It’s been a busy week for USD/JPY, as the pair continues to display strong movement this week. The yen took a tumble on Tuesday, but has since recovered, as the Nikkei is again showing volatility. USD/JPY was trading in the low-102 range in Tuesday’s European session. In economic news, the US CB Consumer Confidence release was outstanding, as the indicator hit a four-year high. In Japan, Retail Sales posted another decline, although the reading did beat the estimate. Bank of Japan Governor Haruhiko Kuroda addressed an international conference in Japan. There are no Japanese releases on Wednesday. The sole US release is a speech by FOMC Member Eric Rosengren.

USD/JPY is showing strong volatility this week, as the Japanese stock market is once again showing volatility. Market confidence in the BOJ’s monetary policy is down, and this could undermine the central bank’s monetary easing program, which involves purchasing large amounts of government bonds. The BOJ was forced to intervene to calm the markets and said it would “fine-tune market operations” in order to ensure that long- and short-term interest rates remain stable. If this fails to assuage the markets, we could see more volatility from USD/JPY. Meanwhile, Japanese Retail Sales posted its fourth straight decline, dropping 0.1%. This was better than the forecast of -0.4%, but points to continuing weakness in consumer spending, despite the BOJ’s extreme monetary policy which has sent the yen tumbling.

The Japanese government and BOJ have declared deflation as Public Enemy Number One, and the BOJ has embarked on an aggressive monetary easing program, as it seeks to double the monetary base within two years. However, inflation indicators continue to point to deflation, despite these efforts. Corporate Services Price Index, which measures corporate inflation, actually worsened, as the indicator fell from -0.2% to -0.4%. Critics of the government’s agenda say economic growth cannot be created by monetary policy alone, and deflation continues to hobble the Japanese economy. If inflation doesn’t start to pick up, the government will face pressure to take additional steps to kick-start the economy.

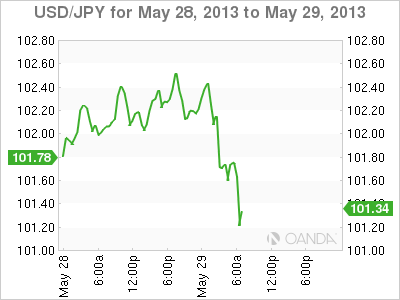

USD/JPY May 29 at 11:30 GMT

USD/JPY 101.28 H: 102.52 L: 100.97 USD/JPY Technical" title="USD/JPY Technical" width="598" height="79">

USD/JPY Technical" title="USD/JPY Technical" width="598" height="79">

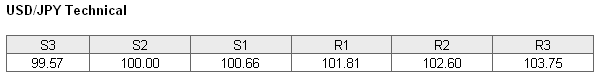

USD/JPY continues to show volatility, and has recovered from Tuesday’s sharp losses. The pair is facing resistance at 101.81. Given the strong movement we are seeing from the pair, this line cannot be considered safe. This is followed by resistance at 102.60. On the downside, there is support at 100.66. This is followed by a support level at the critical 100 level.

- Current range: 100.66 to 101.88

- Below: 100.66, 100, 99.57 and 99.48

- Above: 101.81, 102.60, 103.75, 104.94 and 105.87

USD/JPY ratio has shifted direction in the Wednesday session, and is pointing to movement towards long positions. This is reflected in the current movement of the pair, as the yen has posted sharp gains against the US dollar.

The pair continues to move sharply in both directions, as the yen has pushed back and is now trading in the low-101 range. We could see further volatility on Thursday, as both the US and Japan release a host of important indicators.

USD/JPY Fundamentals

- 13:00 US FOMC Member Eric Rosengren Speaks.