USD/SGD has shown some movement on Tuesday, but remains close to the 1.36 line. In the North American session, the pair is trading at 1.3612. On the release front, Singapore will release the year-on-year Consumer Price Index. In the US, the House Price Index improved to 0.5%, matching the forecast. As well, the US released two manufacturing reports. Manufacturing PMI came in at 51.4 points, within expectations. The Richmond Manufacturing Index jumped 22 points, crushing the estimate of -1 point.

The Singapore dollar has sparkled in March, posting gains of 450 points against its US counterpart. The currency has continued to climb, despite the fact that the Singapore economy has taken a hit from the Chinese slowdown, as the Asian giant is a major export market for Singapore. In December, a Monetary Authority of Singapore survey projected growth in 2016 of 2.2 percent. However, a poll conducted by economists, which was released last week, downgraded that estimate to 1.9 percent.

What does the Federal Reserve have planned? Last week’s policy statement appeared to pour cold water on any imminent rate hikes, but “not so fast”, according to two Federal Reserve officials. On Monday, John Williams, president of the San Francisco Fed, said that the Fed could raise rates in April and June, if economic conditions improve. Although the dot plot (an FOMC projection of rate hikes) was lowered at the March meeting, he insisted that the Fed had not changed its path of rate hikes. His comments were echoed by Atlanta Fed Dennis Lockhart, who also said that an April rate move was a clear possibility. Lockhart noted that the US economy was holding up well, despite weak global conditions. Lockart said that the economy was close to full employment and the Fed’s target of 2 percent inflation was attainable. However, it should be kept in mind that neither Willams nor Lockhart is a voting member of the FOMC. The markets will be hoping to learn more about the Fed’s plans from two other Fed presidents who will speak on Tuesday, Charles Evans and Patrick Harker.

USD/SGD Fundamentals

Tuesday (March 22)

- 9:00 US HPI. Estimate 0.5%. Actual 0.5%.

- 9:45 US Flash Manufacturing PMI. Estimate 51.6 points. Actual 51.4 points

- 10:00 US Richmond Manufacturing Index. Estimate -1 points. Actual 22 points

Upcoming Key Events

Wednesday (March 23)

- 00:00 Singapore Consumer Price Index

*Key events are in bold

*All release times are DST

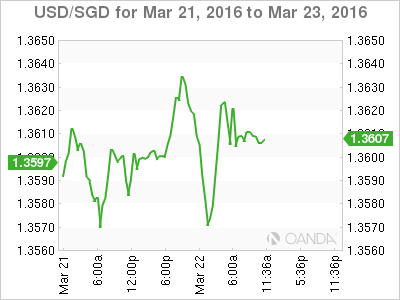

USD/SGD for Tuesday, March 22, 2016

USD/SGD March 22 at 11:05 DST

Open: 1.3616 Low: 1.3564 High: 1.3643 Close: 1.3605

USD/SGD Technicals

| S3 | S2 | S1 | R1 | R2 | R3 |

| 1.3279 | 1.3401 | 1.3535 | 1.3639 | 1.3721 | 1.3810 |

- 1.3639 was tested earlier in resistance and is under pressure

- 1.3535 is providing support

- Current range: 1.3535 to 1.3639

Further levels in both directions:

- Below: 1.3535, 1.3401 and 1.3279

- Above: 1.3639, 1.3721 and 1.3810