USD/SGD lost close to 100 points on Tuesday, as the pair trades at 1.4080 in the North American session. In economic news, Singapore CPI slipped 0.6 points for a second straight month. In the US, CB Consumer Confidence slid to 92.2 points, well short of the forecast. Existing Home Sales remained steady at 5.47 million and beat expectations.

The Singapore dollar has posted sharp losses on Tuesday, following a soft CPI report. The key inflation indicator dropped o.6%, a repeat of the previous release. CPI has now dropped for 15 straight months, prompting the Monetary Authority of Singapore to lower its inflation forecast for 2016. Like developed economies across the globe, Singapore is grappling with weak inflation levels, and the inflation picture has worsened with the collapse in oil prices. The markets don’t have much time to ponder this release, as Singapore will release GDP later on Tuesday. Third-quarter GDP posted a strong gain of 1.9%, but the fourth-quarter report could be softer, given the Chinese slowdown. The Asian giant is Singapore’s largest export market, so weaker Chinese demand could well translate into softer economic growth for the tiny island-state.

The Federal Reserve continues to be scrutinized by the markets, as the timing of another rate hike remains up in the air. The Fed sent out a cautious message in last week’s policy minutes, which reiterated the central bank’s concern that turmoil in global markets could have negative repercussions for the US economy. Policymakers sent out a broad hint that a rate hike is unlikely in March, as they discussed “altering their earlier views of the appropriate path for the target range for the federal funds rate”. This could have a negative impact on the US dollar, as investors will be looking at other options if US rates do not move higher. Fed policymakers appear divided on the Fed’s upcoming strategy. Janet Yellen said last week that the Fed still planned to raise rates later in 2016, but FOMC member James Bullard argued that there was room to delay any rate moves, given global financial turmoil and weak US inflation. Many market players are skeptical that the Fed will make any moves before next year. In December, the Fed hinted at a series of rate hikes during 2016, but the turmoil in the financial markets and the downturn in the US economy in early 2016 have left the timing of another hike in doubt.

USD/SGD Fundamentals

Monday (Feb. 22)

- 00:00 Singapore Consumer Price Index. Actual -0.6%

Upcoming Key Events

Tuesday (Feb. 23)

- 9:00 US S&P/CS Composite-20 HPI. Estimate 5.8%. Actual 5.7%

- 10:00 US CB Consumer Confidence. Estimate 97.4 points. Actual 92.2 points

- 10:00 US Existing Home Sales. Estimate 5.37M. Actual 5.47M

- 10:00 US Richmond Manufacturing Index. Estimate 2 points. Actual -4 points

- 19:00 Singapore GDP. Estimate 0.9%

- 20:30 US FOMC Stanley Fischer Speaks

Wednesday (Feb. 24)

- 10:00 US New Home Sales. Estimate 522K

*Key events are in bold

*All release times are EST

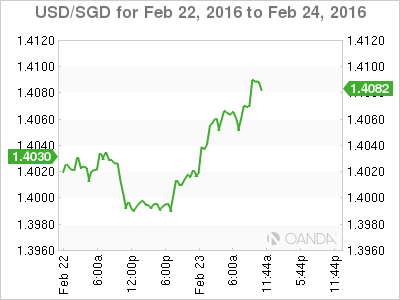

USD/SGD for Tuesday, February 23, 2016

USD/SGD February 23 at 10:40 EST

Open: 1.3991 Low: 1.3981 High: 1.4090 Close: 1.4078

USD/SGD Technicals

| S3 | S2 | S1 | R1 | R2 | R3 |

| 1.3810 | 1.3927 | 1.4016 | 1.4139 | 1.4248 | 1.4368 |

- USD/SGD has posted gains throughout the day

- 1.4016 is providing support

- There is resistance at 1.4139

- Current range: 1.4016 to 1.4139

Further levels in both directions:

- Below: 1.4016, 1.3927, 1.3810 and 1.3721

- Above: 1.4139, 1.4248 and 1.4368