A light economic calendar during the European trading hours kept most of the major currencies in a tight range as the partial US government shutdown has entered its third day with no signs of a deal to end the deadlock. The dollar was little changed, gaining slightly against the yen. The only noticeable economic indicators during the morning calendar were the UK PMI services and the Eurozone retail sales. UK PMI services came below estimations for September (60.3 vs 60.5 est.). Nonetheless, GBP/USD moved upwards at the release covering its morning loses. Soon afterwards, Eurozone retail sales came out much better than expected for August (+0.7% mom vs +0.2% mom est.), but the news had little impact on EUR/USD. The dollar recorded its biggest loses against the Swedish krona despite the fall in the Swedish services PMI to 53.3 from 53.7.

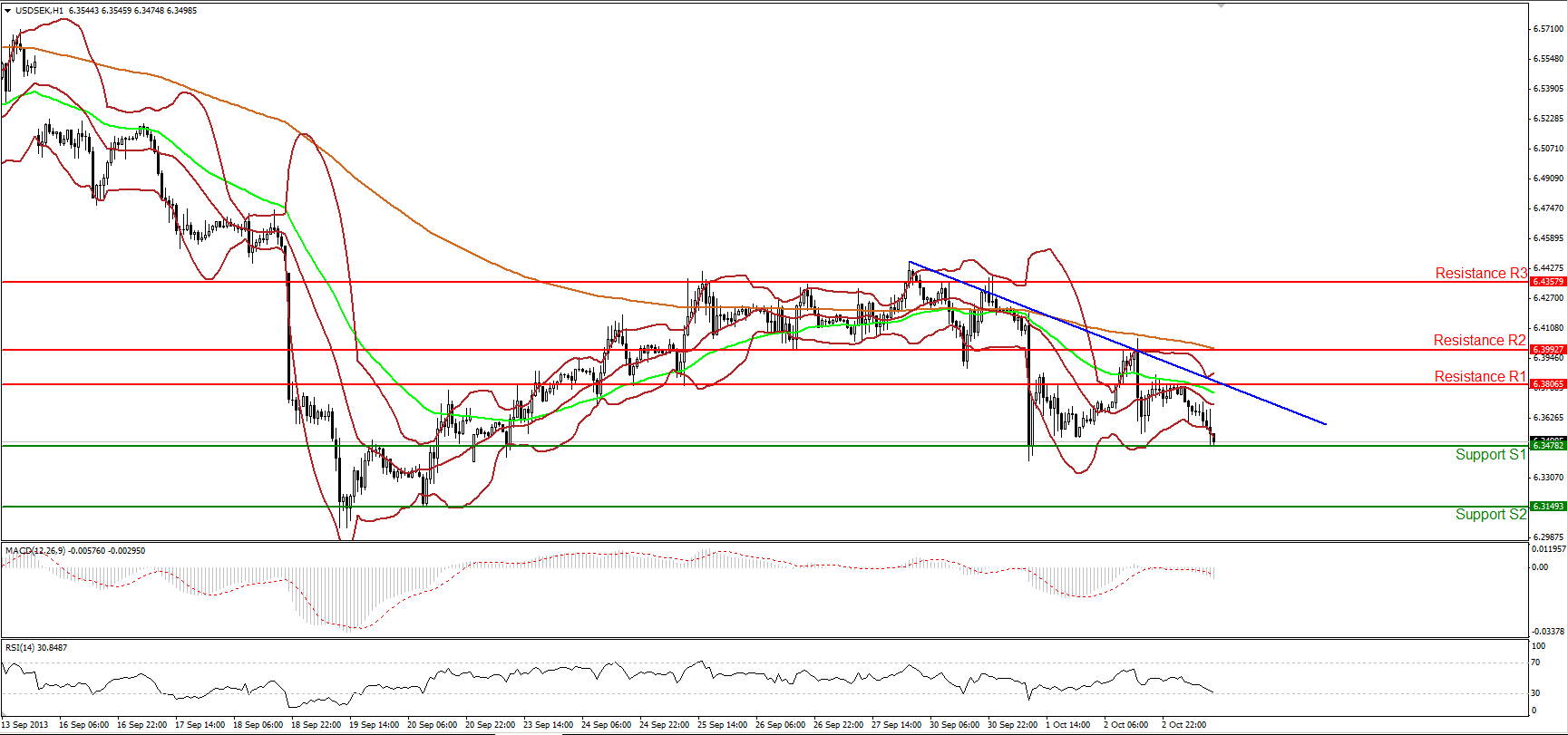

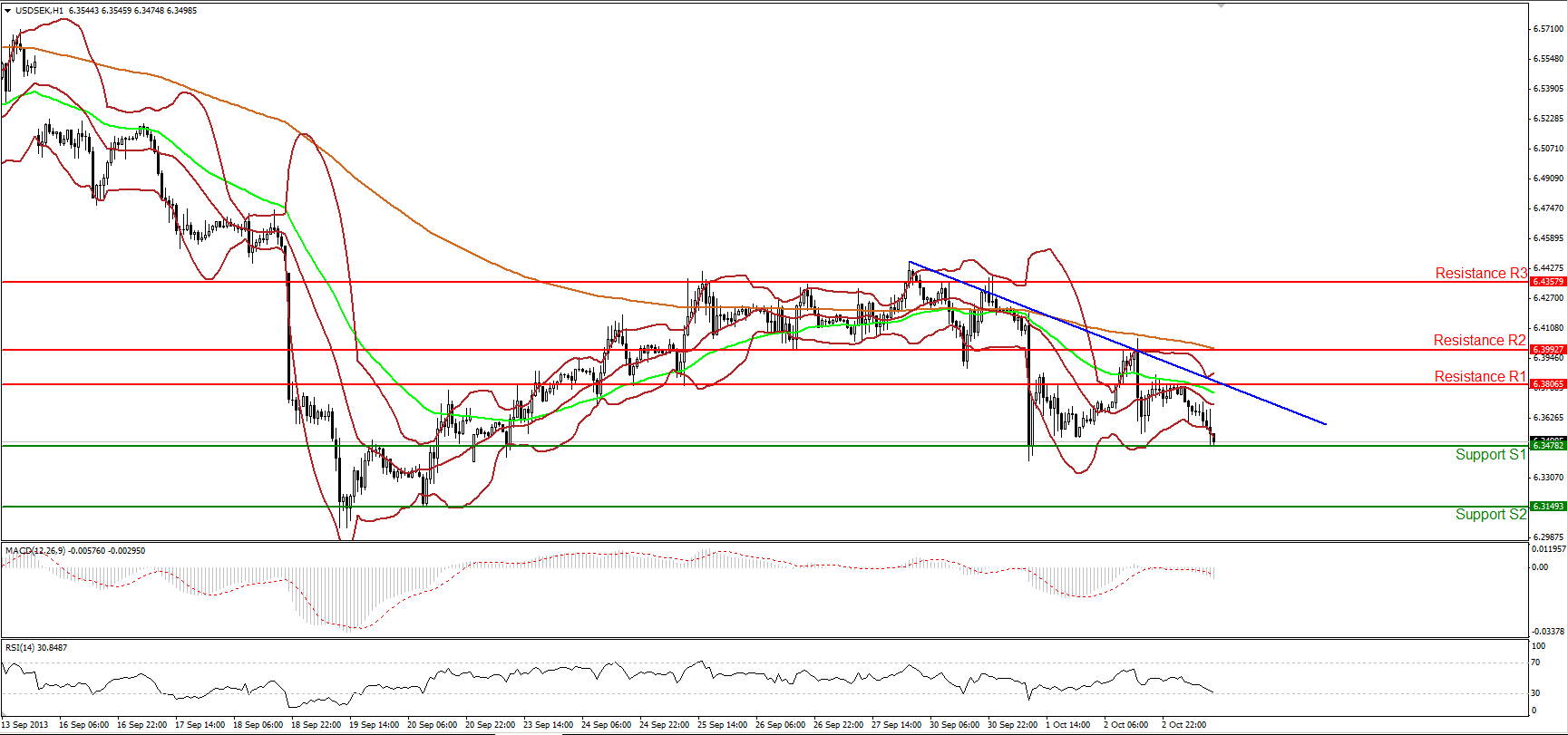

USD/SEK began falling in the Asian day and continued to decline for the whole European morning. In the early afternoon it’s testing the support of 6.3478 (S1). A decisive break below that hurdle will have larger bearish implication and would target the 6.3149 (S2) barrier next. The MACD oscillator is negative, below its trigger, favoring further downside movement; however, future consolidation cannot be ruled out, as the RSI is approaching oversold territory. A triple bearish cross of the moving averages remains on hold, enhancing the downtrend of the rate.

Disclaimer: This information is not considered as investment advice or investment recommendation but instead a marketing communication. This material has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and that it is not subject to any prohibition on dealing ahead of the dissemination of investment research. IronFX may act as principal (i.e. the counterparty) when executing clients’ orders. This material is just the personal opinion of the author(s) and client’s investment objective and risks tolerance have not been considered.

IronFX is not responsible for any loss arising from any information herein contained. Past performance does not guarantee or predict any future performance. Redistribution of this material is strictly prohibited. Risk Warning: Forex and CFDs are leveraged products and involves a high level of risk. It is possible to lose all your capital. These products may not be suitable for everyone and you should ensure that you understand the risks involved. Seek independent advice if necessary. IronFx Financial Services Limited is authorised and regulated by CySEC (Licence no. 125/10). IronFX UK Limited is authorised and regulated by FCA (Registration no. 585561). IronFX (Australia) Pty Ltd is authorized and regulated by ASIC (AFSL no. 417482)

