The dollar's demise continues following the Fed's monetary policy framework changes. The dollar index has rewritten its August lows, falling to a new dip since May 2018.

The world's most popular currency pair, EUR/USD, is trading one step away from an important milestone 1.2000, close to its high since April 2018.

The charts clearly show how the dollar bulls are gradually losing ground. At the beginning of August, they kept the counterstrike at 1.1900, and a couple of weeks later, they had to fight back from 1.1950. This morning, however, they also failed to maintain this level during the Asia session, pushing it to 1.1996.

Earlier in 2020, we witnessed the mid-term trend break down, with EUR/USD overtaking the 200-day average at the end of May with a strong move. Later in July, it broke the resistance of a multi-year downward trend. This level has already worked out in August as strong support.

By confidently entering the area of 1.2000, EUR/USD can very quickly reach 1.2500 before the US Presidential election. This area also coincides with the peak values of the pair in 2018.

Investors are already wondering about the long-term stability of the dollar. Further rapid weakening may trigger an even more nervous cycle of selling dollar assets.

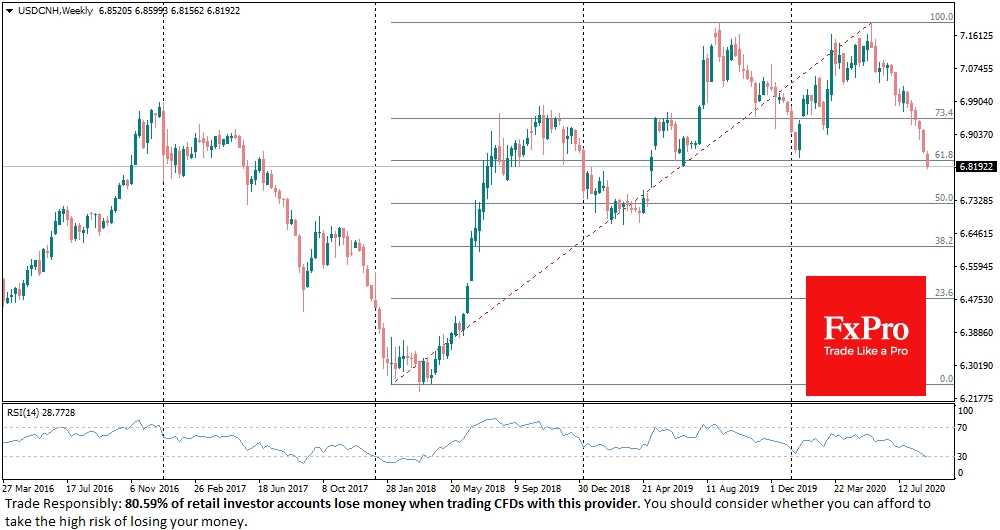

Looking for further signs of USD weakness, one should note the rally of the Chinese currency. On Tuesday morning, USD/CNH dropped to 6.82 and has declined over nine weeks out of the last ten, losing 3.7%, a big move for this currency pair. As a result, the Chinese yuan managed to beat back more than 38% of the decline caused by trade wars and the pandemic. Further decline paves the way for 6.70, the next area of exchange rate consolidation.

Investors are confidently buying Chinese currency and shares while selling the dollar to a wide range of competitors. Isn't this a sign of whom they consider the winner in the confrontation between the two world's largest economies?

Buffett, who recently turned 90, has increased his suspicion of the American market by buying shares in Japanese companies. He is a well known pro-American investor, but now, probably, considers them overestimated, simultaneously not wishing to further sit on a couple hundred of billions of dollars in cash.

The FxPro Analyst Team

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

USD Loses Its Shine As EUR Just A Whisker Away From 1.2000

Published 09/01/2020, 03:44 AM

Updated 03/21/2024, 07:45 AM

USD Loses Its Shine As EUR Just A Whisker Away From 1.2000

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.