Impressive US economic data (higher home prices and a cyclical high in consumer confidence) sent US interest rates soaring, which pushed the dollar higher against almost all currencies overnight. 10yr US Treasury yields jumped 17 bps while expectations for Fed funds in January 2016 also rose 17 bps to 0.86%. It was noticeable that the stock market managed to gain nonetheless, which indicates that this was a “good” rise in rates – one caused by an expectation of a better economy, not expectations of Fed tightening to dampen the economy (as happened last week).

The next step will be to see how the Fed reacts to the higher rates. Will it see the move as an appropriate reflection of the signs of an improving economy, or will it think that the market is over-reacting? Chairman Bernanke gave a speech about interest rates in March in which he said, “(w)e anticipate that long-term rates will rise as the recovery progresses and expected short-term real rates and term premiums return to more normal levels.” But if the market is over-reacting, then “(a)djustments to the pace or timing of asset sales could be used, under some circumstances, to dampen excessively sharp adjustments in longer-term interest rates.” Perhaps when Boston Fed President Rosengren speaks in Minneapolis today he’ll address that issue in the Q&A afterwards.

In any event, the divergence in monetary policy between the Fed and almost all other central banks around the world is why we expect the dollar to rise overall this year. Rising house prices and strong consumer confidence as we saw overnight suggests that the US economy can withstand modestly higher interest rates. When almost all other countries are likely to keep their rates steady or lower them further, the rising interest rate differential should support USD, particularly against countries that will maintain a loosening bias, such as Japan or the UK (and perhaps the Eurozone?).

Today, German CPI for May (EU harmonized version) is forecast to rise to 1.4% yoy from 1.1%. This would probably be EUR-positive, because it implies less need for the ECB to cut rates next week. The German employment data is not expected to be particularly exciting. As for EU money supply, the continued decline in lending may be more important than the headline figure as pressure grows on the ECB to do more to help businesses. The European Commission will make its annual economic policy recommendations for each country today and European austerity programs will be under consideration. In the US, the weekly mortgage application figures are the only data out today. Elsewhere, today is Mark Carney’s last meeting as Governor of the Bank of Canada. No change in rates is expected; rather, the question is whether they will tinker with the last sentence of the statement, which promises that rates will be steady for some undefined “period of time” and then rise. Several other central banks around the world have shifted to an easing bias, and with the Canadian CPI now down to a mere +0.4% yoy (+0.5% yoy core), it’s possible that they shift their bias as well.

