The Japanese yen flexed some muscle last week against the US dollar. After USD/JPY climbed close to the 104 level, the yen fought back and closed the week in the low 101-range. The pair has dropped below the 101 range in Monday’s European session. The Bank of Japan released the minutes of its most recent policy meeting, and the markets will get another look at the inflation situation with the release of Corporate Services Price Index later on Monday.

If anyone was expecting Bernard Bernanke’s testimony to shake up the markets last week, they certainly were not disappointed. The US dollar was broadly weaker after the Fed Chair’s remarks on Wednesday, and the yen took full advantage, as it posted sharp gains against the US currency. Bernanke initially stated that tightening monetary policy could hurt the US recovery. However, he later said that a decision to scale back QE could be taken in the “next few meetings” if the US economy improves. Meanwhile, the QE program continues at full steam, as the Fed purchases $85 billion in assets every month.

Almost overshadowed by Bernanke’s remarks in Congress was the release of the minutes from the FOMC’s last policy meeting. The minutes indicate that the US recovery will have to gain more traction before the Fed winds down QE. Policy members were split, as some suggested scaling back QE in June (at the next policy meeting), while others wanted to increase QE, given the weak inflation readings we are seeing.

The yen has shown some improvement after recent losses against the US dollar, which saw the pair push across the elusive 100 level earlier in May. The weak Japanese currency has resulted in the cost of imports rising dramatically, and this could increase the size of Japan’s trade deficits and weigh on the economy. Meanwhile, minutes of the Bank of Japan’s most recent policy meeting indicated that the BOJ was not making any changes to its monetary policy, as the battle against deflation continues. The BOJ is moving ahead with its plan to expand the supply of money in the economy, and plans to pump in JPY60 – 70 trillion yen a year.

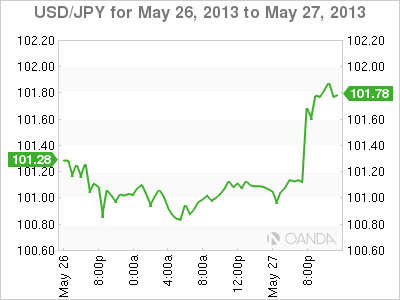

USD/JPY May 27 at 11:40 GMT

USD/JPY 100.94 H: 101.23 L: 100.74 USD/JPY Technical" title="USD/JPY Technical" width="599" height="77">

USD/JPY Technical" title="USD/JPY Technical" width="599" height="77">

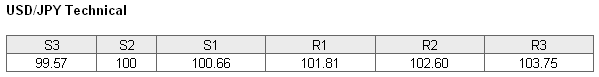

USD/JPY is testing the 101 line in Monday trading. The pair is receiving support at 100.66. This line has weakened as the pair moves lower, and could face pressure if the downward trend continues. This is followed by support at the key level of 100, which has held firm since early May. On the upside,

- Current range: 100.66 to 101.81

- Below: 100.66, 100, 99.57 and 99.48

- Above: 101.81, 102.60, 103.75, 104.94 and 105.87

USD/JPY ratio is showing movement towards long positions. This is consistent with what we are seeing from the pair, as the yen has posted strong gains since the middle of last week. We are now seeing a strong majority made of long positions, indicating a bias towards the pair reversing the current downward trend.

The yen has shown improvement, but we can expect a quiet day from the pair as the US markets are closed for a holiday on Monday. Traders can expect a busier day on Tuesday, as the US releases key consumer confidence numbers and Japan releases Retail Sales.

USD/JPY Fundamentals

- 23:50 Japanese Corporate Price Services Index. Estimate -0.2%.