The U.S. dollar fell across the board against major pairs on Tuesday ahead of the central-bank summit hosted by the Fed. The U.S. Federal Reserve will be releasing the minutes from the July Federal Open Market Committee (FOMC) meeting where it cut the benchmark rate by 25 basis points. The minutes will be posted on Wednesday, August 21 at 2pm EDT. The market expects the central bank to lay on the dovish rhetoric very thick.

The White House has been vocal on its expectations and as more central banks jump on the dove bandwagon, the Fed is expected to lead them. The Fed did slash rates as forecasted after the July meeting, but Chair Jerome Powell confused markets with a slightly hawkish tone and lack of commitment to an easing cycle. The minutes from the July FOMC could confirm the Fed remains dovish – or it could validate Powell’s hesitation to cut rates when the U.S. economy might not warrant that adjustment.

Euro Climbs Ahead Of Fed Minutes, Despite Italian Turbulence

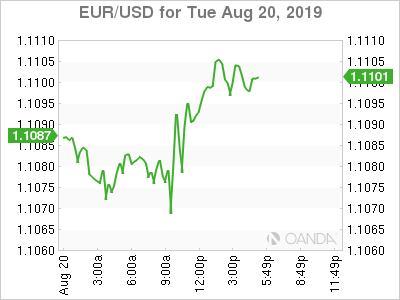

The EUR/USD gained 0.21 percent on Tuesday. The single currency is trading at 1.1101 awaiting the notes from the July FOMC meeting. Investors are more focused on monetary policy than politics as the EUR managed a gain despite tensions rising in Italy and England. The Italian prime minister resigned and in Britain, Boris Johnson has kept a no-deal exit on the table.

Elections in Italy appear to be the next step unless a new government can be formed without them and come at a time when budget negotiations need to take place. The Italian budget is a delicate matter as it is bound to put the not-yet-formed government on a collision course with the European Union.

Oil

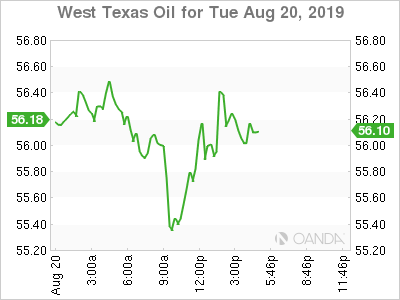

Oil prices are steady ahead of Wednesday’s U.S. inventory data. West Texas Intermediate is flat at 0.02 percent and Brent gained 0.59 percent. Crude has been caught in a tight trading range as optimism of a U.S.-China trade deal is being offset with ample supply.

Central banks have come out in force to guarantee lower rates for longer, but recession fears have surged as there is not enough evidence of how much traction policy makers will get with limited ammunition.

Gold

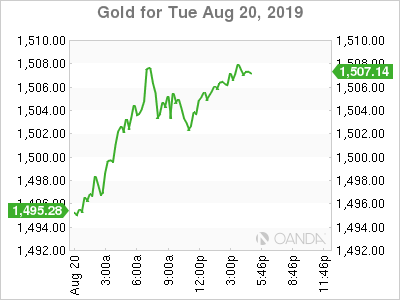

Gold rose 0.36 percent as the USD depreciated. The yellow metal remains atop the $1,500 price level with all eyes on the Fed minutes for guidance on their metal holdings. It will be hard for the Fed to meet the market's dovish expectations but if it manages to do so, gold could keep its upward trajectory.

Failure to validate the market’s view could result in a stronger dollar and put the yellow metal on the back foot, despite its appeal as a safe haven. A neutral Fed is seen as a hawkish Fed in current trading conditions.