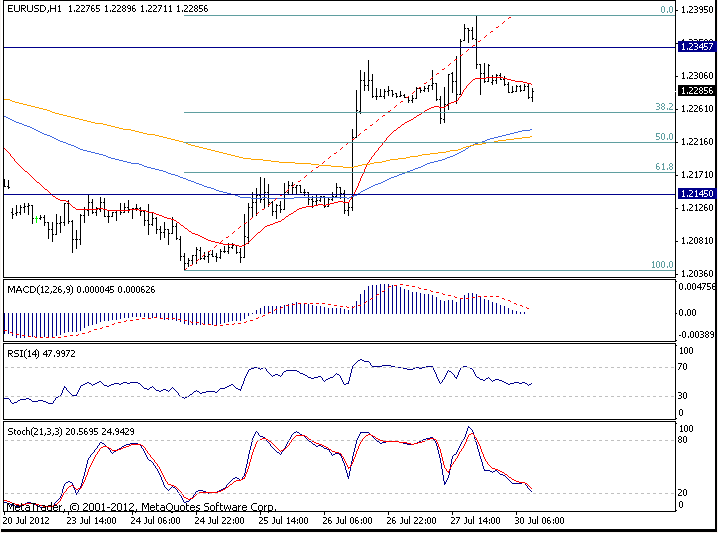

EUR/USD:

1.2287

Very Short-Term Trend: weak uptrend

Outlook:

The rally from last week's low looks impulsive and that suggests further gains ahead. But first, a correction of this gains seems likely. Right now the prices are back below the key 1.2345 Fibo level so the downside correction should be under way indeed. If correct, losses twd 1.2255 and 1.2215 are expected (being 38.2% and 50% Fibonacci levels of last week's rally).

On the upside, only firm and sustained break back abv 1.2345 will indicate the rally from last week's low has resumed for 1.2670...

Strategy: Neutral.

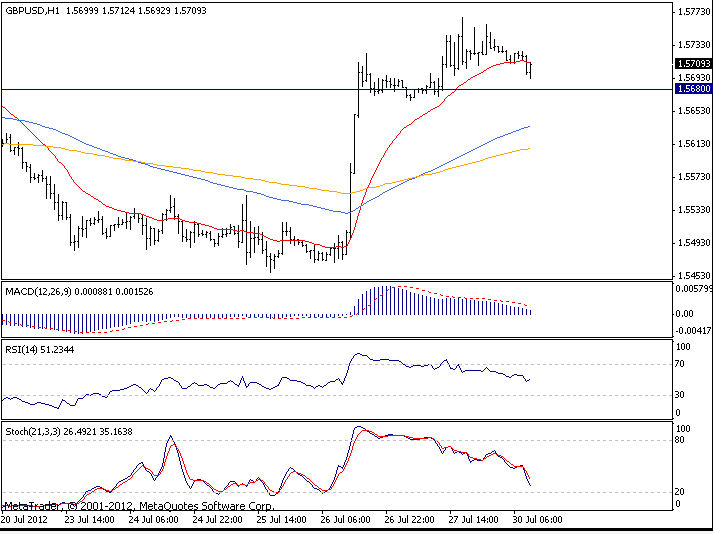

GBP/USD: 1.5711

Very Short-Term Trend: weak uptrend

Outlook:

With last week's strong rally one should be bullish but honestly I do not like the hourly pattern. Maybe we will see one more rally attempt but I expect GBP to fail to move firmly abv 1.5770/80 resistance level. And if this rally occurs and fails, the bears may re-take control here. I personally prefer to be more defensive now and to wait until the technical picture is clearer....

Strategy: Stand aside.

USD/JPY: 78.36

Very Short-Term Trend: sideways

Outlook:

Last week was definetely not a good one for us as we didn't succeed in our strategy in EUR/USD and GBP/USD. On Friday we were also stopped out in USD/JPY. As for this market (USD/JPY), it really does nothing. It moved abv 78.50 but returned quickly below this level. So, it remains in sideways mode with very small daily moves - market conditions that are not very excited for traders.

Strategy: Stay out.

Legal disclaimer and risk disclosureThe services provided by Trend Recognition Ltd are intended for informational and educational purposes only. While a course of conduct regarding investments can be formulated from the presented analysis, at no time will Trend Recognition make specific recommendations for any specific person, and at no time may a reader, caller or viewer be justified in inferring that any such advice is intended. The service is not a recommendation to buy or sell securities or an offer to buy or sell securities. The publishers of Trend Recognition website are not brokers or registered investment advisors and are not acting in any way to influence the purchase or sale of any security and/or its derivatives. The data for information provided by this website is obtained from sources deemed reliable but is not guaranteed as to accuracy, or completeness. The use of Trend Recognition services is done so at your own risk. Trading and investing in any financial markets, including, but not limited to the stock market, options market, futures market, bond market, and/or the commodities market involves serious risk of loss, and in some cases, greater loss than the amount invested. You should not rely solely on the information provided on this site in trading. Use of this site is your agreement to assume full responsibility for any losses, and your acknowledgment that we do not guarantee any results or information provided in this site and that you acknowledge that you are forming an independent opinion based upon your own research and resources, and not on the information contained herein. Trend Recognition recommends that you do your own due diligence and research when considering placing any kind of transaction.

It is possible at this or subsequent date, the publishers of Trend Recognition may own, buy or sell the securities discussed therein or their derivatives. Trend Recognition or its publishers are not liable for any losses or damages, monetary or otherwise, that result from trading the securities and/or derivatives discussed within the Trend Recognition website. The publishers of the Trend Recognition recommend that anyone trading securities and/or derivatives should do so with caution and consult with an experienced broker and/or investment advisor before doing so. Past performance of Trend Recognition may not be indicative of future performance and does not guarantee future results.