Heading into Thursday’s Norges Bank meeting, most analysts weren’t really sure what to expect. According to a pre-meeting survey, about one-third of economists were anticipating a 25bps cut, with the majority expecting that the Norway’s central bank would leave them unchanged at 1.00%. As it turns out, policymakers were far more worried than traders expected.

The Norges Bank opted to cut interest rates to 0.75% and in a surprisingly dovish accompanying statement, the central bank also hinted at further rate cuts to come, though not until next year. The bank cited subdued oil prices and concerns about Chinese economic growth as the major catalysts for its decision. As for the domestic economy, Norges declared that the domestic economy was expanding in-line with previous estimates, helped along by the rapid depreciation in the value of the krone.

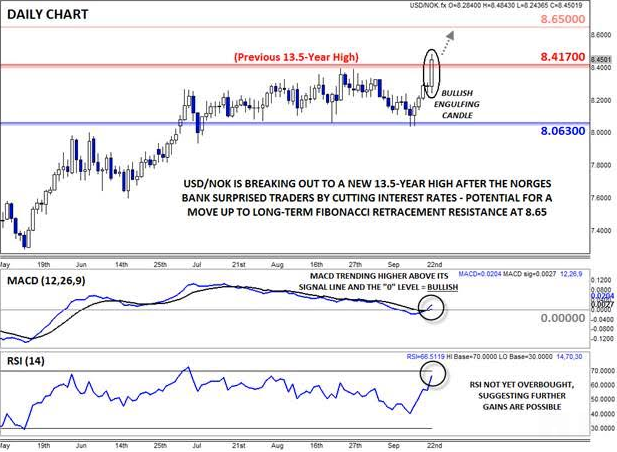

Speaking of the krone, Norway’s currency has predictably taken it on the chin in the wake of the Norges Bank decision. As we go to press, USD/NOK is at its highest level in over 13.5 years and, if anything, the pair looks poised for further gains after consolidating below 8.4200 resistance for the past two months. Rates are putting the finishing touches on a big Bullish Engulfing Candle*, signaling strong buying pressure and a potential continuation higher. Meanwhile, the daily MACD indicator is turning higher to trend up above both its signal line and the “0” level, showing bullish momentum, and despite today’s big rally, the RSI indicator has yet to reach overbought territory.

As long as USD/NOK closes stays above the previous resistance level at 8.4170, further gains are likely as traders look to take advantage of the lingering monetary-policy divergence. To the topside, medium-term bulls may look to target the psychologically significant 8.50 level or even the 78.6% Fibonacci retracement of the entire 2000-2008 drop near 8.6500. Even if rates fall back below the key 8.4170 level, the longer-term uptrend will remain intact above previous support at 8.0630.

*A Bullish Engulfing candle is formed when the candle breaks below the low of the previous time period before buyers step in and push rates up to close above the high of the previous time period. It indicates that the buyers have wrested control of the market from the sellers.

Source: FOREX.com