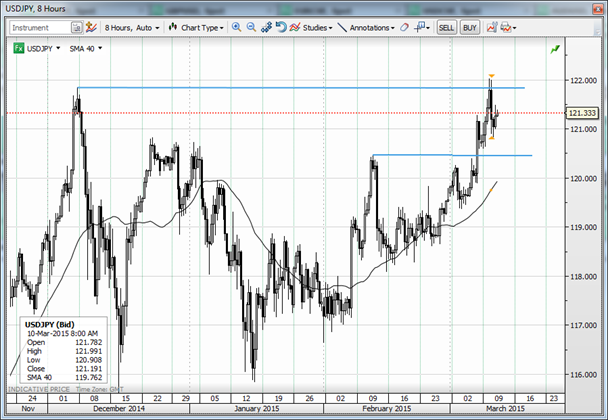

Chart: USD/JPY

As the “atechnical” slide continues in EUR/USD, one of the more interesting sideshows is the relative performance of the USD and JPY, as the pair failed convincingly to take out the previous cycle highs above 121.85. But the reversal lower was not particularly convincing yet.

We need to see either 122.00+ here or sub-120.50, and even sub-120.00 levels, to get a hint either way of where the action will take us, with the preference for downside if risk appetite continues to suggest panic.

The G-10 rundown

USD: The relentless strength is beginning to destabilise world markets and it looks like this may end in some kind of spectacular blow-off rally before we reverse – traders need to beware of the increasing volatility potential if this proves the case. If we are at EUR/USD 1.050 going into the FOMC meeting, it is hard to see the Fed peddling a hawkish message.

EUR: Another day another figure lower as the headlines are starting to tilt towards a parity test sooner rather than later. This pace of decline can’t continue much longer without a response from officialdom – most notably the Fed – so beginning to wonder if this USD move peaks before/around next week’s FOMC meeting.

JPY: The JPY has been resilient lately and has even outperformed the strong USD over the last 24 hours as risk appetite is suffering under the weight of the USD’s relentless advance. The critical focus now is on whether the small reversal lower in USD/JPY after an attempt to cycle highs turns into a rout back lower and the JPY rages stronger against the broader market in the event the sour mood in risk worsens here.

GBP: Its strength has piggy-backed the USD strength against the euro. As with EUR/USD, the EUR/GBP can’t continue at this pace much longer without being checked by officialdom in some way. Watching today’s manufacturing production release as a near-term sentiment on GBP.

CHF: The noise in the market is that the SNB is targeting 1.10 for EUR/CHF and we just hit parity in USD/CHF, though perhaps weak risk appetite is helping to keep EUR/CHF rangebound for now.

AUD: Fresh lows in AUD/USD have been a bit tentative – we need to see follow-through to keep the trend going at these new areas on the chart.

CAD: Touched the first resistance at 1.2700 in USD/CAD and the last range resistance is just ahead of 1.2800 before we shift the focus to 1.3000. Next major event risk for CAD is Friday’s Canadian employment report for Feb.

NZD: A threat to exports to China of milk powder has risen as an odd new risk for kiwi after purported environmental activists have threatened to poison baby formula containing milk powder from New Zealand. The bigger risk in the near term is tonight’s (tomorrow for those in Asia) Reserve Bank of New Zealand meeting, with many looking for dovish rhetoric and a small minority looking for an actual rate cut. Certainly two-way risk at this meeting, with a wildcard factor of risk appetite – NZD is not very liquid and may underperform simply from a liquidity perspective if risk appetite continues to look wobbly.

SEK: Watching whether today’s CPI release can stop a continuation of the sell-off toward the next major support at 9.00. Look for Riksbank to be out on the warpath soon.

NOK: Impressively, it has managed to trade weaker than the hopelessly weak EUR, which suggests further near-term downside risk for NOK, especially if the recent oil slide continues.

Economic Data Highlights

- Australia Mar. Westpac Consumer Confidence out at 99.5 vs. 100.7 in Feb.

- Japan Jan. Machine Orders fell -1.7% MoM an rose +1.9% YoY vs. -4.0%/-1.0% expected, respectively and vs. +11.4% YoY in Dec.

- Australia Jan. Home Loans fell -3.5% MoM vs. -2.0% expected.

- China Feb. Industrial Production rose +6.8% YTD YoY vs. +7.7% expected.

Upcoming Economic Calendar Highlights (all times GMT)

- Sweden Feb. CPI (0830).

- UK Jan. Industrial and Manufacturing Production (0930).

- Eurozone ECB’s Liikanen to Speak (1015).

- Eurozone ECB’s Nowotny to Speak (1300).

- UK BoE’s Weale to Speak (1500).

- Sweden Riksbank’s Floden to Speak (1525).

- New Zealand RBNZ Official Cash Rate (2000).

- UK Feb. RICS House Price Balance (0001).

- UK BoE publishes quarterly bulletin (0005).

- New Zealand RBNZ’s Wheeler to Speak before Parliament Committee (0010).

- Australia Feb. Employment Change/Unemployment Rate (0030).