The Market

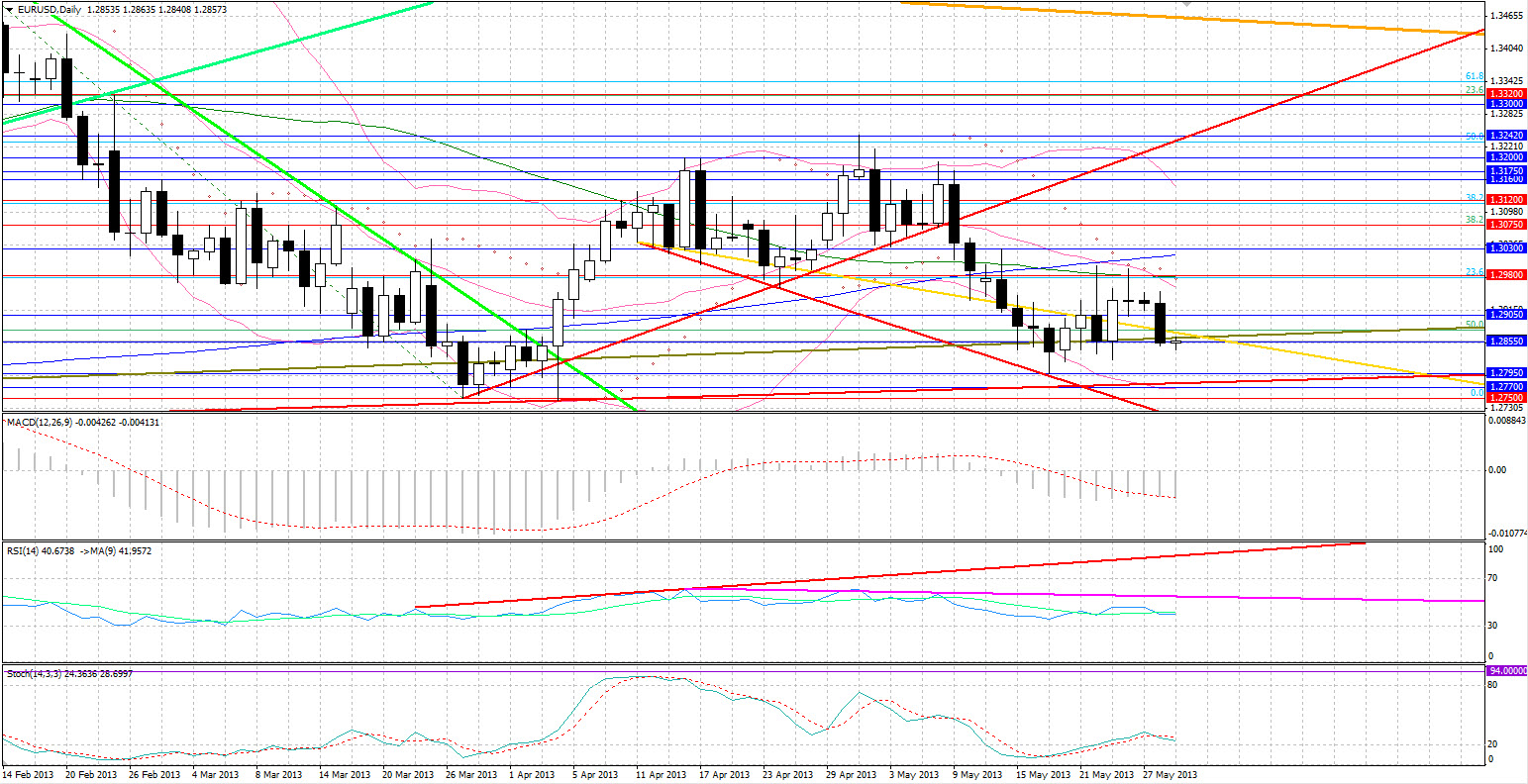

EUR/USD

EUR/USD" title="EUR/USD" width="1560" height="799">

EUR/USD" title="EUR/USD" width="1560" height="799">

• After two days of crawling sideways, EUR/USD finally made a substantial move. The pair dropped until it found support at 1.2850, which is a 1.5 year rising trendline support and also a level that was tested 5 times over the past two weeks. This level is also being tested this morning. The next support lies at 1.2750-1.2780, which upon breakout would see the pair complete a head and shoulders formation. Resistance levels come at 1.2930 followed by the stronger 1.3000.

