Today during the Asian session the USD declined against its major counterparts amid the publication of macroeconomic releases in Japan and China.

Japan's GDP for the second quarter was revised up from -1.6% to -1.2%, on an annual basis, against the forecast of -2%.

But market participants started buying the yen more actively after China released a series of negative statistics. Weak export (-5.5% vs. -5.2% forecast) and import (-13.8% vs. -7.9% forecast) data for August indicated that country's economy had not started recovering yet. People's Bank of China and the Government, most probably, will have to further loosen the monetary policy and to take new measures to stimulate the economy. In this case, the USD/JPY pair is likely to strengthen as the yen is considered to be a safe-haven asset during economic instability.

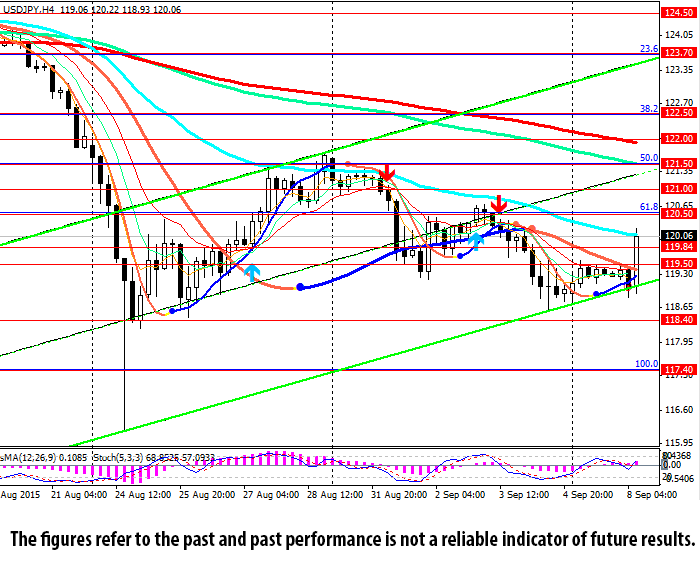

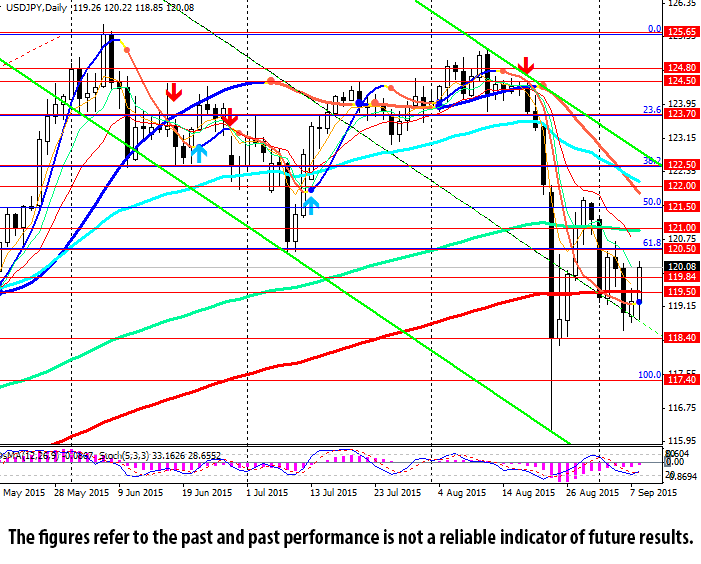

Early in the European session, the JPY/USD pair turned up and the USD strengthened sharply, gaining back its recent losses. The pair rebounded from the strong support level of 119.50 (ЕМА200 on the daily chart) and continues growing. The breakout of the levels of 120.50 (61.8% Fibonacci) and 121.00 (ЕМА144) will push the price up towards 121.50 (50% Fibonacci and ЕМА50), 122.50 (38.2% Fibonacci). Further dynamics will depend on China's and world financial markets situation as well as on the Fed's and the Bank of Japan's decisions.

OsMA and Stochastic indicators on the 4-hour and daily charts are turning to long positions.

- Support levels: 117.40, 118.40, 119.50

- Resistance levels: 120.50, 121.00