Yesterday FOMC announced its decision on the interest rate. Its increase by 25 basis points was not a surprise, but "hawkish" rhetorics of FOMC head in the follow-up comments was absolutely unexpected by market participants. Janet Yellen announced that the regulator planned one more increase this year. Moreover, she spoke about positive tendencies in the economy and labir market and announced plans for the reduction of the Central Bank balance by means of cutting the volume of purchased assets.

However, after Yellen's statement USD stopped growing which means market participants were suspicious about jer statements and paid more attention to macroeconomic data that shows a less favorable picture.

Today's news are mainly formed by US macroeconomic statistics. According to the specialists, the results will be mixed which may cause considerable market volatility. Taking into account sceptical attitude of the investors to USD, any valuable neative statistics may push the pair down to the local minimum of 108.00. Moreover, the Bank of Japan is to announce its decision on the interest rate tomorrow. The value of -0.1% is unlikely to change which will support USD/JPY.

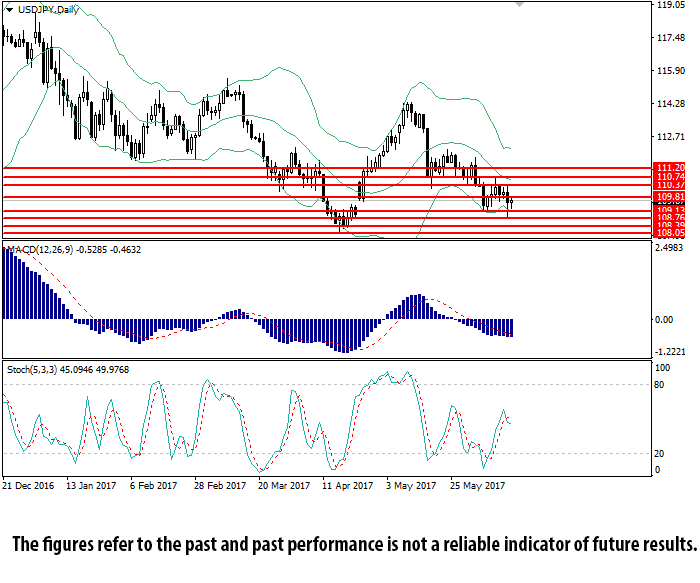

On D1 chart the pair is trading in the lower part of Bollinger Bands. The indicator is directed downwards while the price range is widening which is a ground for the continuation of the current trend. MACD histogram is in the negative zone with its volumes reducing and keeping the sell signal. Stochastic is correcting in the neutral area giving no clear signals for entering the market.

Support levels: 109.14, 108.75, 108.40, 108.05.

Resistance levels: 109.81, 110.35, 110.75, 111.20.