Street Calls of the Week

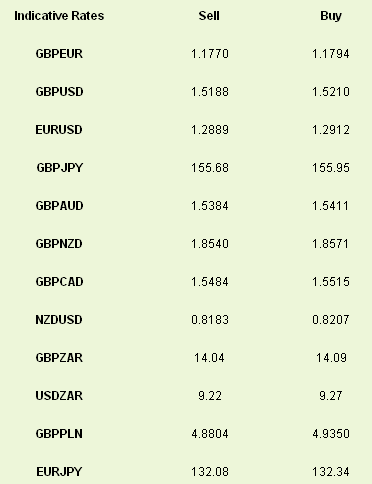

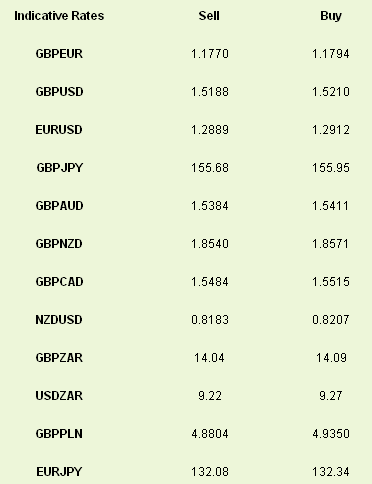

There is plenty going on to impact sterling today, following a further overnight battering by the U.S. dollar that leaves GBP/USD below 1.5200. Given recent data, we expect the employment numbers to be slightly better than expected by the market today with claimant count expected to be slightly improved and unemployment expected to be stable at 7.9%. Most eyes will be on the Quarterly Inflation Report, which will be governor Mervyn King’s last stand before Mark Carney takes over in June.

The recent data points to an improving outlook for the economy so it seems likely that King will be able to maintain growth forecasts in his final inflation report. On the inflation front, we expect to see a lower trajectory with commodity prices coming lower, potentially peaking around 3% in the summer rather than the previous forecast of 3.5%. Given King’s recent votes for additional QE, I’m sure the door will be left firmly open to increase from £375bn if necessary, though I doubt we will see this before he hands over to Mark Carney. This is likely to be taken initially as a sterling negative if it signals further QE in the short term.

After the French and German GDP data already released this morning, we are likely to see euro-zone GDP weaker than the -0.1% expected which is likely to provide further downside for EUR/USD. We have already seen a break through support levels at 1.2935 with the U.S. dollar strength overnight and there is potential to test 1.2850 in the short term. However, with a rare upgrade for Greek debt overnight, it has not all been bad news for the euro. The GBP/EUR cross remains sidelined relative to the U.S. dollar moves trading in a narrow range around 1.18.

We saw a strong return to the U.S. dollar overnight, with new highs against the yen and the Australian dollar. The yen strength was driven by talk of the next phase of stimulus and the Aussie dollar weakness by budget concerns and dovish mining company reports, but this only goes part of the way to explain a much broader based U.S. dollar move. While the U.S. economy performed well in Q1, growth is expected to slow to 2% or less in Q2 meaning no change in the Fed stance anytime soon. As global markets have a general potential for normalisation we are starting to see a correlation to a stronger U.S. dollar. Out today, there will be some interest in U.S. industrial production, with our feeling that the underlying positive USD tone should continue.

The recent data points to an improving outlook for the economy so it seems likely that King will be able to maintain growth forecasts in his final inflation report. On the inflation front, we expect to see a lower trajectory with commodity prices coming lower, potentially peaking around 3% in the summer rather than the previous forecast of 3.5%. Given King’s recent votes for additional QE, I’m sure the door will be left firmly open to increase from £375bn if necessary, though I doubt we will see this before he hands over to Mark Carney. This is likely to be taken initially as a sterling negative if it signals further QE in the short term.

After the French and German GDP data already released this morning, we are likely to see euro-zone GDP weaker than the -0.1% expected which is likely to provide further downside for EUR/USD. We have already seen a break through support levels at 1.2935 with the U.S. dollar strength overnight and there is potential to test 1.2850 in the short term. However, with a rare upgrade for Greek debt overnight, it has not all been bad news for the euro. The GBP/EUR cross remains sidelined relative to the U.S. dollar moves trading in a narrow range around 1.18.

We saw a strong return to the U.S. dollar overnight, with new highs against the yen and the Australian dollar. The yen strength was driven by talk of the next phase of stimulus and the Aussie dollar weakness by budget concerns and dovish mining company reports, but this only goes part of the way to explain a much broader based U.S. dollar move. While the U.S. economy performed well in Q1, growth is expected to slow to 2% or less in Q2 meaning no change in the Fed stance anytime soon. As global markets have a general potential for normalisation we are starting to see a correlation to a stronger U.S. dollar. Out today, there will be some interest in U.S. industrial production, with our feeling that the underlying positive USD tone should continue.