Talking Points

- US Consumer Confidence (FEB): 78.1 versus 80.0 expected, from 79.4 (revised low from 80.7).

- Subindexes shows Americans remain confidence in present situation, less certain about future.

- US Dollar rallies versus European currencies on news, steady versus Asian-Australasian.

Winter’s inclemency may or may not be impacting the US economy but US consumers are thus far weathering the weather. The Consumer Confidence gauge dropped to 78.1 in February from 79.4 in January, but the Present Situation subcomponent climbed to its highest level over the past 12-months at 81.7. The Expectations subindex dropped to 75.7 from 80.8, but remains above the lows set near 71 around the October fiscal hot stove.

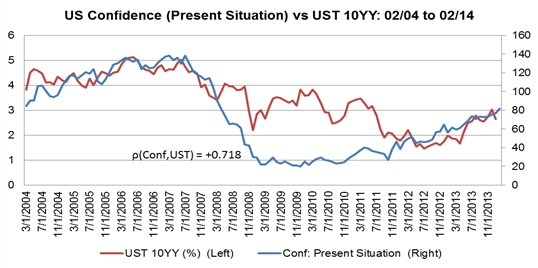

This data suggests that American consumers retain their positivity about the economy, but the recent patch of weakness seen the past few months is starting to erode hope. Considering that Americans feel that their current situation is improving steadily, any drop in consumption data seen from December to February could bounce back once warmer, more amicable spring weather arrives. If the relationship in the chart above holds, this would suggest that US yields should move back higher, which could support the US Dollar.

EUR/USD: 1-Minute" title="EUR/USD: 1-Minute" height="314" width="625" />

EUR/USD: 1-Minute" title="EUR/USD: 1-Minute" height="314" width="625" />

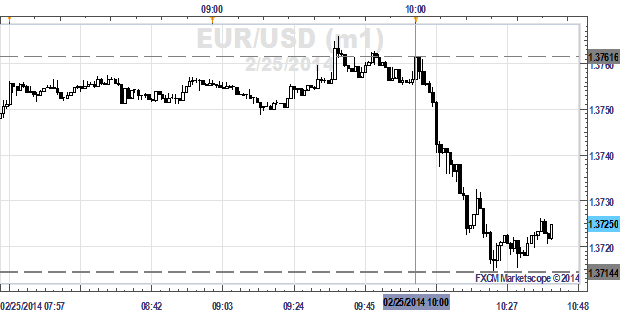

Charts Created using Marketscope – prepared by Christopher Vecchio

The EURUSD initially rallied from $1.3756 to as high as 1.3762 on the news, but soon plunged to fresh daily lows at 1.3714 as the underlying components of the report were absorbed. The EURUSD was trading at 1.3725 at the time this report was written.

--- Written by Christopher Vecchio, Currency Analyst