USD/JPY: We think Fed was rather neutral than hawkish

- The Fed finally pulled the trigger and increased its target interest rate by 25 bp. Just as in 2015, it has thus delivered at least one rate hike during the calendar year – not an awful lot, considering that back in December 2015 the FOMC members’ median forecast was looking for no less than four hikes.

- As yesterday’s policy decision had completely been priced in, markets were focusing on the post-meeting statement and the summary of economic projections for further clues about the near- and medium-term policy outlook.

- Most importantly, and somewhat surprisingly, the FOMC members’ median interest rate projections (the dots) were lifted by 25 bp across the forecast horizon. They now indicate three hikes for 2017 (up from two), followed by another three hikes in 2018 (same as before) and another three in 2019 (same as before). This marks the first increase in the dots since September 2014. At the same time, the Committee members essentially left their economic outlook unchanged.

- The post-meeting statement did not contain any policy-relevant changes. It reiterates that “The Committee expects that economic conditions will evolve in a manner that will warrant only gradual increases in the federal funds rate.”

- In our opinion Fed’s statement is rather neutral than hawkish. The macroeconomic forecast is unchanged and the dots have shifted only very slightly – the median dots went up by 25 bp but the average only went up 6 bp. There are still six FOMC members (out of 17), who continue to see only two hikes (or less) in 2017. We are very confident to say that the most influential FOMC members, including Chair Yellen, Vice Chair Dudley, are among these more dovish members. Yellen pointed out that uncertainties are exceptionally high, and we know that when uncertainties are high the Fed is more cautious than hawkish.

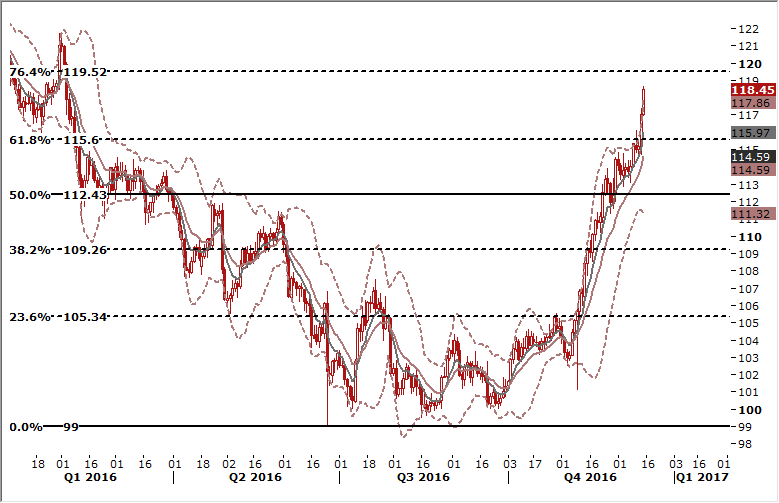

- The upward shift in the FOMC dots by 25bp in the forecast horizon has caused the dollar to soar across the board. Going into year-end, the odds are now for some further USD strengthening as the market may re-price the Fed hike trajectory somewhat higher and momentum increases. As yesterday’s price action reveals, the yen continues to be seen as the most preferred vehicle for USD-bulls as US rates rise, while Japanese rates remain anchored on account of the BoJ’s policies.

- The bull cycle continues on the USD/JPY. The focus is currently at 119.52 (76.4% retrace of 2015-2016 fall). We raised our bid to 115.80 as we look to take advantage of corrective moves, as the continued rise is likely to be uneven.

AUD/USD looks better placed to withstand USD strength after strong Australian jobs report

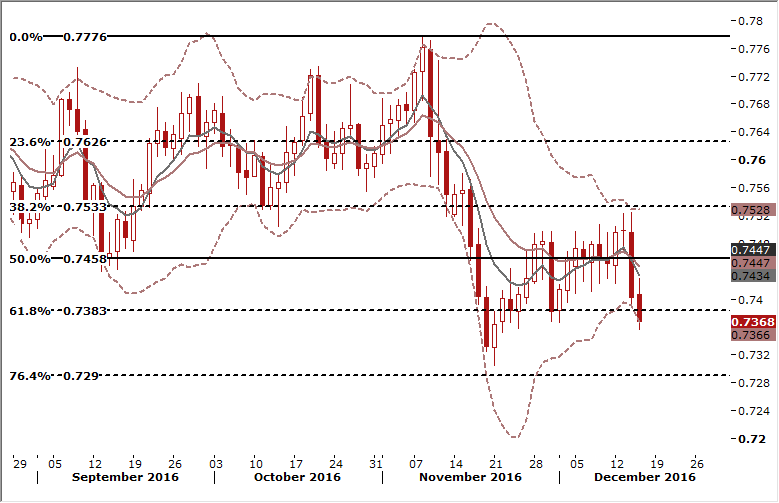

- The commodity FX complex looks better placed to withstand USD-strength at the turn over the year, receiving some tailwinds from still strong commodity prices and signs of resilient fundamentals.

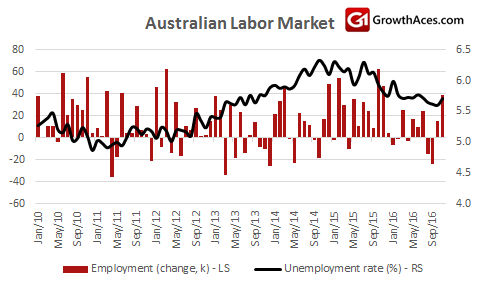

- Thursday's data from the Australian Bureau of Statistics showed employment rose a net 39.1k in November, handily outpacing forecasts of a 20.0k gain. October's report was also revised upward to show an increase of 15.2k. Crucially, full-time jobs bounced by 39.3k and brought the gains since September to a hefty 80k, almost recovering all the losses suffered since January.

