2013 was the worst year for the Japanese Yen in more than a decade. The currency lost over 20% of its value against the U.S. dollar, euro and British pound and as much as 18% against the commodity currencies. Taking a look at the continuous rise in USD/JPY today and its proximity to 105, it is almost hard to believe that on January 1st, it was trading at 86. The first phase of USD/JPY strength was driven by the aggressive $1.4 trillion stimulus program announced by the Bank of Japan on April 4th. This 12% move lasted between April and May but faded quickly when JGB yields started to rise and short Yen traders bailed out of their speculative positions. After a deep sell-off that erased nearly all of the gains, USD/JPY along with all other Yen pairs consolidated for the next 6 months. It wasn't until late November that the rally took off once again but this time, the move was triggered by expectations for Fed tapering. Looking ahead, long USD/JPY is widely expected one of the most popular trades of 2014 thanks to the combination of easier monetary policy from the Bank of Japan and a continued reduction in asset purchases by the Fed. However while a break of 105 is a given, it will not be a smooth sail to 110 for USD/JPY.

Shinzo Abe's Grand Master Plan

The price action in the Japanese Yen aside, this has been a spectacular year for Japan. The Nikkei rose to its strongest level in 6 years, Japan did not experience one quarter of negative annualized GDP growth, inflation hit a 5 year high of 1.1% while the jobless rate hit a 6 year low of 3.8%. These improvements are a testament of the success of Abenomics, the Prime Minister's ambitious plan to bring Japan's economy back to life. For the first time in 2 decades, Japan is becoming attractive to foreign investors who have been underweight for years. By now everyone knows that Abenomics can be broken down into 3 main components known as the "three arrows" - massive monetary easing, expansionary fiscal policy and a long-term growth strategy. The first two was aimed at putting Japan on a growth track and the third is to solidify the recovery. A key part of the strategy is to bring inflation up from an annualized rate of -0.9% in March to 2% by 2015. Tonight the latest CPI figures will be released but so far, with inflation at 1.1% in October, the Japanese government has done a fantastic job. Stocks are up 40% and the yen is down more than 20%, boosting the competitiveness of Japanese exporters. This stimulus has driven manufacturing activity to fastest pace in 7 years. While growth slowed in Q2 and Q3 after hitting a whopping 4.5% rate in Q1, Q4 and Q1 of 2014 is expected to be strong. The government expects the economy to grow by 1.4% for the fiscal year, which starts in March 2014 after growing 2.6% this year.

Biggest Risk in 2014 is Consumption Tax Hike

- Last Tax Hike was in 1997, GDP Contracted 3.8%

- USD/JPY Sell-off Shortlived

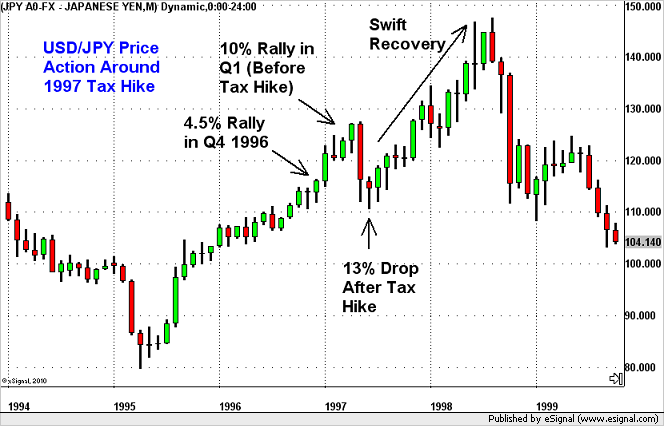

Unfortunately a critical part of Abenomics is an increase to the consumption tax. With a rapidly aging population, Japan needs to find ways to pay for the growing costs of social security and one of Abe's solutions is to raise the consumption tax from 5% to 8% in April and then to 10% in October 2015. This sales-tax increase is the biggest risk for Japan's economy and short Yen trades in the coming year. Raising taxes is always tricky and while Japan has one of the lowest consumption tax rates in the world, the increase comes at a time when the economy is just beginning to recover. The last time a politician in Japan dared to raise taxes was in April 1997 and the increase plunged the economy into recession and later deflation. In the months leading up to the tax increase, the economy grew rapidly with Q4 GDP growth in 1996 hitting a high of 6.1%. Growth remained strong in the first quarter of Q1, with GDP rising 3%. However the economy contracted by 3.8% in the quarter that taxes were increased. The fear of the consumption tax drove the Nikkei lower in the first few months of 1997 but stocks rallied strongly in the 3 months after taxes were raised. It was not until August of that year did stocks begin their long term decline. The sell-off in USD/JPY on the other hand was sharp but short-lived. The currency pair plunged 13% between April and June but recovered strongly for the rest of the year. This same type of performance can be seen in the Yen crosses. In 2014, we expect similar price action if the government does not respond with fiscal and monetary stimulus. The following chart shows how USD/JPY performed after the April 1997 tax hike.

Will the Bank of Japan Ride in Like a White Knight with More Stimulus?

- Will Abe Marry More BoJ Bond Buys with Corporate Tax Reduction?

- Yen will Remain Favorite Funding Currency in 2014

A higher consumption tax is inevitable and the Japanese government has the option of being proactive or reactive. Back in October, they announced a 5 trillion yen stimulus program to offset the tax with more public investment, direct cash to low-income earners and lower corporate taxes but that will not be enough. It is widely believed that the Bank of Japan will need to increase the size of its Quantitative Easing program in response to slower growth. Prime Minister Abe also has the option to reduce corporate taxes - this year he only scrapped the surcharge for the 2011 earthquake reconstruction, leaving room for a further reduction in 2014 if the economy contracts sharply. So far, the Japanese government is playing it cool by saying they have accounted for slower growth and will not react to temporary factors. If they forgo another round of stimulus next year, USD/JPY could be subject to a nasty correction that could match the move in 1997 because many investors are positioned for more easing. If the BoJ increases asset purchases and the Japanese government announces a corporate tax reduction, any sell-off in USD/JPY on the back of weaker demand in April and May will be recovered quickly. We don't expect the central bank to stand back and do nothing and for this reason, the Yen will remain a favorite funding currency in 2014.

USD/JPY - Next Stop 110? New Highs for Carry Trades?

- USD/JPY to 107 in Q1

- 10% Correction Possible in Q2

- USD/JPY Recovery in Q3 Depends on BoJ Response

- EUR/JPY to 145, GBP/JPY to 175 Early 2014

We are looking for further gains in USD/JPY this year but not in a linear manner. Increased economic activity in the first quarter of 2014 should drive stocks higher and the yen lower. A break of 105 is a given and in Q1, we are looking for a move to the 200-month SMA at 107.30. While 105 is an important round number, the more significant technical level is 105.60, the 61.8% Fibonacci retracement of the sell-off that lasted from 2007 to 2011. When the consumption tax hits in the second quarter, we expect USD/JPY to correct sharply as the extreme level of long USD/JPY positions are unwound. Then the recovery will depend on the response from the Japanese government. If they marry more asset purchases with lower corporate taxes, USD/JPY could rise to fresh highs above 108 and possibly even 110. However if they under deliver, the recovery could be limited to 105. Similar moves are expected in the Yen crosses but EUR/JPY, GBP/JPY and NZD/JPY will outperform AUD/JPY, CHF/JPY and CAD/JPY. The Japanese Yen will remain a popular funding currency in 2014 and as such, early next year (if not sooner), we expect a break of 145 for EUR/JPY and a move to 175 for GBP/JPY.

By Kathy Lien, Managing Director of FX Strategy.