The Japanese yen continues to improve, as USD/JPY has dropped close to the 100 level in Monday trading. The pair, which hit a high of 102.50 early last week, has dropped to the low-100 range. On Friday, Japanese Capital Spending improved nicely and beat the forecast. Later on Monday, Japan will release Monetary Base. Today’s highlight is the US ISM Manufacturing PMI. The markets will be hoping for a strong start after a string of weak key releases disappointed last week. of the all-important 100 line.

Recent Japanese releases have been solid, helping the yen post gains against the dollar. On Monday, Japanese Capital Spending improved from -8.7% to -3.9%. This beat the estimate of -5.5%. Last week, Tokyo Core CPI posted a modest gain of 0.1%, but this was an important reading, as it was the first sign of inflation from the indicator in almost a year. Preliminary Industrial Production and Housing Starts also recorded gains, and were well above expectations. Household Spending was not as sharp, as the 1.5% gain fell below expectations. These improving readings have improved market sentiment, as there is a growing feeling that Abenomics is starting to bear fruit, as deflation recedes and economic activity increases. However, the markets will want to see more positive numbers before being convinced that the Japanese economy is on the right track.

In the US, we continue to see mixed numbers from economic releases. Any hopes for a string of positive US releases evaporated on Thursday, as all three key releases missed their estimates. Preliminary GDP improved to 2.4%, but missed the estimate of 2.5% Unemployment Claims shot up to 350 thousand, well above the estimate of 342 thousand. Pending Home Sales gained just 0.3%, well below the forecast of a 1.3% gain. These numbers point to weakness in the US economy, and raises questions about the extent of the US recovery. The US dollar was broadly lower courtesy of the bad news, and the yen took advantage and posted sharp gains.

Will the Federal Reserve scale back quantitative easing? Fed policymakers, including Fed Chair Bernanke, continue to hint that QE could be wound up in the next few months. However, with the US continuing to alternate between good and bad economic releases, the Fed is unlikely to act before it is convinced that the US economy is improving. Much of the volatility we are seeing from the US dollar against the major currencies can be attributed to market uncertainty about what action the Fed will take, and further hints from the Fed about scaling back QE will continue to impact on the currency markets.

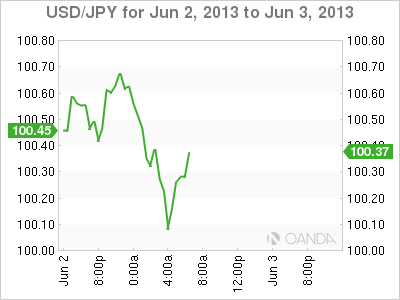

USD/JPY June 3 at 11:10 GMT

USD/JPY 100.32 H: 101.72 L: 100.03 USD/JPY Technical" title="USD/JPY Technical" width="602" height="81">

USD/JPY Technical" title="USD/JPY Technical" width="602" height="81">

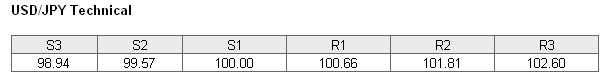

USD/JPY has edged lower in the Monday session, and is trading in the low-100 range. The pair continues to receive at the key 100 level. The pair touched a low of 100.03 in the Asian session, but has since moved higher. This line has held firm since early May, but could face pressure if the yen continues to improve. This is followed by a support line at 99.57. On the upside, there is resistance at 100.66. This is followed by resistance at 101.81.

- Current range: 100.00 to 100.66

- Below: 100, 99.57, 98.94, 97.18 and 96.03

- Above: 100.66, 101.81, 102.60, 103.75, 104.94 and 105.87

USD/JPY ratio is unchanged in the Monday session. This is reflected in the current movement of the pair, which has no shown a lot of movement. Traders should continue to monitor the ratio, as any sudden activity could be an early indication of more movement from USD/JPY.

USD/JPY was very active last week, but has settled down on Monday. We could see some further movement during the day, as the US releases key manufacturing data later in the day.

USD/JPY Fundamentals

- 13:00 US Final Manufacturing PMI. Estimate 52.0 points

- 14:00 US ISM Manufacturing PMI. Estimate 50.6 points

- 14:00 US Construction Spending. Estimate 1.1%

- 14:00 US ISM Manufacturing Prices. Estimate 49.6 points

- All Day: US Total Vehicle Sales. Estimate 15.2M

- 23:50 Japanese Monetary Base. Estimate 24.3%