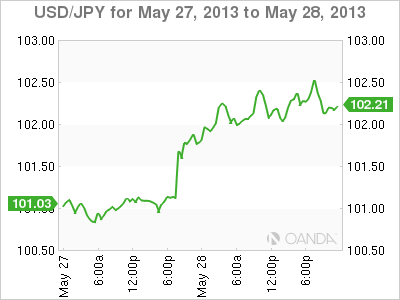

USD/JPY is up sharply in Tuesday trading, as the Nikkei has steadied after its recent volatility. With the Nikkei showing signs of recovery, the Japanese currency has taken a hit. USD/JPY has climbed close to 100 points, as the pair trades just above the 102 line. In economic news, Japanese inflation indicators continue to point to deflation, as the Corporate Services Price Index posted a larger decline than in the previous reading. The markets will get their first look at key US numbers later today, with the release of CB Consumer Confidence.

USD/JPY has resumed its upward climb after the yen enjoyed a short rally late last week. The yen was around the 101 level as we started the week, but the dollar has rebounded as the Nikkei has recovered from sharp losses last week. Further sharp drops on the Japanese stock market threatened to undermine the BOJ’s easing program, which has involved large purchases of government bonds. The BOJ was forced to intervene to calm the markets and said it would “fine-tune market operations” in order to ensure that long- and short-term interest rates remain stable. The markets reacted positively as the stock market moved higher, while the yen dropped sharply.

The Japanese government and BOJ have declared deflation to be enemy number one, and the BOJ has embarked on an aggressive monetary easing program, as it seeks to double the monetary base within two years. However, inflation indicators continue to point to deflation, despite these efforts. Corporate Services Price Index, which measures corporate inflation, actually worsened, as the indicator fell from -0.2% to -0.4%. Critics of the government’s agenda say economic growth cannot be created by monetary policy alone, and deflation continues to hobble the Japanese economy.

In the US, we continue to see ups and downs in US numbers, which has typified US releases in 2013. Last week saw mixed housing numbers, as Existing Home Sales missed the estimate, but New Home Sales looked very sharp. Unemployment Claims bounced back with a strong release, and the week ended with a rise in Core Durable Goods Orders. The mix of positive and weak releases churned out by the US has made it difficult to assess the extent of the economic recovery. The US Federal Reserve has hinted at scaling back QE, but has opted to stay the course with the current round of QE, which involves $85 billion in asset purchases each month.

USD/JPY May 28 at 12:00 GMT

USD/JPY 102.00 H: 102.29 L: 101.11 USD/JPY Technical" title="USD/JPY Technical" width="600" height="79">

USD/JPY Technical" title="USD/JPY Technical" width="600" height="79">

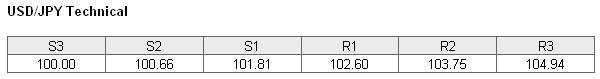

USD/JPY has climbed sharply in Tuesday trading, and is testing the 102 line. The pair is receiving support at 101.81. This is a weak line, and could be tested if the yen shows any signs of recovery from today’s sharp losses. This is followed by support at 100.66. On the upside, there is resistance at 102.60. Given the volatility we are seeing, this line cannot be considered safe. There is stronger resistance at 103.75.

- Current range: 101.81 to 102.60

- Below: 101.81, 100.66, 100, 99.57 and 99.48

- Above: 102.60, 103.75, 104.94 and 105.87

USD/JPY ratio is showing movement towards short positions. With USD/JPY posting sharp gains, a large number of long positions have been covered. We continue to see a strong majority of long positions, indicating a bias towards the US dollar continuing to push higher against the yen.

The pair is having a very busy day, as the USD/JPY has climbed close to a 100 points against the yen on Tuesday. The volatility could continue, as the US releases key consumer confidence numbers while Japan releases Retail Sales.

USD/JPY Fundamentals

- 23:50 Japanese Retail Sales. Estimate -0.4%.

- 13:00 US S&P/CS Composite-20 HPI.

- 14:00 US CB Consumer Confidence. Estimate. 70.7 points.

- 14:00 US Richmond Manufacturing Index. Estimate 2 points.