The US dollar is broadly stronger on Thursday, and is posting sharp gains against the retreating Japanese yen. USD/JPY has jumped more than 300 points this week, and the pair is testing the 98 level in the Thursday’s European session. The dollar got a big boost on Wednesday, after US Federal Reserve head Bernard Bernanke stated that the Fed would likely begin to wind up the current QE program if the US economy continues to show improvement. It’s a busy day in the US, with three key events on the schedule – Unemployment Claims, Existing Home Sales and Philly Fed Manufacturing Index.

The currency markets were in full throttle on Wednesday, after Federal Reserve chair Bernard Bernanke said that QE would likely be scaled down in 2013, and could be terminated in 2014, if the economy continues to improve. The Fed said it expects the U.S. economy to grow between 2.3% and 2.6% this year, and unemployment should fall to between 6.5% and 6.8% by the end of 2014. This means that if the US economy does show stronger growth and unemployment falls, there is a strong likelihood that the Fed will scale down QE. It should be remembered that the Federal Reserve is not making any changes at present to QE, which involves bond purchases of $85 billion each month by the Fed. Bernanke’s comments boosted the dollar against the major currencies, since winding up QE is dollar-positive. The euro lost over a cent following the news, and continues to lose ground on Thursday.

The Japanese government and the BOJ have implemented extreme monetary stimulus in order to kick-start the anemic economy, popularly referred to as “Abenomics”. Has the plan been a success? The jury is still out, but there are some hopeful signs that the economy has picked up, such as an improving GDP, which expanded at an annual rate of 4.1% for the first three months of 2013. This is stronger growth than most of Japan’s trading partners. The low yen has boosted exports, and private spending is up. However, deflationary trends remain in the economy, and Abenomics cannot be considered a success until we see more inflationary indications in the economy. The government has declared a target of 2% inflation, but will likely have a tough time reaching this goal. Another major problem is the country’s huge debt, which is more than double the size of the economy of $5 trillion.

G8 summits are often little more than photo-ops, as confident world leaders shake hands and reiterate their commitment to take steps to improve the global economy. However, this year’s G8 meeting in Northern Ireland served more than the usual fare, as the G8 leaders used the occasion to announce the start of negotiations on a free trade agreement between the European Union and the United States. The stakes are very high – the EU and US produce 50% of the global output, and a third of world trade. The deal would be the largest bilateral trade pact ever, and could add up to $100 billion to the economies of each partner. Negotiations will get underway in Washington next month, with a deal expected to be signed by the end of 2014. USD/JPY" width="400" height="300">

USD/JPY" width="400" height="300">

USD/JPY June 20 at 11:30 GMT

USD/JPY 97.92 H: 98.28 L: 96.20

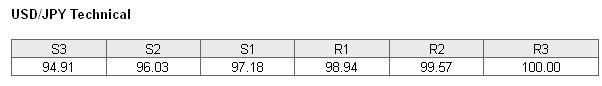

USD/JPY has zoomed higher, and briefly broke through the 98 line. , as the proximate support and resistance lines remain intact (S1 and R1 above). The line of 94.91 is providing support. This is a weak line, and could be tested if the yen continues to improve. The next support level is at 94.02, protecting the 94 line. On the upside, we encounter resistance at 96.03. This is followed by stronger resistance at 97.18.

- Current range: 94.91 to 96.03

- Below: 97.18, 96.03, 94.91, 94.02, 92.73 and 91.62

- Above: 98.94, 99.57, 100.00 and 100.85

USD/JPY ratio has again gone silent, and is unchanged in Thursday trading. This is not reflected in the current movement of the pair, as the dollar continues to pound the yen. If the pair continues to push higher, we can expect the ratio to swing into action as well.

The dollar has taken off since Bernanke’s comments about QE on Wednesday, and the yen has paid the price. Will the pair’s upward movement continue? There could be plenty of action still to come today, as the US releases three key events later in the day.

USD/JPY Fundamentals

- 12:30 US Unemployment Claims. Estimate 343K.

- 13:00 US Flash Manufacturing PMI. Estimate 52.5 points.

- 14:00 Eurozone Consumer Confidence. Estimate -22 points.

- 14:00 US Existing Home Sales. Estimate 5.01M.

- 14:00 US Philly Fed Manufacturing Index. Estimate -0.6 points.

- 14:00 US CB Leading Index. Estimate 0.2%.

- 14:30 US Natural Gas Storage. Estimate 89B.