The US dollar has rebounded after sustaining sharp losses last week against the yen. USD/JPY is trading in the high-98 range in Monday’s European session. The dollar has managed to post gains despite solid Japanese numbers on the weekend, as Current Account and GDP beat their estimates. In the US, today’s sole release is a speech by FOMC member James Bullard.

Japanese weekend releases looked solid. Current Account rose to 0.85 trillion yen, easily surpassing the estimate of 0.39 trillion yen. This was the best result in over a year. GDP rose a respectable 1.0%, beating the estimate of 0.9%. These readings are good news for the Japanese government, which hasn’t had much to show for its aggressive monetary policy, except a very weak currency.

Last week, Prime Minister Abe outlined his plan for reviving the Japanese economy. Abe discussed economic growth as the “third arrow” in the fight against deflation, together with fiscal and monetary stimulus. However, the speech received a cold response from the markets, as Abe was short on substance, and failed to provide any specifics on new stimulus measures. The Nikkei fell, which was good news for the yen, as nervous investors snapped up the safe-haven currency. A Japanese government spokesman brushed aside the market’s tepid reaction to Abe’s speech, saying that the government’s policies were not aimed at pleasing the financial markets.

Over in the US, employment numbers were a disappointment last week. ADP Non-Farm Payrolls slipped badly, as the key employment indicator missed the estimate for the third consecutive month. The indicator posted a reading of 135 thousand, well off the forecast of 171 thousand. Unemployment Claims managed to meet the estimate, but the market reaction was lukewarm. On Friday, Non-Farm Payrolls was weak, climbing from 165 thousand to 175 thousand. This was above the market forecast of 167 thousand. The Unemployment Rate rose edged higher to 7.6%, above the forecast of 7.5%. With speculation growing that the Fed could scale back QE in the next few months, employment figures have taken on added significance. However, the Fed may decide to hold a steady course if the employment picture does not improve.  USD/JPY" width="400" height="300">

USD/JPY" width="400" height="300">

USD/JPY June 10 at 11:15MT

USD/JPY 98.36 H: 98.42 L: 97.36 USD/JPY Technical" title="USD/JPY Technical" width="597" height="82">

USD/JPY Technical" title="USD/JPY Technical" width="597" height="82">

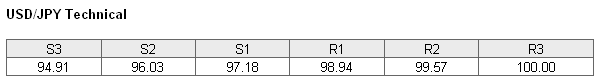

USD/JPY has reversed direction in Monday’s session, as the pair trades in the high-98 range. There is strong support at 97.18. This line has strengthened as the pair trades at higher levels. On the upside, the pair is facing resistance at 98.94. This line could face pressure if the US dollar continues to move higher. This is followed by resistance at 99.57, which is protecting the all-important 100 line.

- Current range: 97.18 to 98.94

- Below: 97.18, 96.03, 94.91, 94.02 and 92.73

- Above: 98.94, 99.57, 100.00, 100.66

USD/JPY ratio is pointing to movement towards short positions in the Monday session. This is not reflected in the current movement of the pair, as the dollar has posted gains against the yen. The activity in the ratio could be an indication that we will see a correction and the yen will recover.

The US dollar is looking much better as we start the new week, and has pushed higher against the yen. There are no major releases out of Japan or the US today, but we could see some volatility from the pair early on Tuesday, as the BOJ releases a monetary policy statement.

USD/JPY Fundamentals

- 5:00 Japanese Consumer Confidence. Estimate 44.8 points. Actual 45.7 points.

- 6:00 Japanese Economy Watchers Sentiment. Estimate 56.3 points. Actual 55.7 points.

- 13:50 US FOMC Member James Bullard Speaks.

- 23:50 Japanese BSI Manufacturing Index. Estimate -2.1 points.

- 23:50 Japanese M2 Money Stock. Estimate 3.5%.