The US dollar continues to post gains against the Japanese yen in Friday trading. USD/JPY is just above the 99 line in the European session. There was a host of Japanese releases late Thursday, and the numbers were mostly positive. Tokyo Core CPI and the National Core CPI both improved and matched their estimates, and manufacturing numbers also were positive. However, Household Spending was well below the estimate. US releases continue to be positive, as Unemployment Claims were very close to the estimate and Pending Home Sales sparkled, hitting a multi-year high. Over in the US, Friday’s highlight is UoM Consumer Sentiment Index. On Friday, Japanese Housing Starts looked sharp, hitting a sixth-month high.

US releases enjoyed a strong week, and this has helped the dollar post gains against the yen. Earlier in the week, Core Durable Goods, CB Consumer Confidence and New Home Sales, all key releases, beat their estimates. Manufacturing data, often a sore spot, also looked good as the Richmond Manufacturing Index had its best performance since last November. Although GDP figures missed the estimate, the markets didn’t react negatively, as the US dollar held firm against the major currencies. On Thursday, Unemployment claims fell to 346 thousand, just below the estimate of 347 thousand. Pending Home Sales skyrocketed, posting a gain of 6.7%, its highest since 2006. This crushed the estimate of a 1.1% gain. These solid numbers are particularly encouraging as they come from a wide range of economic sectors. If US indicators continue to point upward, the Federal Reserve could act and start to reduce QE. Such a move would likely have a dramatic positive effect on the US dollar.

Is the Federal Reserve backtracking on QE? The US dollar surged last week after Federal Reserve Chair Bernard Bernanke said that the Fed was planning to scale down QE. However, US (and global) stock markets fell sharply on the news, and the Fed finds itself trying to contain the damage and calm the nervous markets. Dallas Fed President Richard Fisher declared that “tapering” should not be confused with “tightening” and said that the Fed was not exiting from its accommodative policy action just yet. Minneapolis Fed President Naraya Kocherlakota reiterated that the Fed was continuing with an expansionary monetary policy event if QE was terminated, and said that it was a misperception to assume that the Federal Reserve had turned more hawkish. One can be excused for dismissing these statements as little more than linguistic acrobatics, and it is questionable if the markets will be reassured by these statements from the Fed, which are clearly aimed at damage control and reassuring nervous investors.

The Japanese government and Bank of Japan are waging an all-out war against deflation, which has hampered economic growth for years. The government’s extreme monetary easing is aimed at creating inflation and kick-starting the economy, and we are starting to see some improvement from inflation indicators. Earlier in the week, Corporate Services Price Index, which measures inflation in the corporate sector, posted a gain of 0.3%. On Thursday, Tokyo Core CPI, considered the most important Japanese inflation indicator, climbed from 0.1% to 0.2%. National Core CPI also moved higher, from -0.4% to a flat 0.0%. Both indicators matched the estimates. Stronger inflation numbers would be a sure sign that Prime Minister Abe’s economic policy is bearing fruit, and would be bullish for the yen. USD/JPY" width="400" height="300">

USD/JPY" width="400" height="300">

USD/JPY June 28 at 10:30 GMT

USD/JPY 99.00 H: 99.13 L: 98.46

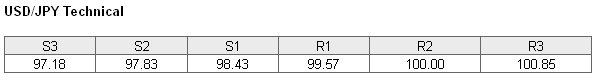

USD/JPY has been a see-saw all week, but the dollar has flexed some muscle on Friday, and pushed above the 99 line in the Asian session. The pair is receiving support at 98.43. This is not a strong line, and could see more activity if the dollar retracts. There is stronger support at 97.83. On the upside, the pair faces resistance at 99.57. This line is protecting the all-important 100 level, which is the next line of resistance -will it hold firm against the improving US dollar?

- Current range: 98.43 to 99.57

- Below: 98.43, 97.83, 97.18, 96.03, 94.91 and 94.02

- Above: 99.57, 100.00, 100.85 and 101.66

USD/JPY ratio continues to show movement towards short positions in Friday trading. We are not seeing this reflected in the pair, as the dollar continues to register gains against the retreating yen. Long positions continue to make up a very wide majority of the open positions, indicating a strong trader bias towards USD/JPY moving higher.

The dollar is moving higher on Friday, and is trading just above the 99 level. We could see USD/JPY remain close to this line, unless today’s UoM Consumer Sentiment surprises the markets with an unexpected reading, which could result to some volatility

- USD/JPY Fundamentals

- 5:00 Japanese Housing Starts. Exp. 6.3%. Actual 14.5%.

- 12:00 US FOMC Member Jeremy Stein Speaks.

- 13:45 US Chicago PMI. Estimate 56.0 points.

- 13:55 US UoM Consumer Sentiment. Estimate 82.8 points.

- 13:55 US UoM Inflation Expectations.

.