UK construction which has consistently been the worst performing sector in quarterly figures, posted growth for Oct of 50.9 v 49.1 (exp). At first glance this was almost seen as an anomaly, considering construction in last week’s Q3 GDP was -3.5%. Further dissection of the figures makes things slightly clearer. October’s figure masks the fact that new orders are down and construction firms are seeing the most protracted period of new business since 2008/09. Markets will look to UK services figures released today to either reinforce or dismiss last Friday’s construction figure as a temporary uptick in an otherwise consistent deterioration in UK construction.

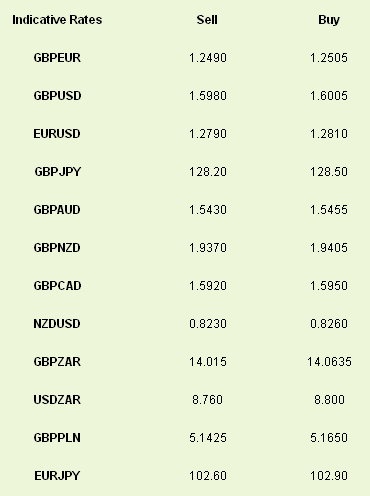

EU manufacturing was weak for all involved which saw GBP/EUR push higher through Friday and reach a new 1 month high at 1.2520 in early morning Asian trading. Ireland was the only country to see manufacturing grow in October, but alas the burdens of the Eurozone weighs too heavily on such slight albeit resilient shoulders. The Greek government votes this morning on whether or not to accept the austerity measures needed to receive the next tranche of their aid package. Scepticism and lack of trader conformity surrounding the nation’s future have also helped push EUR lower this morning. Greece effectively has no money left to pay any public sector expenditures, so to reject or delay the package will leave them broke and short of options.

As expected US jobs data continued to shine as 171k new jobs were created in Oct vs 125k (exp). Unemployment increased to 7.9% as forecasted, so all in all good news for Obama and USD, which reached a new month high against the EUR, touching 1.2790 this morning.

Polls put Obama marginally ahead as we head into the last frantic day before the nation takes to the ballot box. The two candidates are neck and neck with a busy day of jet setting and public speaking. Markets are tipping Obama to retain the presidency as Obama still has a slender lead in the states that he needs to win.

Overnight retail sales for Austraila showed growth for October of 0.5% vs 0.3% for the previous month. Last month’s interest rate cut has clearly helped spending. Trade balance figures were better than expected which saw GBP/AUD drop off slightly to 1.5440.

Looking to the day ahead, UK Services figures will be the key note figure as markets look for reaction to last weeks mixed bag of data. A good figure will see GBP/EUR push higher and take back some of the USD gains we saw on Friday. A quiet day for the US in terms of data as election fever reaches its climax.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

USD Rallies As The Election Battle Heats Up

Published 11/06/2012, 06:30 AM

Updated 07/09/2023, 06:31 AM

USD Rallies As The Election Battle Heats Up

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.