Yesterday was a fairly straightforward day of follow-through on the post-Federal Open Market Committee reaction, though trading ranges weren’t especially noteworthy. Still, the technical breaks pointed out yesterday in my FX Board post late yesterday show that the US dollar has really laid down the gauntlet, save for the pesky USDJPY which is looking a bit heavy this morning in early trading (more on JPY crosses and the status of broad risk appetite measures below).

Looking ahead

The calendar is very thin today, leaving it up to market sentiment and how it wants to close the week after the FOMC meeting mid-week. The overall impression is that major Europe is weak and will continue to trade that way from here after major breaks, the G10 small currencies are inconsistent but in danger if risk appetite crumbles and the JPY is the high-beat inverse of the G10 smalls. The widening sanction and verbal battle between the US and Russia may give the bulls cause for pause ahead of this weekend.

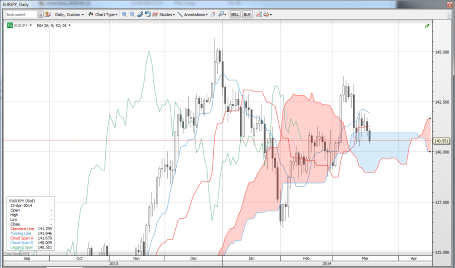

Chart: EUR/JPY

Unbelievable indecision here but it looks like the pair wants to test below support today after a long bout in a very constrained range. This does not fit at all with the generally risk-on response after the FOMC.

EUR/JPY" title="EUR/JPY" height="242" width="455" />

EUR/JPY" title="EUR/JPY" height="242" width="455" />

Source: Saxo Bank

Watch out for the data out of Canada later today — particularly the February CPI data — as market focus on inflation data is intense after Governor Stephen Poloz’s recent speech in which he said he couldn’t rule out a rate cut in the event of persistent further downside risks in inflation materialising. The key support area for USD/CAD is 1.1200. CAD is beginning to look a bit excessively weak versus its commodity dollar peers, but I need signs of a technical reversal before believing the timing is right for fading AUD/CAD or NZD/CAD. The sell-off in NZD/USD over the last couple of days has finally shown that the little kiwi isn’t invincible. At some point this year, it’s going to get squashed.

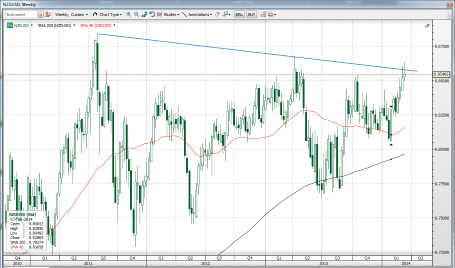

Chart: NZD/USD

Let’s see where we close the day, but the weekly NZD/USD candlestick is shaping up to be a shooting star at the top of the multi-year range, an interesting set-up for those looking to fade kiwi strength.

NZD/USD" title="NZD/USD" height="242" width="455" />

NZD/USD" title="NZD/USD" height="242" width="455" />

Source: Saxo Bank

Also, please watch for what the Fed’s Jeremy Stein has to say as you sift through the news this weekend. He’s meant to be the watchdog on financial stability, and with stocks continuing to test toward the highs, any step-up in the rhetoric suggesting that the Fed is concerned about the reach for yield. On that point, I haven’t checked my risk indicators in some time, but a review of one of my old models this morning shows that we are seeing a marked decline in some of the risk indicators:

- The VIX based out recently at a higher level despite the nominal new highs in the indices earlier this month but it wouldn’t take much for the index to push to new lows again and defuse the signal.

- In FX, we’re getting some confirmation of this in the JPY crosses not rallying despite the generally risk-on response in the stock averages and rates jumping higher. However, we have a total lack of confirmation in the implied volatilities, as broad measures have set new lows for the year.

- The most interesting signals are in the signs of increasing strain in corporate credit (CDS prices rising in several industries/indices) and in Junk bonds, where the spread in junk to US/German treasuries has seen the most significant rise since the beginning of the month since the spike caused by former Fed chairman Ben Bernanke’s May 2013 taper comments.

Look for any pointed comments from Stein to finally make for an interesting market on Monday, with currencies trading along the axis of liquidity in the event risk appetite is challenged by his rhetoric.

Economic data highlights

- New Zealand Mar. ANZ Consumer Confidence out at 132 vs. 133 in Feb.

- New Zealand Feb. Credit Card Spending rose +0.3% MoM and +5.9% YoY vs. +9.2% YoY in Jan.

Upcoming economic calendar highlights (all times GMT)

- Eurozone Jan. Current Account (0900)

- Italy Jan. Industrial Orders/Sales (0900)

- Canada Jan. Retail Sales (1230)

- Canada Feb. CPI (1230)

- US Fed’s Bullard to Speak (1545)

- US Fed’s Fisher to Speak (1745)

- US Fed’s Kocherlakota to Speak (2030)

- UK BoE’s Dale to Speak (2030)

- US Fed’s Stein to Speak on Monetary Policy (2320)