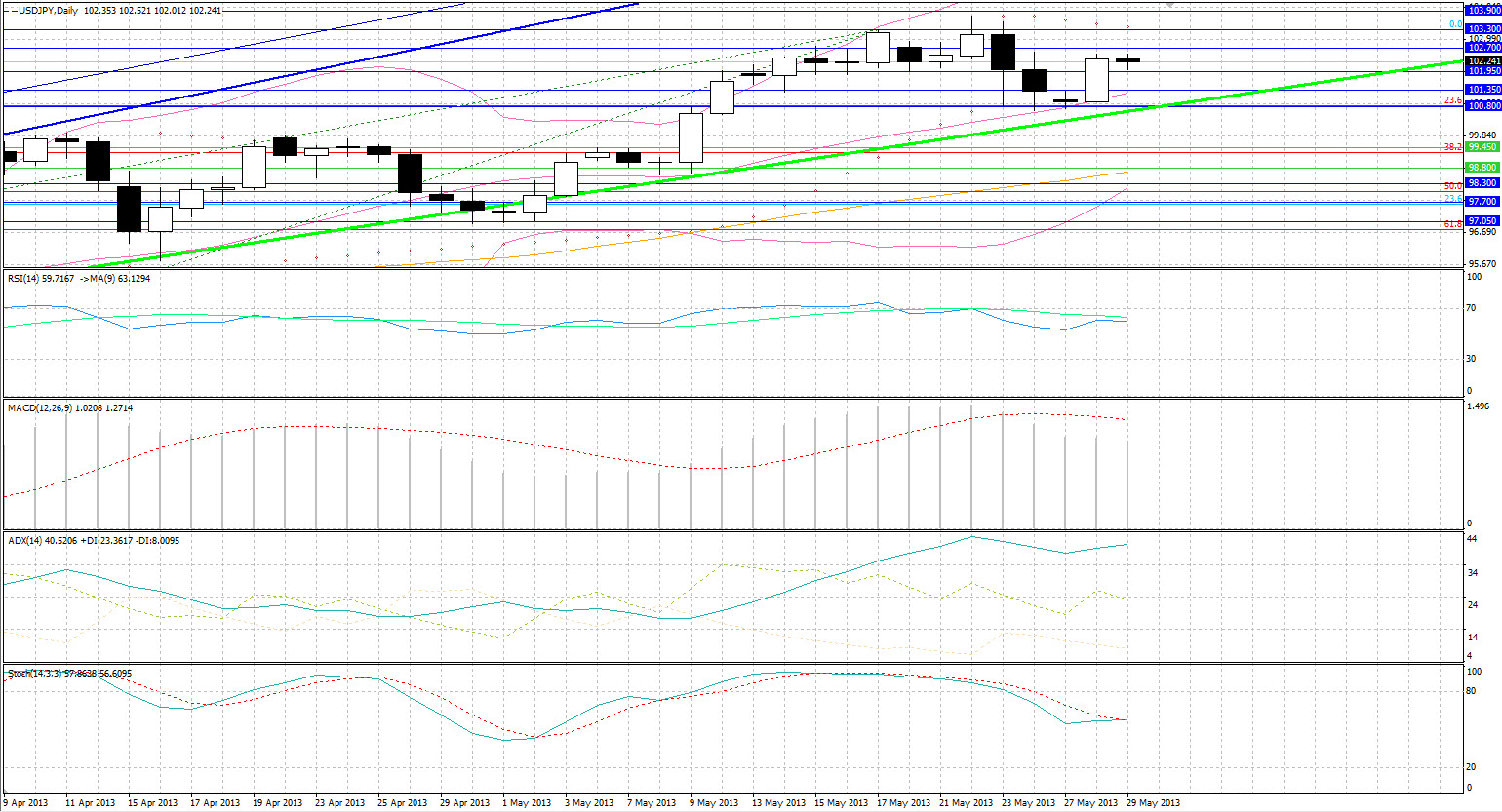

USD/JPY  USD/JPY" title="USD/JPY" width="1560" height="799">

USD/JPY" title="USD/JPY" width="1560" height="799">

• USD/JPY was a significant gainer yesterday after bouncing from the 100.80 resistance level and breaking the 102.00 level, showing that the decline of the previous three sessions was only a retracement. Resistance remains the 102.70 level followed by 103.30 . The 100.80 level remains a strong support with a breakout leading towards 99.90, a previous support.

