The Yen has been looking active as of late on the market charts, with some of the heaviest trading and the most volatility situated around the Yen crosses like the AUD/JPY, EUR/JPY and USD/JPY.

The USD/JPY is the main focus of trading early on, especially when it comes to the fundamentals and technicals.

Fundamentally, the Yen has been weaker than expected after preliminary industrial production showed unexpected weakness, with yearly production coming in at 6.9% compared to forecasts of 9.9% and monthly data showed negative growth at -2.3% with forecasts at 0.3%. Business conditions in Japan also showed weakness yet again. Many are starting to question if more action would be needed to be taken by the Bank of Japan. Abenomics though, seems positive and Shinzo Ave was quoted as saying he will “continue with flexible fiscal policy”.

Chinese weakness can certainly lead to a buy up in the Yen. This has been seen many times when we have seen small shocks in China, leading to a buy up in the safe haven currency. It seems unlikely that we will see any shocks though in the short term.

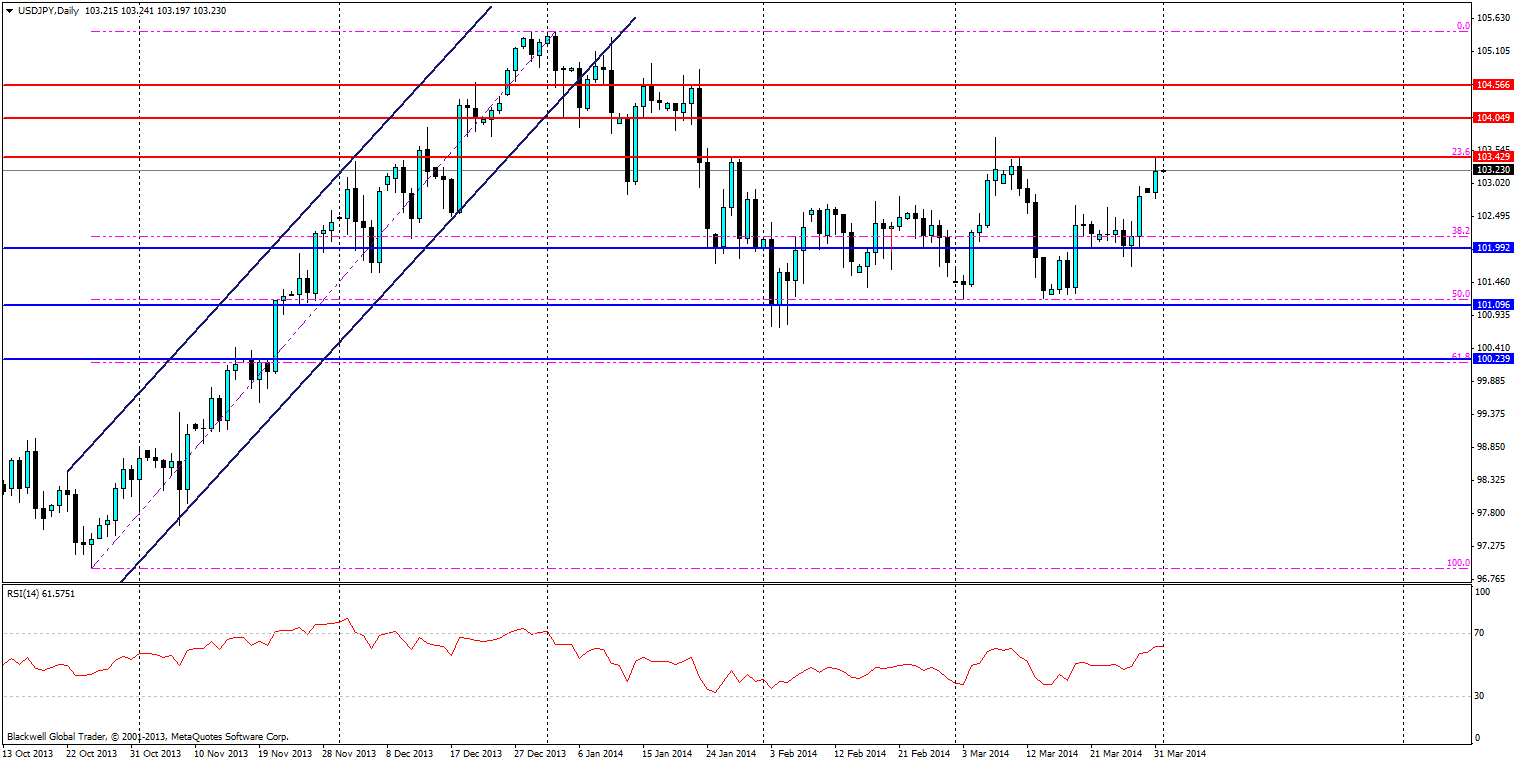

Looking at the technical on the chart, we can see that for the most part, the Yen has ranged heavily against the USD after storming up the charts back in November and since then, it has found no real direction. It has mostly looked to play off fib lines when it ranges, as well as other support and resistance levels that are in the market.

While buying pressure has been heavy for the USD against the Yen and the RSI certainly points to an uptrend in demand, it may be a little too early for a breakout from its current range. Markets looking to push up opportunities to catch and trade off the fib levels are very much apparent.

Currently, the market is testing the 23.6 fib level at 103.429, it looks unlikely to break given recent market sentiment and a lack of data to help a breakout push higher. Market ranging is more likely a given possibility and a move lower to the 102.592 level is more likely than anything else.

Despite this, I am still bullish on the USD/JPY. I believe that the current sales tax will lead to more accommodating from the Government and the Bank of Japan to hit the magical 2.0% level of inflation that Japan yearns for.

In the short term, there are certainly opportunities for people looking to trade the USD/JPY especially in its current ranging patterns. Any break out above the fib line would spell out very solid bullish signalsand I would look for pushes higher. However, in the mean time it looks like short term strategies in a ranging market may come into play.