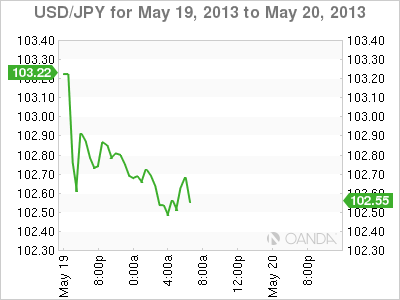

USD/JPY is steady as we start the new trading week. The pair is trading in the high-102 range in Monday’s European session. USD/JPY briefly darted above the 103 line on Friday, but has since retracted. In economic news, Monday could shape up to be a quiet day. There are no Japanese releases, and the sole US event is a speech by FOMC member Charles Evans.

The markets were treated to a host of US releases last week, and for the most part, they didn’t like what they saw. US Inflation and manufacturing numbers fell below expectations, and housing numbers were also weak. Unemployment Claims, one of the most important releases and often a market-mover, had looked impressive in recent readings. However, the key indicator couldn’t keep pace last week, as the number of new claims jumped to 360 thousand, much higher than the estimate of 332 thousand. There was some good news from Building Permits, which were up nicely. On Friday, there was some relief from UoM Consumer Sentiment which jumped from 72.3 points to 83.7 points. This was well above the estimate of 77.9 points, and points to a sharp increase in consumer confidence. However, the host of weak US numbers we saw last week will again bring into question the extent of the US recovery, which has not been able to demonstrate sustained growth and continuous positive releases.

In Japan, there was some good news last week, as Core Machinery Orders sparkled. The important manufacturing indicator jumped from 7.5% to 14.2%, blowing away the estimate of 3.1%. This release comes on the heels of a solid GDP release, which hit a four-month high as it gained 0.9%. The improvement in Japanese numbers is encouraging, and there is a growing feeling in the market that “Abenomics” is starting to bear fruit. However, the proof in the pudding will be Japanese inflation numbers, which for the most part continue to point to deflation, the sworn enemy of the government and the Bank of Japan. The BOJ meets for a policy meeting on Wednesday, and the markets will be paying full attention, as the US dollar has barreled past the 100 mark and continues to surge higher.

The Federal Reserve has not been in the spotlight recently, but that could change if the Fed modifies its current round of quantitative easing, which involves the purchase of $85 billion in assets each month. The Fed will be tempted to act if it feels that the US recovery has gained more traction, giving it some room to ease up on QE. On Thursday, John Williams, president of the Federal Reserve Bank of San Francisco, stated that the Fed could begin reducing QE this summer and terminate bond buying late in 2013. After every solid US release, (which have been heavily outnumbered by weak data), speculation rises that the Fed could take action. As the QE program is dollar negative, any moves by the Fed to wind up QE would be bullish for the dollar at the expense of the euro. So traders can expect any new developments (real or rumor) regarding QE to impact on the currency markets.

USD/JPY May 20 at 10:35 GMT

USD/JPY 102.64 H: 102.90 L: 102.42 USD/JPY Technical" title="USD/JPY Technical" width="596" height="80">

USD/JPY Technical" title="USD/JPY Technical" width="596" height="80">

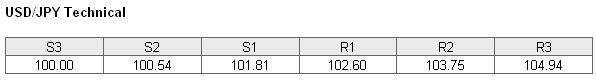

USD/JPY has started the Monday session in subdued fashion, and the proximate resistance and support levels (S1 and R1 above) remain intact. The pair is testing resistance at 102.60. This is a weak line, and could break if the dollar rebounds. This is followed by a strong line of resistance at 103.75. On the downside, the pair is receiving support at 101.81. This is followed by a support level at 100.54, which is protecting the 100 level.

- Current range: 101.81 to 102.60

- Below: 101.81, 100.54, 100 and 99.57

- Above: 102.60, 103.75, 104.94, 105.87 and 106.55

USD/JPY is not showing any movement in Monday trading. This is consistent with what we are seeing from the pair, as the pair is trading quietly. The ratio is showing a slight majority of open positions in favor of short positions, indicating that trader sentiment is biased towards the yen recovering after the recent strong rally by the dollar.

USD/JPY continues to trade at multi-year highs, and flirted with the 103 line on Friday. With no numbers out of the US or Japan on Monday, it could well be a quiet day for the pair.

USD/JPY Fundamentals

- 17:00 Federal Reserve Bank of Chicago President Charles Evans speaks