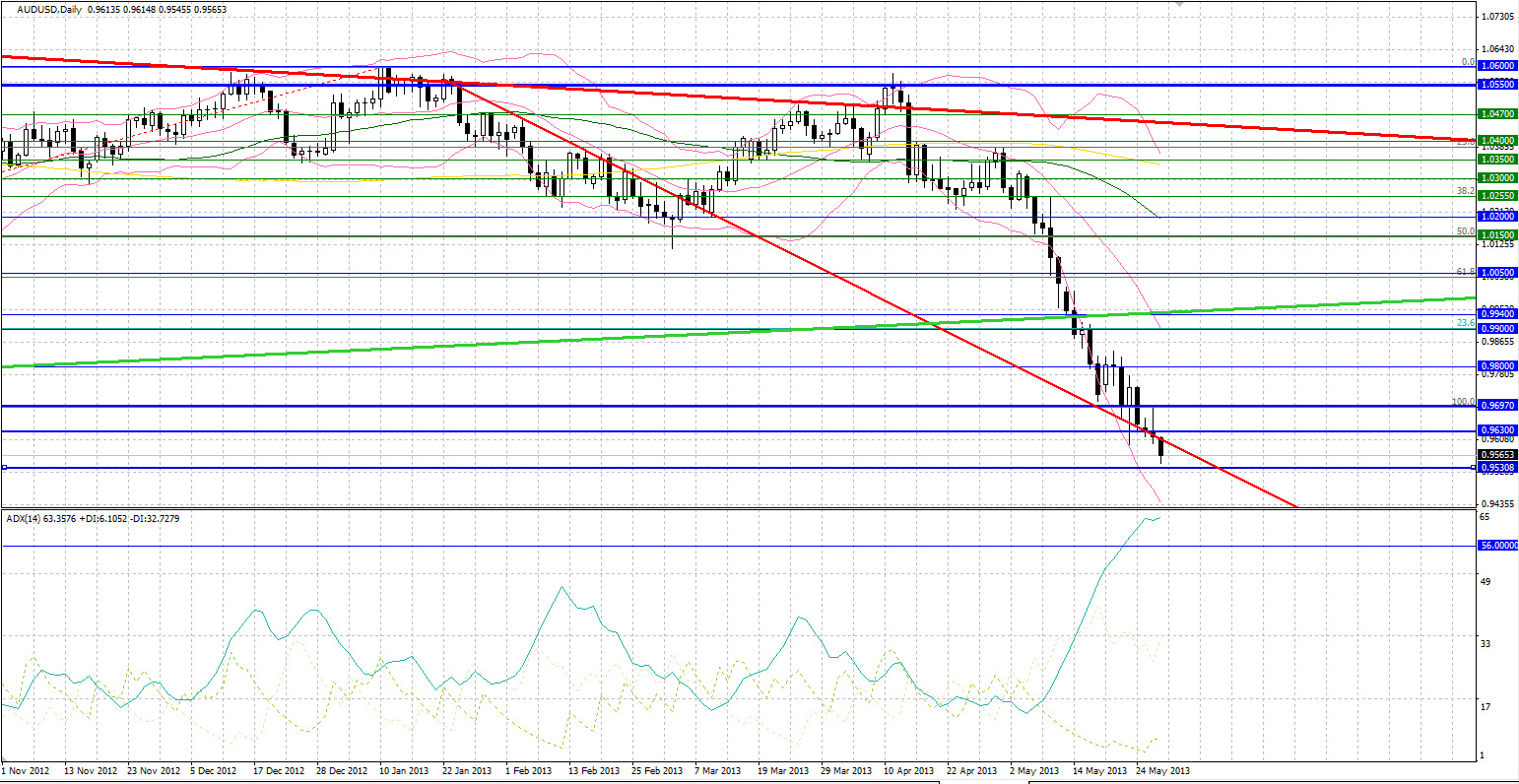

AUD/USD  AUD/USD" title="AUD/USD" width="1560" height="799">

AUD/USD" title="AUD/USD" width="1560" height="799">

• AUD/USD suffered another substantial loss as it broke overnight the 0.9600 support level that is considered a key technical level. If this down move continues, the next support level is 0.9530, which is a two year low. A breakout of that would makeg 0.9400 very possible as there is an absence of any significant support in between. Resistance is now the 0.9630 level followed by 0.9700