USD/SEK began falling in the Asian day and continued to decline for the whole European morning. In the early afternoon it’s testing the support of 6.3478 (S1). A decisive break below that hurdle will have larger bearish implication and would target the 6.3149 (S2) barrier next. The MACD oscillator is negative, below its trigger, favoring further downside movement; however, future consolidation cannot be ruled out, as the RSI is approaching oversold territory. A triple bearish cross of the moving averages remains on hold, enhancing the downtrend of the rate.

- Support levels are identified at 6.3478 (S1), followed by 6.3149 (S2) and 6.2786 (S3). The latter one is found from the daily chart.

- Resistance is at 6.3806 (R1), followed by 6.3992 (R2) and 6.4357 (R3).

Disclaimer: This information is not considered as investment advice or investment recommendation but instead a marketing communication. This material has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and that it is not subject to any prohibition on dealing ahead of the dissemination of investment research. IronFX may act as principal (i.e. the counterparty) when executing clients’ orders. This material is just the personal opinion of the author(s) and client’s investment objective and risks tolerance have not been considered.

IronFX is not responsible for any loss arising from any information herein contained. Past performance does not guarantee or predict any future performance. Redistribution of this material is strictly prohibited. Risk Warning: Forex and CFDs are leveraged products and involves a high level of risk. It is possible to lose all your capital. These products may not be suitable for everyone and you should ensure that you understand the risks involved. Seek independent advice if necessary. IronFx Financial Services Limited is authorised and regulated by CySEC (Licence no. 125/10). IronFX UK Limited is authorised and regulated by FCA (Registration no. 585561). IronFX (Australia) Pty Ltd is authorized and regulated by ASIC (AFSL no. 417482)