The US dollar picked up where it left off at the end of last week and continues to post gains against the retreating Japanese yen. USD/JPY has gained about 200 points since the middle of last week, and is close to the all-important 100 level. Friday’s highlight is the UoM Consumer Sentiment Index. On Friday, Japanese Housing Starts looked sharp, hitting a sixth-month high. In the US, Chicago PMI dropped sharply, but UoM Consumer Sentiment beat the estimate. Japan released the important Tankan economic indexes on Sunday, and both indexes were within expectations. Monetary Base will be released late Monday. In the US, today’s highlight is ISM Manufacturing PMI. The markets are hoping that the key index will bounce back from a weak release last month and climb above the 50-point level, which indicates expansion.

The Japanese Tanken indexes, which are released quarterly, looked solid, but this didn’t help the struggling Japanese yen. The Manufacturing Index jumped from -8 to 4 points, and beat the estimate of 3 points. This was the best showing since Q1 of 2011. The Non-Manufacturing Index kept pace, climbing from 6 to 12 points, which matched the estimate. These positive readings come on the heels of some Japanese numbers last week, and indicate that the Japanese economy is showing signs of improvement.

The markets may have become accustomed to seeing mixed numbers out of the US, but last week’s releases were mostly solid, helping to boost market confidence and the US dollar. Manufacturing, consumer confidence and housing numbers all beat their estimates. Unemployment Claims bounced back after a poor release the week before, and almost matched the estimate. Although GDP fell short of the estimate, the dollar remained strong, as the indicator pointed to respectable growth by the US economy. These solid numbers are particularly encouraging as they come from a wide range of economic sectors. Further strong numbers out of the US could be an indication that the recovery is gaining steam.

There have been some conflicting signals lately out of the US Federal Reserve concerning quantitative easing. The US dollar surged after Federal Reserve Chair Bernard Bernanke said that the Fed was planning to scale down QE. However, US (and global) stock markets fell sharply on the news, and the Fed found itself trying to contain the damage and calm the nervous markets. Dallas Fed President Richard Fisher declared that “tapering” should not be confused with “tightening” and said that the Fed was not exiting from its accommodative policy action just yet. Minneapolis Fed President Naraya Kocherlakota reiterated that the Fed was continuing with an expansionary monetary policy event if QE was terminated, and said that it was a misperception to assume that the Federal Reserve had turned more hawkish. One can be excused for dismissing these statements as little more than linguistic acrobatics, and it is questionable if the markets will be reassured by these statements from the Fed, which are clearly aimed at damage control and reassuring nervous investors. Talk of tapering QE has been a positive factor for the US dollar, which remains strong against the major currencies.

Global growth has been sputtering for some time, and there was more bad news, as an HSBC report downgraded its forecast for global growth. In its report, HSBC said that it had lowered its forecast due to the US Federal Reserve decision to cut QE, as well as a sharp slowdown in China and other emerging countries such as India and Brazil. The report revised China’s GDP from 8.2% to 7.4% for 2013 and from 8.4% to 7.4% for next year. Weaker global growth will likely have a strong impact on countries which heavily depend on exports, such as Japan, Canada and Australia, and this could have a strong negative impact on these countries’ currencies. USD/JPY" width="400" height="300">

USD/JPY" width="400" height="300">

USD/JPY July 1 at 10:50 GMT

USD/JPY 99.61 H: 99.72 L: 99.18

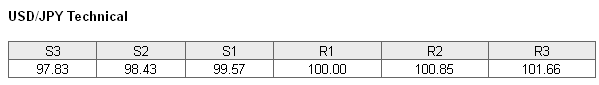

USD/JPY continues to move higher, and the important 100 level finds itself under pressure. The pair is testing support at 99.57, and this line could continue to be busy during the day. There is stronger support at 98.43. On the upside, the next line of resistance is the 100 line. Will this line manage to keep at bay the improving US dollar? This is followed by resistance at 100.85.

- Current range: 99.57 to 100.00

Further levels in both directions:

- Below: 99.57, 98.43, 97.83, 97.18, 96.03 and 94.91

- Above: 100.00, 100.85, 101.66 and 102.52

USD/JPY ratio continues to show movement towards short positions in Friday trading. We are not seeing this reflected in the pair, as the dollar continues to register gains against the retreating yen. Long positions continue to make up a very wide majority of the open positions, indicating a strong trader bias towards USD/JPY moving higher.

The dollar is continues to move higher, continuing the upward trend which began in the middle of last week. Will we see the pair push past the 100 level? With the US releasing a key PMI later today, USD/JPY could remain active.

USD/JPY Fundamentals

- 13:00 US Final Manufacturing PMI. Estimate 52.4 points.

- 14:00 US ISM Manufacturing PMI. Estimate 50.6 points.

- 14:00 US ISM Manufacturing Prices. Estimate 50.5 points.

- 14:00 US Construction Spending. Estimate 0.6%.

- 23:50 Japanese Monetary Base. Estimate 41.2%.