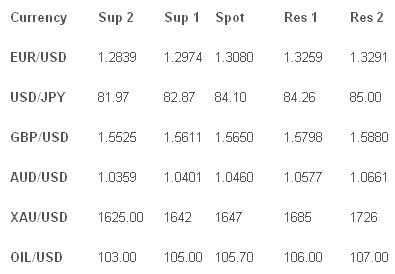

U.S. Dollar Trading (USD) the USD is gaining across the board even as US stocks continue to rally in what could be the start of a game changing trend. The safe haven status of the US Dollar has meant it would usually be sold when stock markets rally but since the US jobs data last Friday the USD has been on the front foot. Reports suggest the US economic recovery is looking stronger than the European and Japanese this year and this is being credited for the Dollar buying. Looking ahead, Weekly Jobless claims forecast at 356k vs. 362k previously.

The Euro (EUR) the selling continued overnight with a grind lower towards the 1.3000 level but the move was slow and the level was not tested. The outlook is negative with the post Greece bailout price action suggesting little support the single currency and the ECB likely to cut rates rather than hike as their next move. The Sterling (GBP) the 1.5650 level held on GBP/USD and this helped the crosses gain against the Euro and the AUD. The GBP/AUD is starting to reverse after hitting all-time lows at 1.4500 with the market testing 1.5000 overnight. Other news for the Pound was the negative watch of UK’s AAA rating by Fitch with the rating agency putting their chance of a downgrade at over 50% in the next 2 years. Looking ahead, Swiss Interest Rate decision forecast to remain at 0.25% with focus on the 1.2000 EUR/CHF floor.

The Japanese Yen (JPY) the strongest trend in the market continued overnight with USD/JPY above Y84 by Thursday’s Asian morning and the Yen crosses are also bucking the major’s trend and moving to recent highs. EUR/JPY is in striking distance of Y110. Australian Dollar (AUD) the AUD/USD broke lower with the USD strength to much for the China linked risk currency falling below 1.0500 and sliding to fresh multi month lows near 1.0420. The news out of China is for a continued managed slowdown to counter rising social inequality especially in the housing sector.

Oil & Gold (XAU) Gold was hammered as the US longer term yields continued to rally and USD demand soared through the markets. Gold has been used as a USD hedge and so any pro USD story hurts the precious metal dramatically. OIL/USD broke below the $106 level on general USD strength but the movement was muted.

Pairs to watch

USD/JPY one way action Y85 level?

EUR/JPY near year highs Y110 to test today?

TECHNICAL COMMENTARY

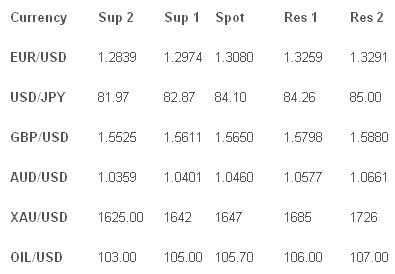

The Euro (EUR) the selling continued overnight with a grind lower towards the 1.3000 level but the move was slow and the level was not tested. The outlook is negative with the post Greece bailout price action suggesting little support the single currency and the ECB likely to cut rates rather than hike as their next move. The Sterling (GBP) the 1.5650 level held on GBP/USD and this helped the crosses gain against the Euro and the AUD. The GBP/AUD is starting to reverse after hitting all-time lows at 1.4500 with the market testing 1.5000 overnight. Other news for the Pound was the negative watch of UK’s AAA rating by Fitch with the rating agency putting their chance of a downgrade at over 50% in the next 2 years. Looking ahead, Swiss Interest Rate decision forecast to remain at 0.25% with focus on the 1.2000 EUR/CHF floor.

The Japanese Yen (JPY) the strongest trend in the market continued overnight with USD/JPY above Y84 by Thursday’s Asian morning and the Yen crosses are also bucking the major’s trend and moving to recent highs. EUR/JPY is in striking distance of Y110. Australian Dollar (AUD) the AUD/USD broke lower with the USD strength to much for the China linked risk currency falling below 1.0500 and sliding to fresh multi month lows near 1.0420. The news out of China is for a continued managed slowdown to counter rising social inequality especially in the housing sector.

Oil & Gold (XAU) Gold was hammered as the US longer term yields continued to rally and USD demand soared through the markets. Gold has been used as a USD hedge and so any pro USD story hurts the precious metal dramatically. OIL/USD broke below the $106 level on general USD strength but the movement was muted.

Pairs to watch

USD/JPY one way action Y85 level?

EUR/JPY near year highs Y110 to test today?

TECHNICAL COMMENTARY