The US dollar has taken it on the chin from the Japanese yen since late May, as USD/JPY has dropped sharply. However, this week the US dollar has recovered, and put together a modest rally. The pair was trading in the mid-95 range in Tuesday’s European session. In economic news, Japanese Revised Industrial Production posted a second straight gain of 0.9%, but this was way off the estimate of 1.7%. The US releases its first key data of the week, with Building Permits and Core CPI.

All eyes will be glued to the US Federal Reserve on Wednesday, as the FOMC releases an highly anticipated policy statement. The markets will be particularly interested in what the Fed has to say with regard to its quantitative easing program. Speculation has been growing that the Fed could scale back QE later in the year, and this has had a very strong impact on stocks, commodities and the US dollar. The Federal Reserve has repeatedly stated that it will stick with the current program until it sees an improvement in the US economy, especially in the employment market. Currently the Fed purchases $85 billion in assets every month. If the Fed does take action or even hint at a move to tighten QE, we can expect the dollar to move higher against the major currencies.

Is Abenomics working? The Japanese government and the BOJ have implemented extreme monetary stimulus in order to kick-start the anemic economy, and the jury is still out on the success of the plan. However, a Reuters poll found that the economy has picked up, and with GDP expanding at an annual rate of 4.1% for the first three months of 2013. This is stronger growth than most of Japan’s trading partners. The low yen has boosted exports, and private spending is up. However, deflationary trends remain in the economy, and Abenomics cannot be considered a success until we see more inflationary indications in the economy. The government has declared a target of 2% inflation, but will likely have a tough time reaching this goal. Another major problem is the country’s huge debt, which is more than double the size of the economy of $5 trillion.

USD/JPY June 18 at 11:10 GMT

USD/JPY 95.30 H: 95.44 L: 94.53

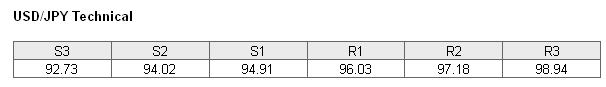

USD/JPY continues to move higher, a the pair pushed above the 95 line in the European session. The line of 0.9494 has reverted to a support role. This is weak line, and could face pressure if the yen improves. The next support level is at 94.02. This line has strengthened as the pair trades above the 95 line. On the upside, we encounter resistance at 96.03. This is followed by resistance at 96.03.

Further levels in both directions:

- Below: 94.91, 94.02, 92.73, 91.62 and 91.02

- Above: 94.91, 96.03, 97.18, 98.94, 99.57 and 100.00

USD/JPY ratio is unchanged in Tuesday trading. This inactivity has not spread to the pair, as the dollar has posted gains against the yen. Long positions have a significant majority in the ratio, signaling a strong bias towards further gains by the US dollar.

The week started with some gains by the US dollar, and this trend has continued on Tuesday. Will the dollar continue to move higher? We could see more movement from USD/JPY during the day, as the US releases two key events later in the day.

USD/JPY Fundamentals

- 4:30 Japanese Revised Industrial Production. Estimate 1.7%. Actual 0.9%.

- 12:30 US Building Permits. Estimate 0.98M.

- 12:30 US Core CPI. Estimate 0.2%.

- 12:30 US CPI. Estimate 0.1%.

- 12:30 US Housing Starts. Estimate 0.95M.

- Day 2 of G8 Meetings.