- The unemployment rate did tick up to 5.7%, from a three-year low of 5.6%, but only because more people went looking for work.

- The futures market slightly pared back the chance of a cut in interest rates from the Reserve Bank of Australia. It implies a 10% probability of a move by mid-2017, from 14% before the jobs report. Our scenario assumes no further rate cuts in Australia.

- We think that current losses in the AUD/USD are only temporary and our long-term view remains constructive. An important support level is 0.7380. If the AUD/USD does not break this support despite broad USD strength, a quick comeback near 0.7530 is likely in the near term.

EUR/CHF: SNB keeps policy unchanged to curb franc

- The Swiss National Bank left interest rates at record low levels to keep a lid on the "significantly overvalued" CHF. "The negative interest rate and the SNB's willingness to intervene in the foreign exchange market are intended to make Swiss franc investments less attractive, thereby easing pressure on the currency," the SNB said in a statement.

- It trimmed its forecasts for inflation in 2017 and 2018 but kept its outlook for the economy to grow around 1.5% this year and next. "The SNB expects the moderate pace of global growth to continue in 2017. The baseline scenario for the world economy is still subject to considerable risks, however," it said, adding structural problems in some advanced economies could hurt the outlook.

- A strong franc is a headache for Switzerland's export-based economy by pushing up the price of Swiss products or slashing profit margins. The SNB's goal of weakening the franc has also been made more difficult by the asset buying of the European Central Bank, which is reducing the value of the single currency by increasing the amount of euros in circulation. Before the ECB announces or hints at a definitive end of the quantitative easing programme it's not possible for the SNB to start hiking rates.

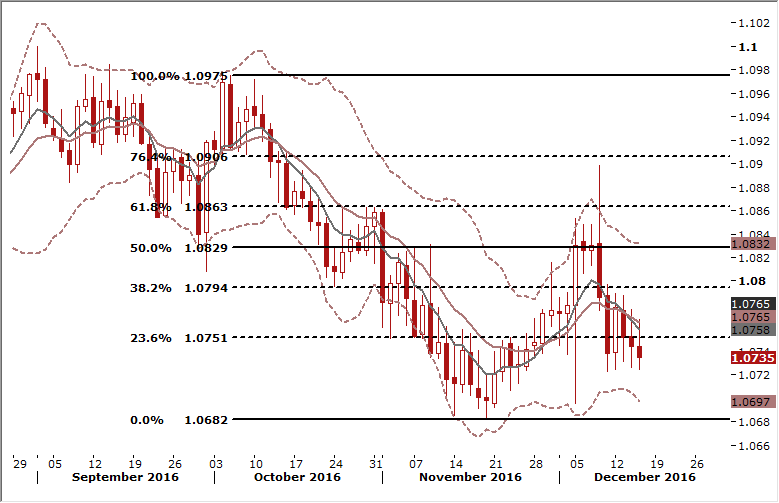

- The EUR/CHF is fluctuating near 23.6% fibo of October-November fall. An important support level is at 1.0730. A close above 1.0790 should open the way towards 1.0830 in the near term. We are looking for a full retracement to 1.0975.

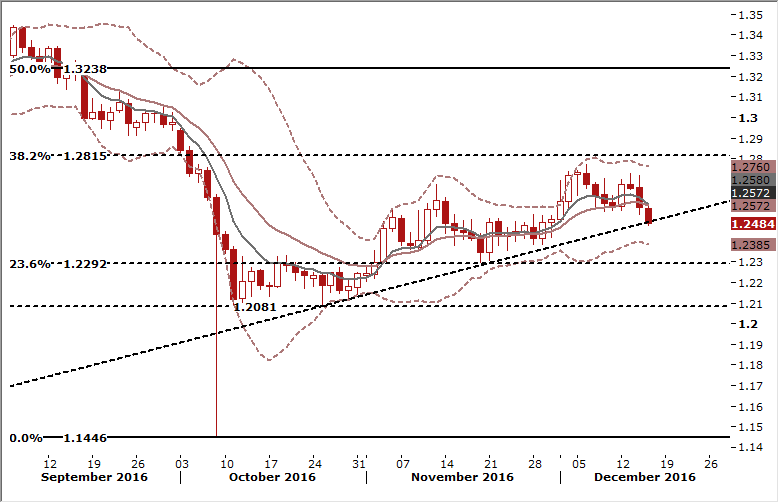

GBP/USD: Dollar extend post-Fed rally. Eyes on BOE now

- Today, the BoE will publish the MPC monetary policy decision and the MPC minutes of its meeting that ended yesterday (12:30 GMT). The committee will almost certainly vote unanimously to keep the monetary policy stance on hold. The focus will be on the minutes and how the MPC interprets the recent tightening of financial conditions, particularly the recovery in the value of sterling.

- British retail sales growth slowed as forecast to 5.9% yoy in November from 7.2% yoy in October. Inflation and wages data this week have both been marginally above forecast. That reinforces the picture of an economy that for now appears to be riding out any turbulence generated by June's vote to leave the European Union.

- The GBP/USD broke below an important support near and our long positions were stopped. We think that today’s BOE statement may help the GBP bulls. Technical situation is also supportive. Positive alignment of the tankan and kijun ling highlights the overall bullish bias. We think switching to the short position would not be justified.