The Japanese yen continues to improve against the US dollar. USD/JPY is trading the low-97 range in Tuesday’s European session. The yen got a boost from a solid inflation release, as the Japanese Corporate Services Price Index was higher than the estimate. It’s a busy day over in the US, with three key releases later today – Core Durable Goods Orders, CB Consumer Confidence and New Home Sales. There are no Japanese releases on Tuesday.

The Japanese government has launched an all-out attack on deflation, which has hampered economic growth for years. The government’s extreme monetary easing is aimed at creating inflation and kick-starting the economy, but we haven’t seen much improvement in the country’s inflation indicators. However, Monday’s Corporate Services Price Index, which measures inflation in the corporate sector, was the kind of reading that policymakers have been waiting for. The CSPI rose 0.3%, beating the estimate of 0.1%. The markets will be hoping for more good news from the Tokyo Core CPI, considered the most important Japanese inflation indicator, on Thursday.

The US dollar was broadly stronger last week, courtesy of comments from the Federal Reserve that QE would likely be scaled down in 2013, and could be terminated in 2014, if the economy continues to improve. The Fed has put the markets on notice – if the US economy shows stronger growth and unemployment falls, expect the Fed to taper QE. Currently, the Fed purchases $85 billion in assets each month. Bernanke’s comments boosted the dollar against the major currencies, including the yen, since scaling back QE is dollar-positive.

Speaking in London last week, Japanese Prime Minster Shino Abe defended his government’s monetary policy of extreme easing. The government is hoping that this policy will kick-start the stagnant Japanese economy and stamp out deflation. Abe has defined his aggressive economic policy has having three prongs: extreme monetary easing, fiscal stimulus, and pro-growth moves. However, the program has severely eroded the value of the Japanese yen. Japan’s trading partners are not happy with the sinking yen, which has hurt their export markets. Abe dismissed criticism that he is purposely pushing the yen lower, saying that Abenomics is a win-win for the global and Japanese economies. He noted that GDP in Q1 climbed 4.1%, which he argued is proof that the Japanese economy is showing improvement. If inflation figures point higher, we could see the yen move upwards against the dollar. USD/JPY" width="400" height="300">

USD/JPY" width="400" height="300">

USD/JPY June 25 at 10:40 GMT

USD/JPY 97.45 H: 98.05 L: 96.96

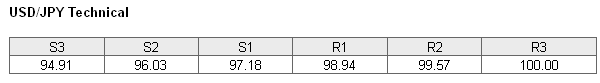

USD/JPY is lower on Tuesday, as the yen continues to push higher this week. The line of 97.18 is providing support. This line has weakened, and could be tested if the pair’s downward trend continues. The next support level is at 96.03, protecting the 96 line. On the upside, 98.94 is providing strong resistance.

- Current range: 97.18 to 98.94

- Below: 97.18, 96.03, 94.91, 94.02, 92.73 and 91.62

- Above: 98.94, 99.57, 100.00 and 100.85

USD/JPY ratio has changed directions, and is pointing to movement towards short positions. This is reflected in the current movement of the pair, as the yen continues to improve against the US dollar. Long positions make up most of the ratio, indicating a strong bias towards USD/JPY moving higher.

The dollar surged against the yen last week, but the pair has reversed direction this week and is moving downwards. Will the yen continue to post gains? With the US releasing three major events this week, we could see some volatility from the pair during the day.

USD/JPY Fundamentals

- 12:30 US Core Durable Goods Orders. Estimate 0.0%.

- 12:30 US Durable Goods Orders. Estimate 3.0%.

- 13:00 US S&P/CS Composite-20 HPI. Estimate 10.6%.

- 13:00 US HPI. Estimate 1.2%.

- 14:00 US CB Consumer Confidence. Estimate 75.2 points.

- 14:00 US New Home Sales. Estimate 462K.

- 14:00 US Richmond Manufacturing Index. Estimate 0 points.

- 21:00 US Treasury Secretary Jack Lew Speaks.