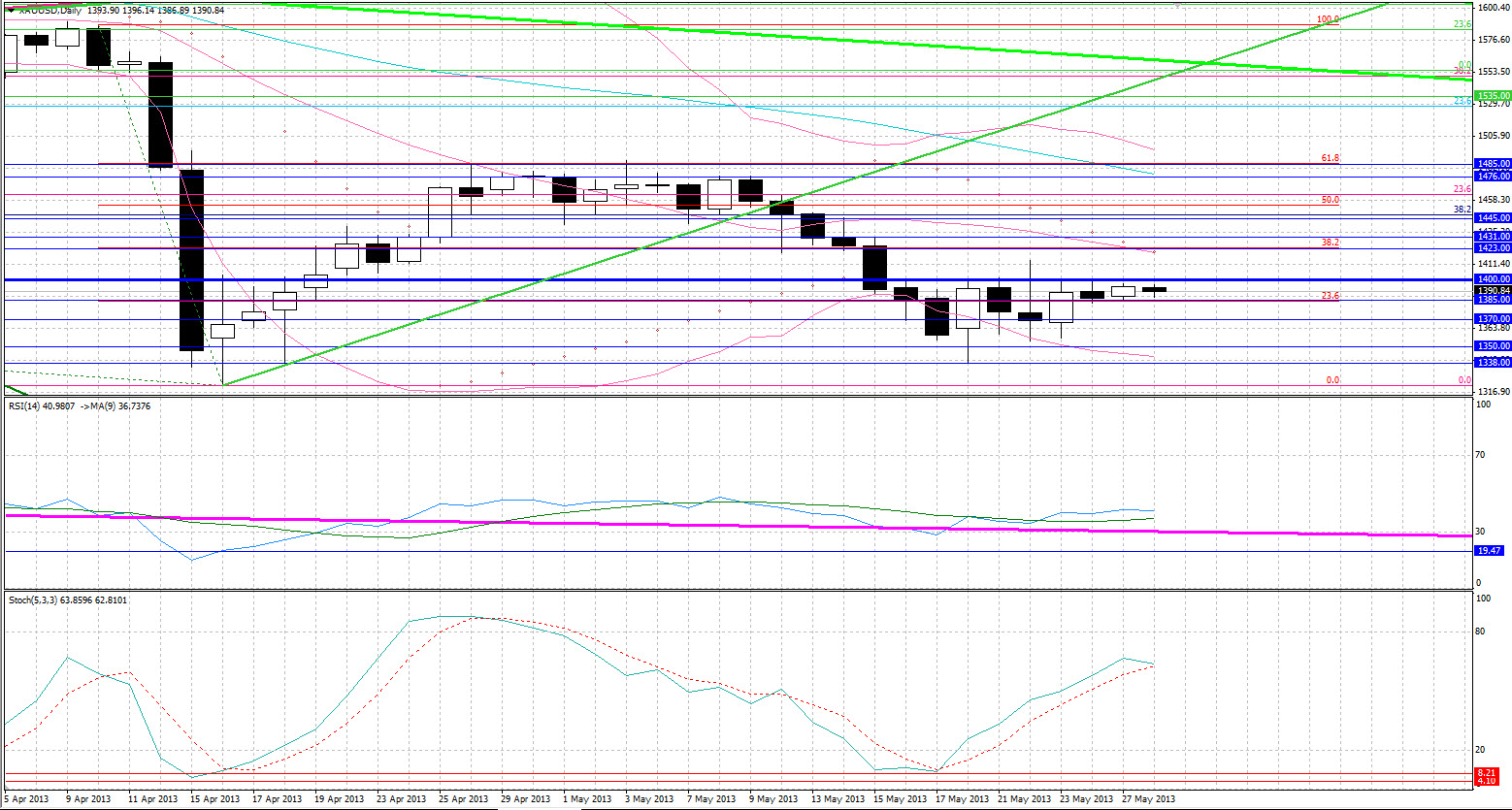

Gold

• Gold had another quiet trading session trading at its usual $1383-1400 range. Though it was able to reach both higher and lower than that range, these breakouts were only marginal and hence no major movements. Resistance levels remain the $1400 and $1430 levels. Support level today has moved slightly lower to $1370 followed by the $1350 level.

