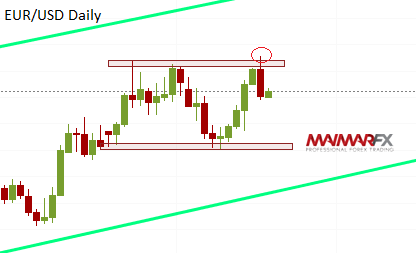

The U.S. dollar experienced a rebound last Friday after the euro and British pound were unable to overcome crucial resistance levels. The euro rejected again from the upper barrier of its current sideways trading range, even though the single currency took a short glimpse above 1.2550 before it reversed direction. For the euro to regain strength it would need a sustained break above 1.2650 which could result in further gains towards 1.28. As long as the EUR/USD remains stuck between 1.26 and 1.22 the outlook is neutral.

The British pound bounced off the upper trendline of its recent downward channel around 1.4150 and traders now wonder whether there will be further losses towards 1.37 and 1.3670 now. As long as the downward channel remains unbroken we see a higher likelihood of bearish momentum driving the pound towards 1.37. A renewed break above 1.4140, however, may encourage sterling bulls for a run towards 1.4250.

It could be a quiet start to the new week as U.S. markets will be closed for the President’s Day holiday today. Looking out for fundamental themes that could impact the price action in major currency pairs in the days ahead, we have the FOMC minutes (Wednesday) and a range of Fed as well as BoE speakers on tap this week.

Sterling traders should keep an eye on key BoE members speaking (today and Wednesday) as well as on the U.K. jobs report due for release on Wednesday.

BoE Governor Mark Carney is scheduled to speak at an event in London today at 17:45 UTC.

We wish you a good start to the new week and profitable trades in the days ahead.

Here are our daily signal alerts:

EUR/USD

Long at 1.2465 SL 25 TP 20, 40

Short at 1.2380 SL 25 TP 20, 40

GBP/USD

Long at 1.4065 SL 25 TP 30-40

Short at 1.4085 SL 25 TP 40

We wish you good trades and many pips!

Disclaimer: Any and all liability of the author is excluded.