USD/SGD is unchanged on Wednesday, as the pair trades at 1.3560. In economic news, Singapore Retail Sales posted a gain of 1.1%. In the US, today’s highlight is the FOMC rate statement, with the markets expecting the Fed to maintain the current benchmark rate of 0.25%. As well, the US will release PPI, with the estimate standing at 0.3%. Thursday promises to be busy, with the US releasing Unemployment Claims and CPI reports.

The Singapore dollar started the week with gains, following a strong Singapore employment report. The unemployment rate came in at 1.9% in the first quarter, unchanged from the fourth quarter of 2015. Singapore’s economy is closely linked to growth trends in China and the Chinese slowdown in 2016 has had a negative impact on the Singapore economy. There was positive news on Wednesday, as Retail Sales, the primary gauge of consumer spending, posted a strong gain of 1.1% in May. However, the Singapore dollar did not react to the strong reading.

USD/SGD Fundamentals

Wednesday (June 15)

- 1:00 Singapore Retail Sales. Actual 1.1%

- 8:30 US PPI. Estimate 0.3%

- 8:30 US Core PPI. Estimate 0.1%

- 8:30 US Empire State Manufacturing Index. Estimate -3.4

- 9:15 US Capacity Utilization Rate. Estimate 75.2%

- 9:15 US Industrial Production. Estimate -0.2%

- 10:30 US Crude Oil Inventories

- 14:00 US FOMC Economic Projections

- 14:00 FOMC Statement

- 14:00 US Federal Funds Rate. Estimate

- 14:30 US FOMC Press Conference

- 16:00 US TIC Long-Term Purchases

Thursday (June 16)

- 8:30 US CPI. Estimate 0.3%

- 8:30 US Core CPI. Estimate 0.2%

- 8:30 US Philly Fed Manufacturing Index. Estimate 1.1

- 8:30 US Unemployment Claims. Estimate 267K

*All release times are EDT

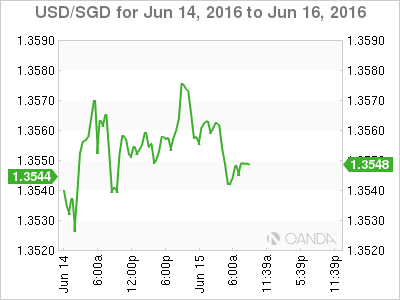

USD/SGD for Wednesday, June 15, 2016

USD/SGD June 15 at 8:15 EDT

Open: 1.3556 Low: 1.3532 High: 1.3582 Close: 1.3550

USD/SGD Technical

| S3 | S2 | S1 | R1 | R2 | R3 |

| 1.3199 | 1.3279 | 1.3443 | 1.3553 | 1.3695 | 1.3828 |

- USD/SGD has shown limited movement in the Asian and European sessions

- 1.3443 is providing strong support

- 1.3553 remains fluid and is currently under strong pressure in resistance

- Current range: 1.3443 to 1.3553

Further levels in both directions:

- Below: 1.3443, 1.3279 and 1.3199

- Above: 1.3553, 1.3695, 1.3828 and 1.3939

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.