- US Dollar breaks significant resistance versus Euro, Yen

- We see risk of a short-term EUR/USD low next week

- Shifts in trends nonetheless leave us in favor of USD strength

The US Dollar near multi-year highs against major counterparts. There’s always risk of pullback, but we see further room for the Greenback to rally.

In recent weeks we’ve warned that the US Dollar could soon reverse as it showed clearly difficulty trading above important resistance versus the Euro and Japanese Yen. Yet the Greenback has since broken to major highs versus both the EUR and JPY, and indeed the Dow Jones FXCM Dollar Index is now at its 7th-consecutive weekly advance.

Source: FXCM Trading Station Desktop, Prepared by David Rodriguez

The risk of a short-term pullback is clear, but the trend has turned and we mostly want to position ourselves for USD strength.

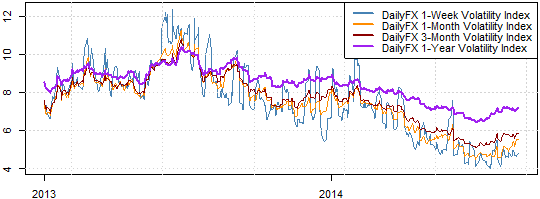

FX volatility prices show that traders are increasingly betting on/hedging against sharper currency swings. This in itself hardly guarantees that the Dollar will continue higher, but it does support the case for an important shift in broader market conditions.

Data source: Bloomberg, DailyFX Calculations

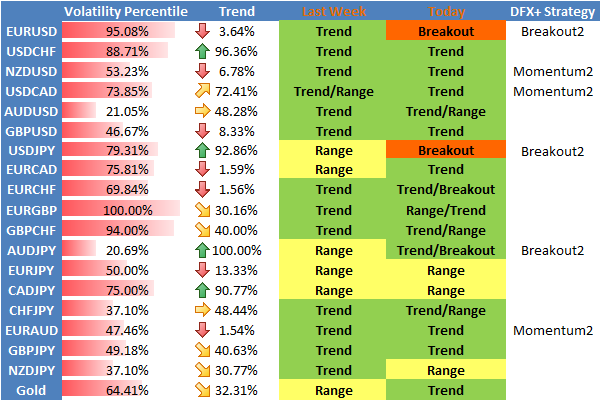

DailyFX Individual Currency Pair Conditions and Trading Strategy Bias

--- Written by David Rodriguez, Quantitative Strategist for DailyFX.com