Investing.com’s stocks of the week

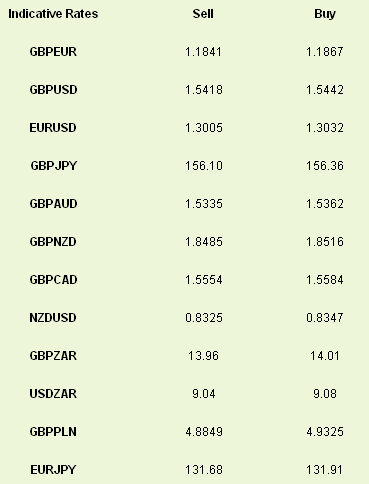

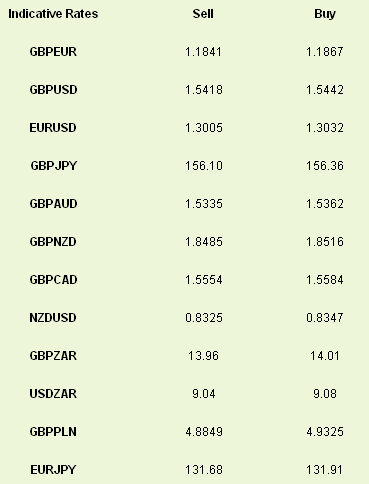

There was a slew of data out yesterday and it was more or less all positive. We started the day with a positive surprise for sterling with the industrial and manufacturing production data numbers both coming in at -1.4% for the year, well ahead of expectations and backing up the growth figures seen in Q1 GDP. GBP traded higher following these results, but GBP/USD failed to test the 1.56 level and ultimately ran out of steam and drifted lower even before this big US dollar move we saw later on. The UK trade deficit today is expected to narrow slightly after the sharp deterioration seen in February and this should see GBP/USD supported around the 1.54 level.

The big surprise yesterday and overnight was the US dollar strength across the board. The move started with the modestly positive initial jobless claims data, though there were clearly other factors at work. Overnight USD/JPY climbed 2.2% to break through the psychological 100.00 level and power up to 101.00. Some have laid the blame for this move on Japanese structured products that led to large amounts of US dollar buying on the break above 100.00 instigating much broader strength against all of the majors currencies.

In EUR/USD we saw a similar picture to sterling, with US dollar strength leading the market to May lows just above 1.3000. Following the Ascension Day break yesterday, the German trade balance is the only release today, which is likely to see GBP/EUR relatively unchanged within recent ranges.

The meeting of G7 finance ministers starts today and carries into the weekend, with discussion around ‘currency policy’ likely to be on the cards given the intervention announced by New Zealand and the weakness in the Japanese Yen. We will also see the US Fed Chairman Ben Bernanke giving a press conference on monetary policy.

The big surprise yesterday and overnight was the US dollar strength across the board. The move started with the modestly positive initial jobless claims data, though there were clearly other factors at work. Overnight USD/JPY climbed 2.2% to break through the psychological 100.00 level and power up to 101.00. Some have laid the blame for this move on Japanese structured products that led to large amounts of US dollar buying on the break above 100.00 instigating much broader strength against all of the majors currencies.

In EUR/USD we saw a similar picture to sterling, with US dollar strength leading the market to May lows just above 1.3000. Following the Ascension Day break yesterday, the German trade balance is the only release today, which is likely to see GBP/EUR relatively unchanged within recent ranges.

The meeting of G7 finance ministers starts today and carries into the weekend, with discussion around ‘currency policy’ likely to be on the cards given the intervention announced by New Zealand and the weakness in the Japanese Yen. We will also see the US Fed Chairman Ben Bernanke giving a press conference on monetary policy.