Although USD/JPY closed lower last week, the pair maintained a bullish state as Kuroda was formally confirmed as the new BOJ governor along with Iwata and Nakaso as deputy governors. We know Kuroda is an advocated of additional easing and has a strong belief in a reaching an inflation target, so now we have to wait and see whether the BOJ will hold an emergency policy meeting to launch new easing measures as soon as late next week.

The Yen has declined over 20% in the past 4 months as investors bet on Prime Minister Abe following through with his campaign promise of aggressive easing. The appointment of Kuroda is the biggest step so far. Whilst on paper it is spells Yen weakness, the expectation level is so high that if Kuroda disappoints in anyway we could see some Yen strength.

The coming few weeks are very important for the medium term outlook for the Yen. If Kuroda introduces new easing measures USD/JPY will have the support to continue its rise. Any hint that Kuroda may not act immediately and aggressively could se unwinding of longs.

This week the Trade Balance report on Wednesday is the only domestic report. However, Kuroda’s movements and actions will far outweigh any other event for the Yen.

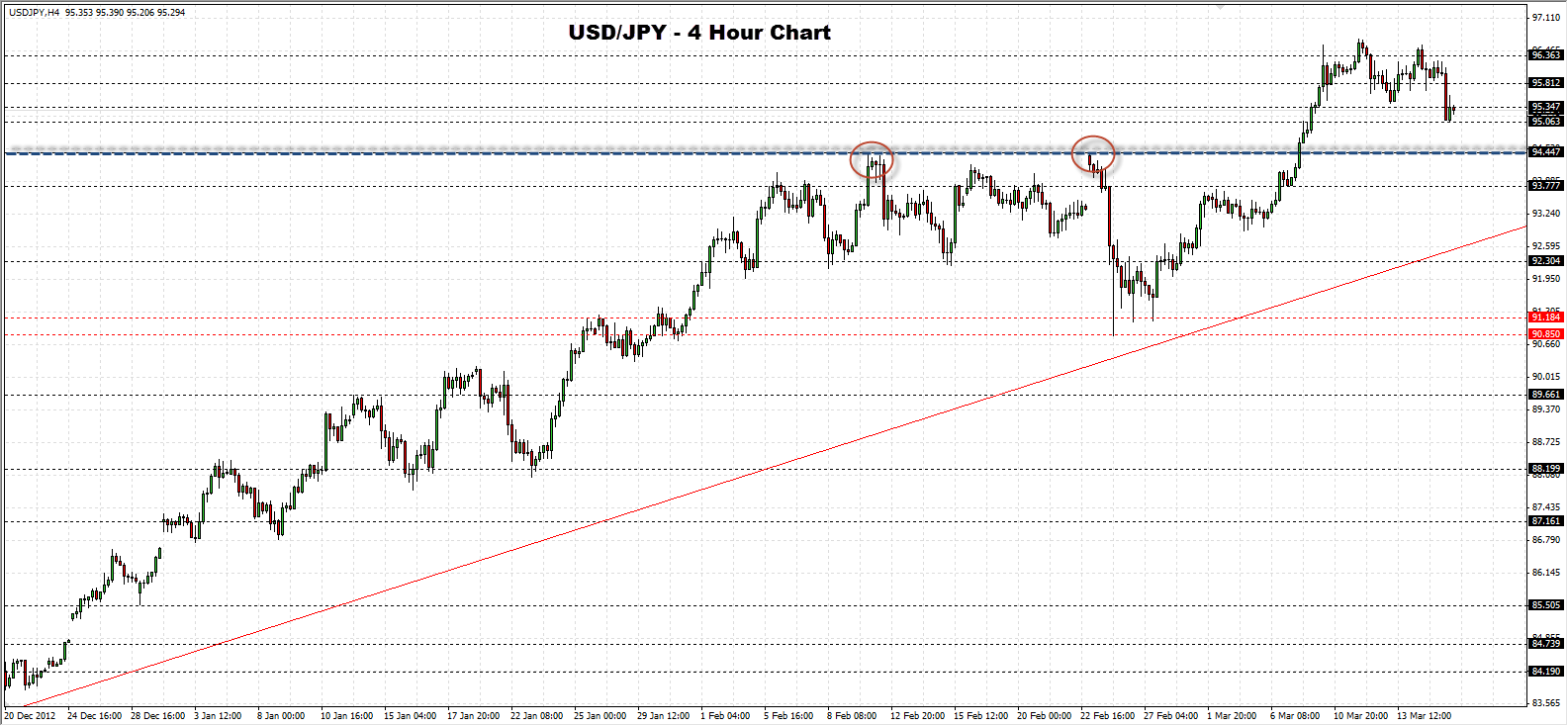

USD/JPY continues to trade in a positive fashion from a technical perspective. Pullbacks to key levels offer high probability trade opportunities as long as the fundamental picture remains geared towards easing of monetary policy. USD/JPY" title="USD/JPY" width="1585" height="734">

USD/JPY" title="USD/JPY" width="1585" height="734">

•USD/JPY has reversed the longer term downtrend (since 2007). The break of the 85.51 key level has triggered extremely bullish price action as expected.

•Price set another fresh high at 96.56, but has since experienced some profit taking. A break through the highs brings into play the 97.77 key level.

•Expect pull backs to find supp

ort on previous key level as marked on the chart. Below 91.18 and 90.85 could trigger corrective phase.

•Buying on dips (at key levels) is a good plan.

•Bullish bias.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

USD/JPY: Maintained A Bullish State

Published 03/18/2013, 01:32 AM

Updated 07/09/2023, 06:31 AM

USD/JPY: Maintained A Bullish State

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.