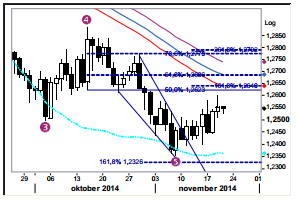

EUR/USD: Continued upward progress. The market last night, after FOMC, printed a high at 1.2602 before retreating back to the mid 1.25’s. Despite the topside failure the market continues to progress according the correction plan. Short term, with most of the orders up to 1.26 cleared, there will possible some consolidation before making the next attempt to move on to 1.2623/40 (en route either the 1.2740/90 area or if following the textbook, 1.2888).

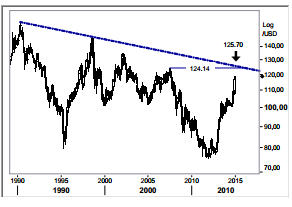

USD/JPY: Where to find medium term targets. Today we’re trying to determine some important topside reference points for this runaway phase. The next obvious target is a 161.8% Fibo projection point at 120.46. As the rise from the Oct low, 105.20, to 120.46 will be labelled wave 3 there should after a consolidation (wave 4) come a 5 th wave higher with possible targets in the 124.14-125.70 (2007 top and the top line from the early 1990’s).

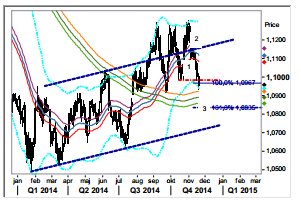

AUD/NZD: Pushing for a 1.0919 break. The bounce from the recent low point, 1.0936, only lasted for approximately 24h before the sellers gained the upper hand pushing prices lower again. Our focus is now entirely with the 1.0919 support, the confirmation point for the triple top formation and barrier to the low end of the corrective rising channel.

USD/CAD: Correction lower turned a corner? The overall trend points higher still and the 1.1466-1.1260 decline is a correctional to this trend. Price action over the past four sessions indicates that a correctional low is in place. Violation above the high end of the “Flag” (at market) and later advance through 1.13942 is needed to confirm. Current intraday stretches are located at 1.1285 & 1.1400.