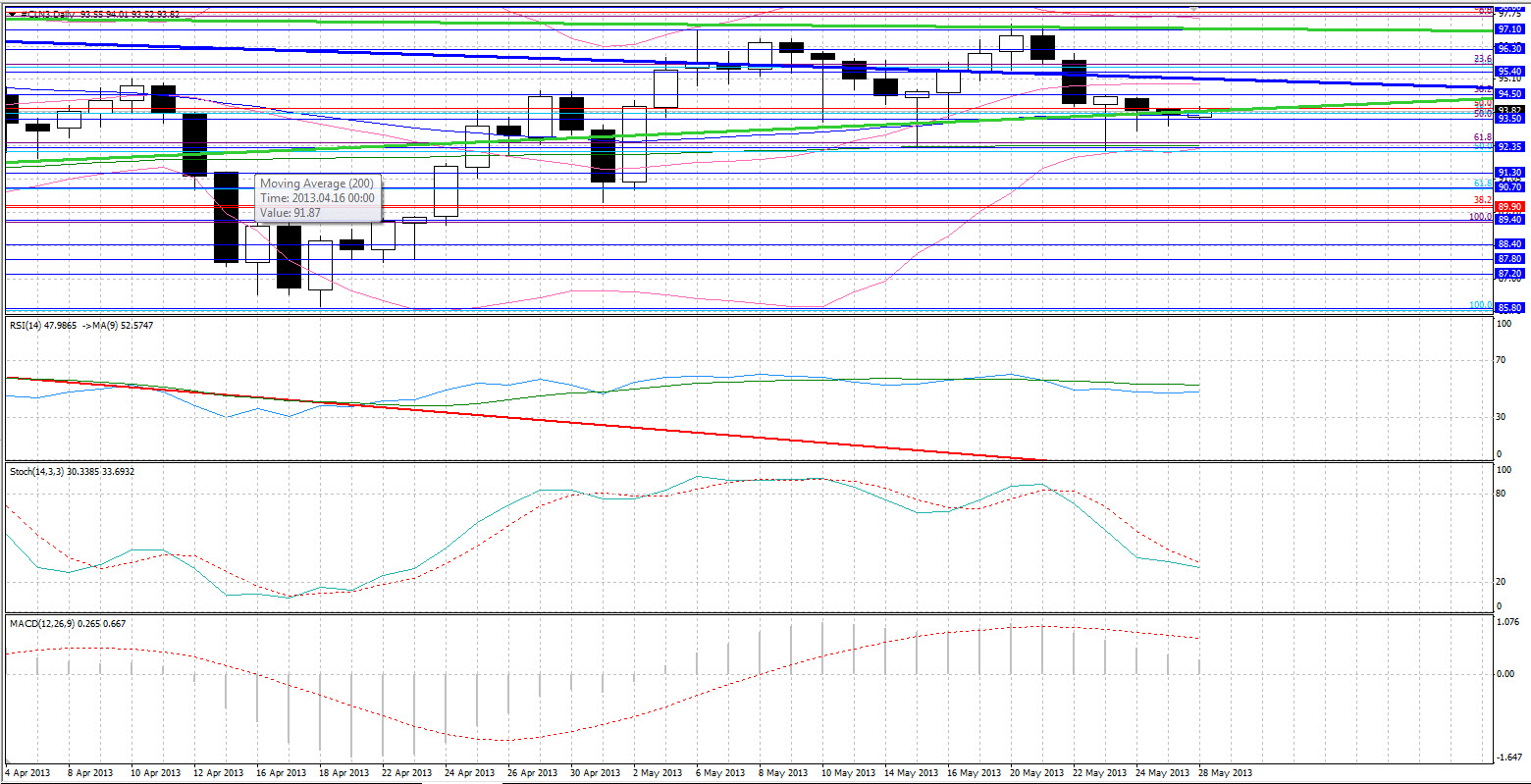

Oil

• WTI was a major gainer yesterday after bouncing higher from the $93.50 support level. Following this rise WTI found resistance at the $95.00 psychological level and spiked towards $96.00. WTI is very close to the $95.00 level, as at the point of writing, with $96.30 being the next major resistance. Support levels remain at $93.50 and $92.20

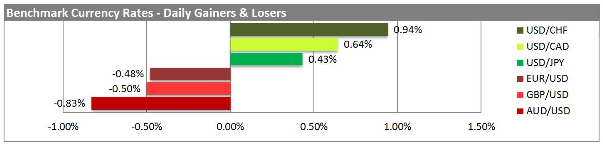

BENCHMARK CURRENCY RATES - DAILY GAINERS AND LOSERS

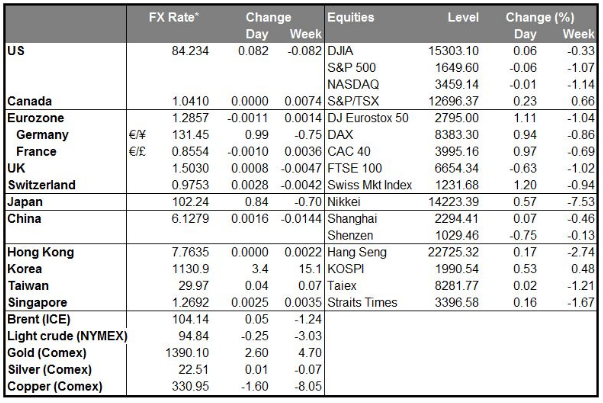

MARKETS SUMMARY

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

USD Rallies On Rising Rates

Published 05/29/2013, 06:36 AM

Updated 07/09/2023, 06:31 AM

USD Rallies On Rising Rates

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.