Talking Points:

- The USDr Pares Decline as Private Spending Remains Resilient

- Bullish EUR/USD Trend Remains in Focus- Retest of 1.3800 in View

|

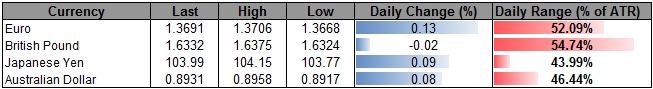

Index |

Last |

High |

Low |

Daily Change (%) |

Daily Range (% of ATR) |

|

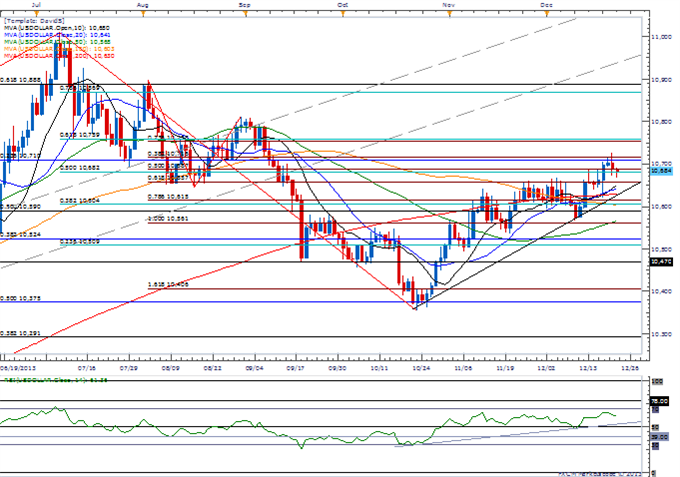

DJ-FXCM Dollar Index |

10684.88 |

10690.88 |

10669.24 |

-0.07 |

47.14% |

- Looking for Lower High as Long as Dollar Preserves Bullish Trend

- Relative Strength Index Reinforces Bullish Outlook as It Retains Upward Trend

- Interim Resistance: 10,753 (23.6 expansion) to 10,759 (61.8 retracement)

- Interim Support: 10,657 (61.8 extension)- Closing Basis

|

Release |

GMT |

Expected |

Actual |

|

Chicago Fed National Activity Index (NOV) |

13:30 |

0.30 |

0.60 |

|

Personal Income (NOV) |

13:30 |

0.5% |

0.2% |

|

Personal Spending (NOV) |

13:30 |

0.5% |

0.5% |

|

Personal Consumption Expenditure Deflator (MoM) (NOV) |

13:30 |

0.1% |

0.0% |

|

Personal Consumption Expenditure Deflator (YoY) (NOV) |

13:30 |

0.9% |

0.9% |

|

Personal Consumption Expenditure Core (MoM) (NOV) |

13:30 |

0.1% |

0.1% |

|

Personal Consumption Expenditure Core (YoY) (NOV) |

13:30 |

1.2% |

1.1% |

|

U. of Michigan Confidence (DEC F) |

14:55 |

83.0 |

The Dow Jones-FXCM U.S. Dollar Index pared the decline to 10,669 as Personal Spending in the world’s largest economy increased another 0.5 percent in November, and the reserve currency appears to be searching for a higher low as it retains the bullish trend carried over from the end of October.

At the same time, Richmond Fed President Jeffery Lacker argued that the Federal Open Market Committee (FOMC) may continue to reduce the asset-purchase program by $10B as growth prospects improve, but the heightening threat for disinflation may raise the central bank’s scope to retain its highly accommodative policy stance for an extended period of time as price growth is expected to hold below the 2 percent target over the policy horizon.

As a result, the FOMC under Janet Yellen may implement a wait-and-see approach throughout the first-quarter of 2014, and the bullish sentiment underlying the USD may come under pressure should the central bank further highlight the downside risks for price growth.

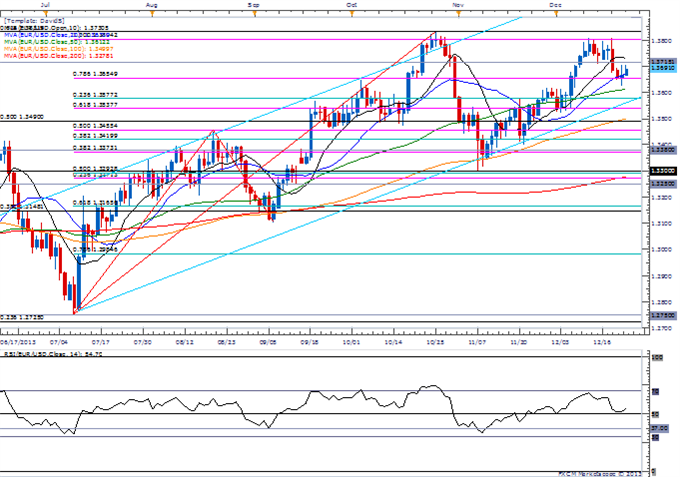

EUR/USD Daily Chart" title="EUR/USD Daily Chart" width="600" height="650">

EUR/USD Daily Chart" title="EUR/USD Daily Chart" width="600" height="650">

- Appears to Have Carved a Higher Low Ahead of 50-Day SMA (1.3612)

- Interim Resistance: 1.3800 (100.0 expansion) to 1.3830 (61.8 retracement)

- Interim Support: 1.3530 (61.8 expansion) to 1.3570 (23.6 retracement)

Three of the four components strengthened against the greenback, led by a 0.13 percent advance in the euro, and the EUR/USD appears to be coiling up for another run at the 1.3800 handle as it retains the bullish structure from earlier this year.

The ascending channel should get carried into 2014 as the European Central Bank (ECB) looks poised to retain its current policy at the January 9 meeting, and the single currency may continue to benefit from the more neutral tone struck by President Mario Draghi as the central bank refrains from further embarking on its easing cycle.

However, the ongoing turmoil in the periphery countries may continue to drag on the real economy as they struggle to get their house in order, and the ECB may have little choice but to offer additional monetary support as the region faces a slowing recovery.